In mid-December 2025, the Passenger Car Association and CAAM successively released data related to the automotive industry and passenger car market for November 2025. In November, auto production and sales continued their strong performance. Enterprises seized the policy window period, and production supply maintained a rapid pace. On a high base, both production and sales achieved growth on both a MoM and YoY basis... SMM compiled relevant data for the automotive market and power battery market in October for readers' reference.

Automotive Sector

CAAM: November Auto Production and Sales Hit Record High; Jan-Nov Auto Production and Sales Both Exceeded 31 Million Units

In November, auto production and sales reached 3.532 million and 3.429 million units, respectively,up 5.1% and 3.2% MoM, and up 2.8% and 3.4% YoY, respectively.Monthly production exceeded 3.5 million units for the first time, setting a historical record.

From January to November, auto production and sales reached 31.231 million and 31.127 million units, respectively,up 11.9% and 11.4% YoY, respectively.The growth rates of production and sales narrowed by 1.3 and 1 percentage point(s), respectively, compared to January-October.

CAAM: Jan-Nov NEV Production and Sales Both Exceeded 15 Million Units; NEV Sales Accounted for 47.5% of Total New Auto Sales

In November, NEV production and sales reached 1.88 million and 1.823 million units, respectively,up 20% and 20.6% YoY, respectively.NEV sales accounted for 53.2% of total new auto sales.

From January to November, NEV production and sales reached 14.907 million and 14.78 million units, respectively,up 31.4% and 31.2% YoY, respectively.NEV sales accounted for 47.5% of total new auto sales.

CAAM: November Auto Exports Hit Record High, Exceeding 700,000 Units for the First Time

In November, auto exports reached 728,000 units, up 9.3% MoM and 48.5% YoY.This month's export volume exceeded 700,000 units for the first time in history.

From January to November, auto exports reached 6.343 million units, up 18.7% YoY. Chen Shihua, Deputy Secretary General of CAAM, revealed that China's full-year auto exports for 2025 are expected to challenge 7 million units.

CAAM: Jan-Nov NEV Exports Reached 2.315 Million Units, Doubling YoY

In November, NEV exports reached 300,000 units,up 17.3% MoM and 2.6 times YoY.Among these, passenger NEV exports were 294,000 units, up 17.7% MoM and 2.8 times YoY; commercial NEV exports were 7,000 units, up 4.2% MoM and 41% YoY.

From January to November, NEV exports reached 2.315 million units, doubling YoY. Among them, passenger NEV exports totaled 2.238 million units, doubling YoY, while commercial NEV exports reached 77,000 units, up 1.2 times YoY.

The China Passenger Car Association (CPCA) recently released data on the passenger vehicle market for November 2025. According to CPCA data, retail sales of passenger vehicles nationwide in November reached 2.225 million units, down 8.1% YoY and down 1.1% MoM. Cumulative retail sales from the beginning of the year reached 21.483 million units, up 6.1% YoY. The cumulative growth rate of domestic vehicle retail sales this year started at 1.2% from January to February, rose to 15% from March to June, hovered around 6% from July to September, and pulled back to a relatively low level from October to November, showing a deceleration characteristic of a high base in Q4, which basically aligns with the "low start, high middle, and flat end" trend predicted at the beginning of the year.

For passenger NEVs, retail sales in November reached 1.321 million units, up 4.2% YoY and up 3.0% MoM; cumulative retail sales from January to November reached 11.472 million units, up 19.6%. Retail sales of conventional fuel-powered passenger vehicles in November were 900,000 units, down 22% YoY and down 7% MoM; cumulative retail sales from January to November were 10.01 million units, down 6%.

Regarding exports, the CPCA stated that with the scale advantages and market expansion demands of Chinese NEVs, China-made NEV brand products are increasingly going global, with continuously growing recognition overseas. Passenger NEV exports in November reached 284,000 units, up 243.3% YoY and up 19.3% MoM. They accounted for 47.3% of passenger vehicle exports, an increase of 26.3 percentage points compared to the same period last year; among them, pure electric vehicles accounted for 57% of NEV exports (74% in the same period last year), with A00 and A0 segment pure electric vehicles, as the core focus, accounting for 61% of pure electric vehicle exports (59% in the same period last year).

