【SMM Analysis】Aluminium Import Duties in Mexico: Previewing Possible Upcoming Changes

Mexico’s Chamber of Deputies has moved forward with reforms to its General Import and Export Tax Law, setting the stage for significant changes to aluminium import duties. The Commission on Economy, Trade and Competitiveness approved the revised draft in early December, lowering tariffs on hundreds of products while introducing new duties that could reshape trade flows and impact key industrial sectors. As of 11 December 2025 Beijing Time (10 December 2025 Mexico City Time), the Mexican Senate has also approved these changes to the import tariff law, effectively locking in the new tariff schedule for implementation from 2026.

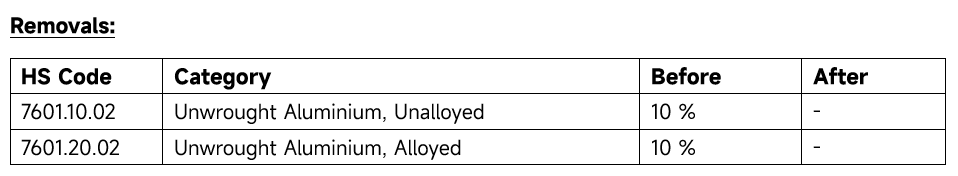

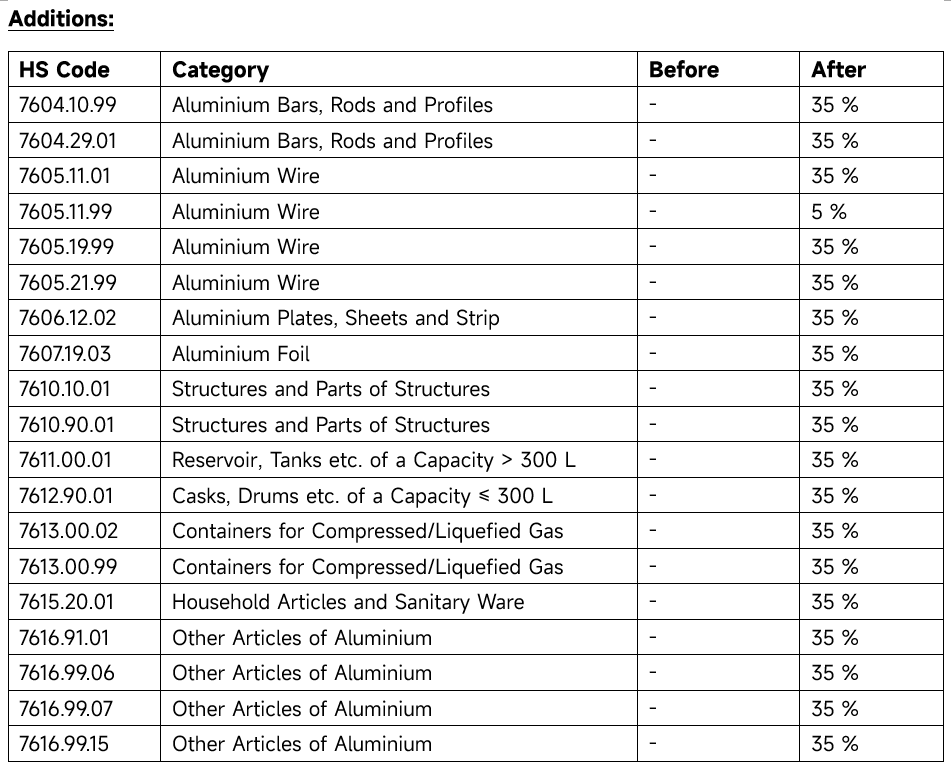

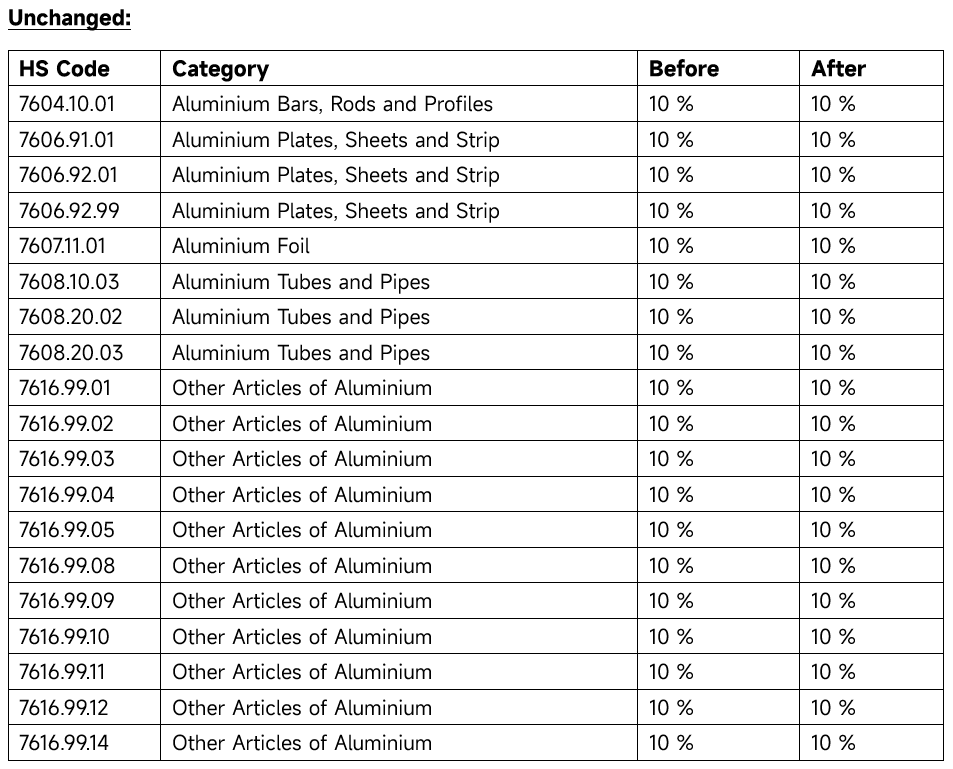

Aluminium as a key sector and trade product saw important changes to its import tariff schedules and listings, many related HS codes are set to face revised duties under Mexico’s latest tariff reform. In total for aluminium-related HS codes, 2 were removed, 19 were added and 19 codes remained:

Implications

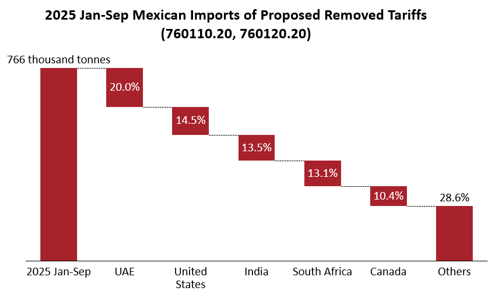

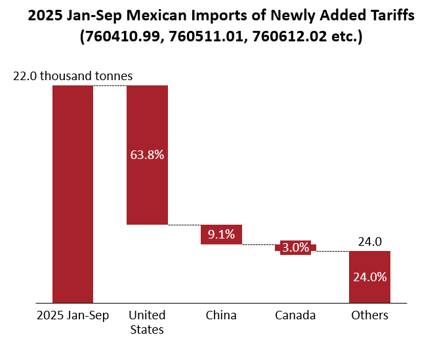

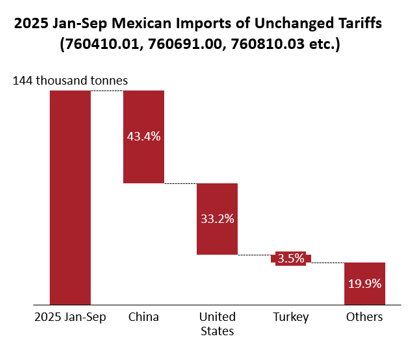

The new tariff regime unequally affects different partner countries of Mexico in aluminium trade:

- The United Arab Emirates (UAE), United States, South Africa, India and Canada gained the most from the removal of tariffs from primary aluminium.

