1. Price Surge

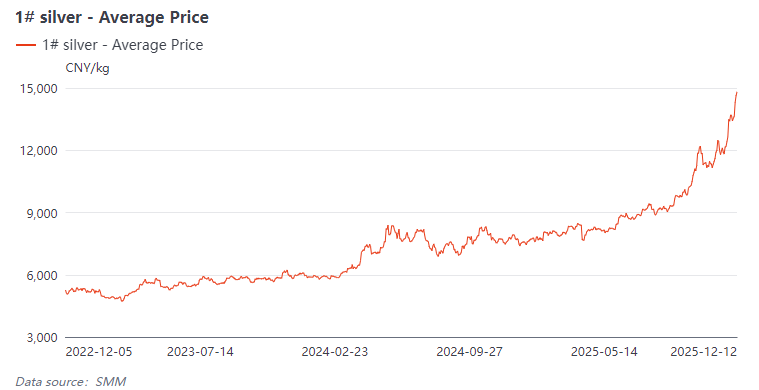

The silver market has recently witnessed an unprecedented price surge, with gains exceeding 80% year-to-date and a quarterly increase surpassing 20%. This sharp volatility has directly impacted the midstream cell manufacturing segment of the photovoltaic industry chain, emerging as a critical factor affecting cell profitability. The cost of photovoltaic silver paste has now exceeded the ten-thousand-yuan threshold per kilogram, and continues to trend upwards.

2 Cost Pressure

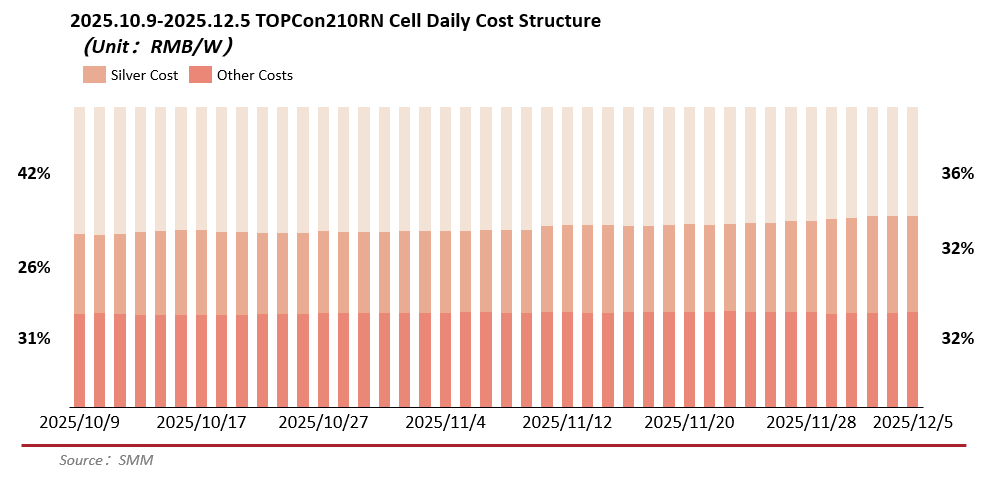

According to SMM data, silver paste costs now exceed 30% of the total cost of solar cells (using TOPCon 210RN cells as an example) and account for over 50% of non-silicon costs. This translates to an increase of approximately ¥0.01–0.015 per watt in silver paste expenses, a rise that has virtually eroded all profit margins.