Regarding the November passenger vehicle market, the CPCA stated that due to the rapid growth earlier this year, the policy subsidies themselves aimed to stabilize the overall growth rate, so the phenomenon of stabilizing the growth rate towards year-end is a reasonable trend. The ultra-high base in November last year and the slight negative growth in November this year smoothed out last year's high growth; compared to November 2022, growth still reached 5%, so the overall trend remains relatively normal. An important policy for adjusting the growth rate this year was the trade-in subsidy. As of October 22, 2025, applications for the automotive trade-in subsidy exceeded 10 million units, and the number of applications in the first 11 months reached 11.2 million units. With the large-scale suspension of local subsidies, the daily average subsidy volume dropped to 30,000 units in November, showing a significant effect on growth rate adjustment.

According to the CPCA's analysis, the passenger vehicle market in November 2025 exhibited the following characteristics: First, production, exports, and wholesale of passenger vehicles by manufacturers all hit record highs for the month, with exports reaching a new all-time high for any month. Second, the proprietary brands of major state-owned groups showed strong growth; the combined sales of proprietary brands from six major state-owned groups, including Dongfeng, SAIC, FAW, BAIC, Chery, and Changan, increased 3% YoY in November. Among them, proprietary second-generation brands from groups like JiHu, VOYAH, and Shenlan saw particularly strong growth. Third, with many new models launched this year and the advancement of "anti-involution" efforts to curb disorderly price cuts, NEV promotions remained at 10% in November, and the overall trend was stable. Fourth, domestic retail sales of internal combustion engine vehicles in November fell 22% YoY; retail sales of the pure electric market grew 9.2% YoY, while the extended-range market fell 4.3% YoY, and the plug-in hybrid market declined 2.8% YoY. The structure of pure electric versus extended-range models among new automakers shifted from 57%:43% in November last year to 73%:27% this November. Fifth, the domestic retail penetration rate of NEVs reached 59.3% in November, showing steady growth underpinned by policies such as vehicle retirement and renewal, replacement subsidies, and exemptions from NEV purchase taxes. Sixth, from January to November 2025, exports of proprietary internal combustion engine passenger vehicles totaled 2.61 million, down 8%, while exports of proprietary NEVs reached 1.78 million, up 139%; NEVs accounted for 40.6% of proprietary exports. Seventh, retail sales of Korean and French brands grew 13% and 6% YoY, respectively, becoming highlights of growth.

The CAAM commented that in November, automotive production and sales continued to perform well. Enterprises seized the policy window period, maintaining a rapid pace in production and supply. On a high base, both production and sales achieved growth MoM and YoY. Among them, the passenger vehicle market operated steadily, the commercial vehicle market continued to improve, NEVs performed strongly, and automotive exports grew rapidly.

Regarding power batteries,

from January to November, the cumulative sales of power and other batteries in China reached 1,412.5 GWh, up 54.7% YoY.

In November, sales of power and other batteries in China were 179.4 GWh,up 8.1% MoM and 52.2% YoY.Among them, power battery sales were 134.0 GWh, accounting for 74.7% of total sales, up 7.8% MoM and 52.7% YoY; sales of other batteries were 45.4 GWh, accounting for 25.3% of total sales, up 8.9% MoM and 50.7% YoY.

From January to November, cumulative sales of power and other batteries in China reached 1,412.5 GWh, up 54.7% YoY. Among them, cumulative sales of power batteries were 1,044.3 GWh, accounting for 73.9% of total sales, up 50.3% YoY; cumulative sales of other batteries were 368.2 GWh, accounting for 26.1% of total sales, up 68.9% YoY.

From January to November, domestic power battery installations totaled 671.5 GWh, up 42.0% YoY.

In November, domestic power battery installations reached 93.5 GWh,up 11.2% MoM and 39.2% YoY. Among them, ternary battery installations were 18.2 GWh, accounting for 19.4% of total installations, up 9.9% MoM and 33.7% YoY; LFP battery installations were 75.3 GWh, accounting for 80.5% of total installations, up 11.6% MoM and 40.7% YoY.

From January to November, domestic power battery installations totaled 671.5 GWh, up 42.0% YoY. Among them, ternary battery installations totaled 125.9 GWh, accounting for 18.8% of total installations, up 1.0% YoY; LFP battery installations totaled 545.5 GWh, accounting for 81.2% of total installations, up 56.7% YoY.