- In terms of newly added tariffs, The United States and China are the two largest exporters of all new tariff schedules combined in 2024, accounting for 65.3% of Mexico’s imports of various types of bars, wires and structures. Most of the newly added import tariff rates fall at 35%, except 760511.99 which has a 5% tariff rate.

- Lastly, tariffs which schedules remained unchanged all have their rates set at 10%. These tariffs are mostly to be paid by China, the United States and Turkey, which are all large manufacturers and exporters of aluminium parts.

These tariff adjustments mark a turning point in Mexico’s aluminium trade policy. By removing duties on primary aluminium while imposing new levies on downstream products, the government is signalling support for domestic manufacturing while reshaping import dynamics with major partners such as China, the United States, and Turkey. As final approval by the Senate has been passed by the11th of December 2025, industry stakeholders should prepare for implementation and possible implications by 2026, especially for traders and manufacturers based in China and the USA.

![Aluminum Producers' Operating Rates Rebound to 61.9%; High Prices Challenge "Golden March" Peak Season [SMM Survey]](https://imgqn.smm.cn/usercenter/tXCfs20251217171653.jpg)

![ADC12 Prices Rose Again This Week[[Weekly Review of Aluminum Scrap and Secondary Aluminum]]](https://imgqn.smm.cn/production/admin/votes/imageskkgTu20240508153005.png)