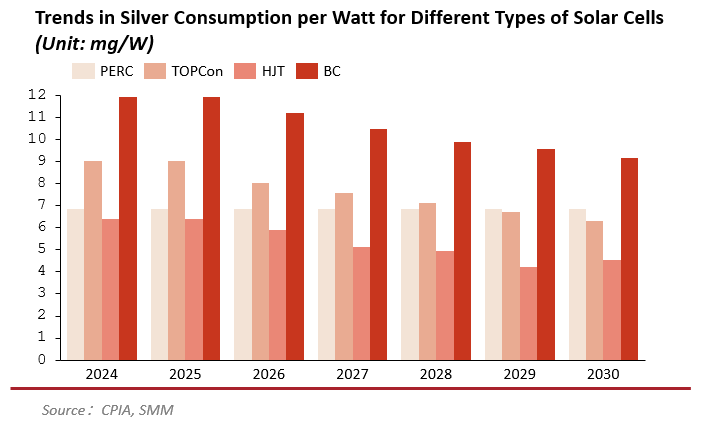

The widespread adoption of N-type cell technology has intensified cost pressures on silver paste. According to CPIA data, by 2025, the silver paste consumption per watt for TOPCon cells is projected to be approximately 9mg/w, while BIC cells could reach as high as 11.92mg/w. Both figures significantly exceed the 6.85mg/w consumption of traditional PERC cells. Only HJT cells, utilising 30% low-temperature silver-coated copper paste, reduce consumption to around 6.39mg/w.

Moreover, it is noteworthy that industry insiders from leading enterprises have indicated that the spot premium for silver ingots surged significantly in November due to short-term supply constraints and persistent inventory depletion. However, given the extremely limited scope for price increases in solar cells themselves, the upstream premium costs cannot be effectively passed on. This has severely eroded profit margins across intermediate processing stages—from silver nitrate and silver powder to silver paste—with the risk of losses now accumulating and spreading upwards.

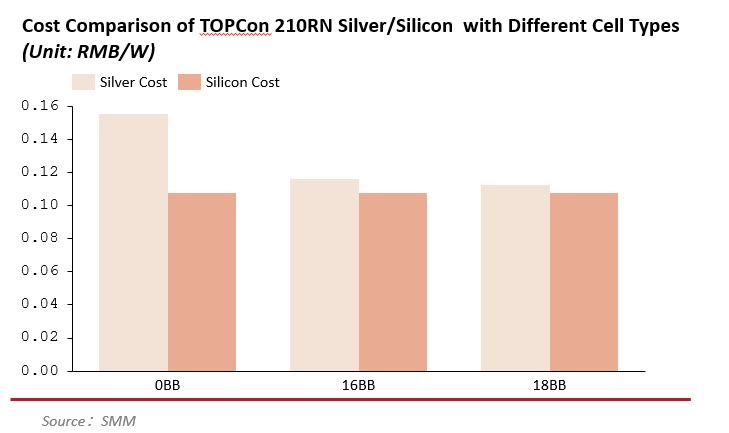

Should cell manufacturers produce SMBB or 0BB high-efficiency cells, silver paste costs would rise to ¥0.15/W (as illustrated, assuming Grade 1 silver at ¥13,500/kg and 210RN wafers at ¥1.18/piece), exceeding silicon costs.

3 Technological Breakthroughs

Faced with cost pressures, photovoltaic enterprises are pursuing technological breakthroughs across multiple dimensions.

Regarding the application of novel conductive materials, silver-coated copper technology has commenced large-scale implementation in HJT cells, reducing silver content to 30%. Leading silver paste manufacturers' 10%-20% silver-coated copper technology has achieved mass production standards. The ‘high-temperature silver seed layer + low-temperature silver-wrapped copper’ solution for TOPCon cells is also slated for mass production introduction in the second half of 2025.

Regarding complementary printing and process innovations, companies are upgrading from traditional 430-13 mesh screens to finer 500-9 or even 700-7 mesh screens; novel printing techniques such as laser transfer printing enable ultra-fine grid lines, reducing paste consumption by 20%-40%.

These metallisation innovations are rapidly transitioning from laboratories to production lines, united by the objective of systematically reducing cell dependence on the precious metal silver and establishing long-term, controllable cost advantages.

![[SMM PV News] US Energy Storage Hit by Policy Shifts](https://imgqn.smm.cn/usercenter/EcOMz20251217171741.jpg)

![[SMM PV News] EU Auctions and PPAs Drive 92 GW from 2022-2025](https://imgqn.smm.cn/usercenter/vghcI20251217171739.jpg)

![[SMM PV News] Waaree Solar Americas Invests $30M in United Solar for Traceable Polysilicon](https://imgqn.smm.cn/usercenter/AuVub20251217171738.jpg)