Multiple New EV Makers Achieve Annual Sales Targets Ahead of Schedule in November, Leap Motor Continues to Lead

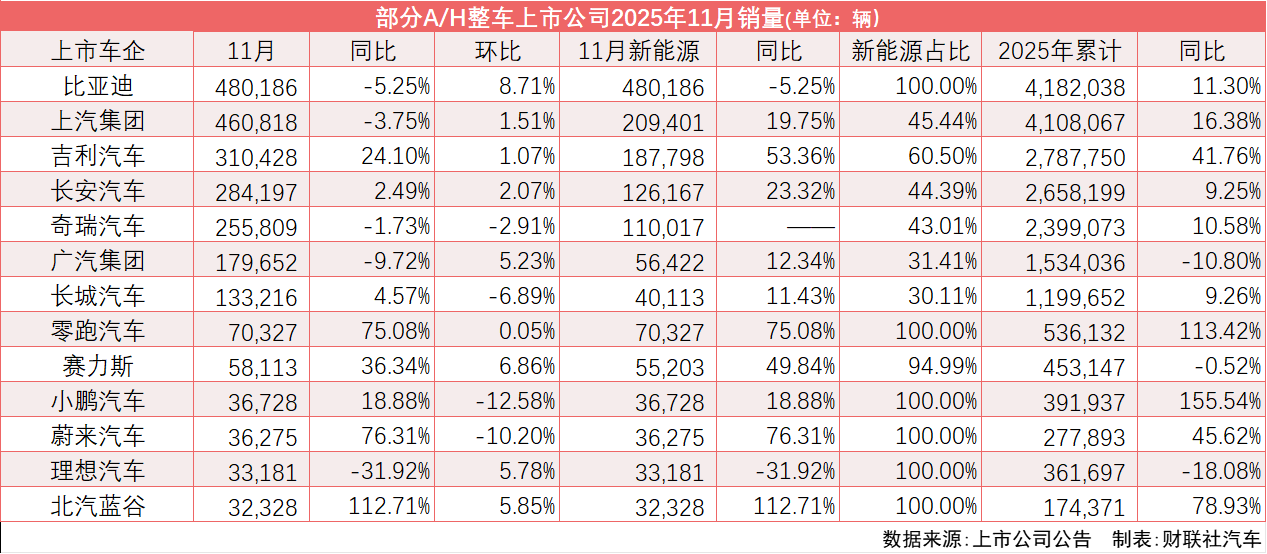

The chart below, compiled by Cailianshe, shows the November sales figures of some A/H-listed automakers as follows:

As November sales data for new EV makers were released, Leap Motor performed outstandingly, continuing to refresh the monthly sales record for new EV makers. Data showed that Leap Motor delivered 70,327 new vehicles in November,up over 75% YoY, marking the ninth consecutive month of growth.In 2025, Leap Motor delivered a total of 536,132 new vehicles, up 113.42% YoY.

Previously, Leap Motor had set its 2025 sales target at 500,000 units. As early as November 15, it announced that its cumulative sales for 2025 had exceeded 500,000 units,achieving its annual sales target ahead of schedule.While announcing the delivery figures, Leap Motor Chairman Zhu Jiangming set higher goals for the company's development on the same day, stating that Leap Motor achieved its annual sales target of 500,000 units 45 days ahead of schedule and would aim for a sales target of 1 million units in 2026.

In addition, both XPeng Motors and NIO delivered over 36,000 units in November, but recorded varying degrees of decline compared to October, though both showed growth YoY. XPeng Motors delivered 36,728 new vehicles in November, up 19% YoY. From January to November 2025, XPeng Motors delivered a total of 391,937 units, up 156% YoY. Public information shows that XPeng Motors' 2025 sales target was 380,000 units, and the current results indicate thatXPeng Motors also achieved its annual sales target ahead of schedule.

NIO delivered 36,275 new units in November, up 76.3% YoY; cumulative deliveries for 2025 reached 277,893 units, up 45.62% YoY.

Xiaomi Auto maintained a delivery volume of over 40,000 units in November, exceeding the annual target of 350,000 units set at the beginning of 2025. Since April 3, 2024, to December 2, 2025, Xiaomi Auto has cumulatively delivered more than 500,000 units.

As the undisputed leader in domestic EVs, BYD continued to outperform in sales, selling 480,186 units in November, setting a new high for the year. From January-November, auto sales reached 4.18 million units, up 11.3% YoY.

It is worth noting that BYD, which often ranks first in overall auto sales, was surpassed by SAIC in September and October of this year but reclaimed the top spot in November. At a recent extraordinary shareholders' meeting, BYD Chairman Wang Chuanfu addressed the decline in domestic market sales for the first time, stating that it was partly due to BYD's current technological lead not being as strong as in previous years. Additionally, user pain points such as slow charging speeds in low temperatures need to be resolved through technological breakthroughs. Wang Chuanfu also hinted, "I say the technology is not leading enough now because there will be significant technological releases later, but I cannot disclose them at present."

Cui Dongshu, Secretary General of the China Passenger Car Association, stated that the cumulative growth rate of retail sales in the domestic car market in 2025 showed a phased characteristic: cumulative growth from January-February was 1.2%, from March-June it climbed to 15%, from July-September it pulled back to around 6%, and from October-November it further entered a lower range, generally aligning with the initial forecast of 'low at the beginning, high in the middle, and flat at the end.' Cui Dongshu noted that under the strong support of nearly 400 billion yuan in tax exemptions and subsidies, the car market in 2025 achieved growth beyond expectations, but this also puts considerable pressure on the growth of the car market in 2026. "From the perspective of ensuring a good start for the 14th Five-Year Plan, we should not overly deplete the growth potential for next year at the end of 2025."

With the approach of year-end, many regions have introduced measures to subsidize car consumption. On December 8, 2025, Shenyang launched its winter car consumption subsidy program, distributing a total of 50 million yuan in car consumption subsidies.

On December 5, Qingdao released the Implementation Rules for the "Qingdao Warm Winter" New Car First Insurance Consumption Subsidy Activity, continuing to provide consumption subsidies for the first insurance of new cars, with a maximum subsidy of 8,000 yuan per vehicle.

It is reported that, in addition to Shenyang and Qingdao, other regions conducting car consumption subsidy activities in December include Qinzhou and Hangzhou. For example, Qinzhou City established three subsidy tiers, planning to distribute over 700 subsidy quotas. Eligible car buyers must purchase new passenger vehicles from participating auto sales enterprises in Qinzhou during the event period according to the activity rules, with no restrictions on household registration or vehicle licensing region.

Looking ahead to December, the Passenger Car Association stated that there are 23 working days in December 2025, one more day compared to the same period last year and three more days than November's 20 working days, providing relatively ample time for production and sales. New energy vehicle retail sales in December are expected to be very strong. Influenced by the expiration of the new energy vehicle purchase tax exemption this year and the policy next year increasing the purchase tax by 5 percentage points, consumers have a greater sense of urgency for year-end car purchases, leading them to consider delivery timelines more carefully when choosing car models.

To address the rising car purchase costs caused by extended delivery cycles, automakers have introduced purchase tax subsidy schemes. These safety-net measures are only temporary actions for this year-end and are unsustainable in the future. Consumers are significantly influenced by the car purchase environment and atmosphere; due to long waiting lists for popular models, many consumers turn to readily available models, which drives sustained heat in the auto market consumption and further boosts new energy vehicle sales.

Due to higher profits from overseas sales, the trend of "go global or be out" is evident, with export growth exceeding expectations. Since H2, China's auto export situation has continued to improve, with independent new energy vehicles gaining increasing recognition in overseas markets, rapid expansion of overseas marketing networks, and good growth in some overseas markets. The new parallel export policy is about to be implemented, and there is high enthusiasm for parallel exports of 0-kilometer used cars this year, forming a sharp contrast with the sluggish parallel imports.

For the full year, CAAM indicated that the domestic auto demand market has effectively improved driven by the combined effects of policies, new momentum is accelerating its release, and foreign trade has shown good resilience. Auto production and sales for the full year are expected to hit another record high, achieving a successful conclusion to the "14th Five-Year Plan". The Political Bureau of the CPC Central Committee held a meeting on December 8 to analyze and study economic work for 2026, clarifying that next year's economic work should adhere to seeking progress while maintaining stability and improving quality and efficiency. Not long ago, the Ministry of Industry and Information Technology and five other departments jointly issued the "Implementation Plan on Enhancing the Supply-Demand Adaptability of Consumer Goods to Further Promote Consumption". The relevant meeting spirit and policy documents release positive signals, helping to boost development confidence, stabilize market expectations, expand auto consumption across the entire chain, and lay a solid foundation for a good start to the "15th Five-Year Plan".