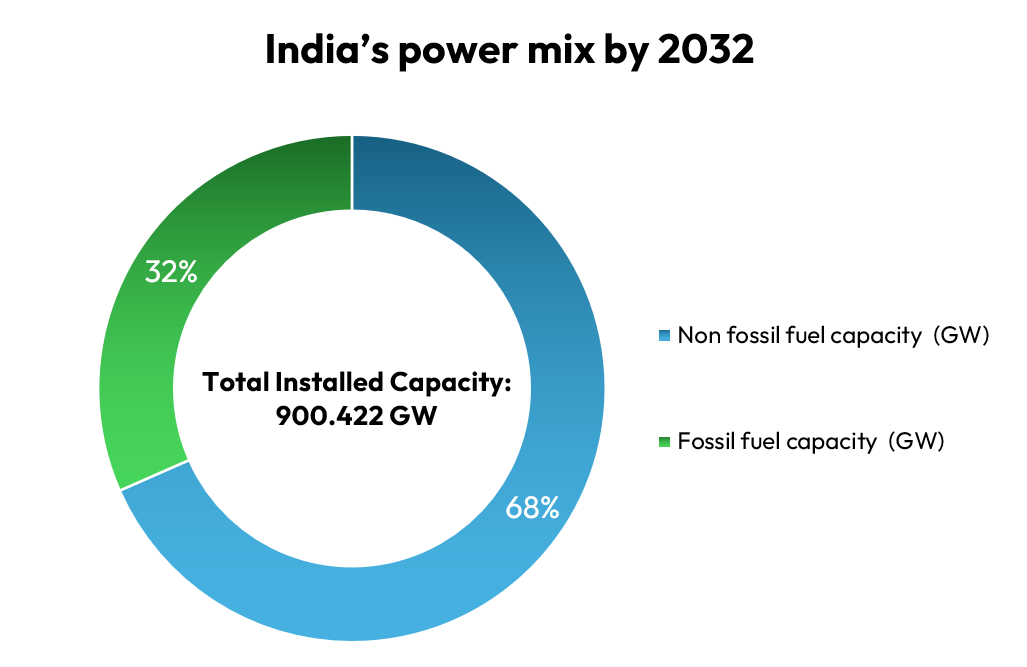

India is exactly in the middle of energy transition, with its non-fossil fuel capacity exceeding 50 per cent of the national power mix. By 2032, the aim is to achieve 68 per cent of renewable and nuclear power capacity of the total energy mix. With this, the wake-up call for energy-intensive industries becomes explicit that the adoption of renewable energy is no longer optional. Particularly for the aluminium industry, which is one of the most electricity-hungry industrial sectors, the implications are sharp, but the path is far from straightforward.

India’s reliance on coal and why so

Not judging, but Indian aluminium industry is still heavily reliant on coal-fired electricity for its operations. Reasons are many, such as the need for round –the-clock power supply. An aluminium smelter typically needs 14-15 megawatt-hours of power per tonne of aluminium throughout the day, leaving no room for interruptions. Renewable sources, such as solar and wind, although cheaper per unit (INR 4–4.3 per kWh) than coal (INR 6 per kWh), are inherently intermittent. As Tata Power CEO Praveer Sinha pointed out, India’s climate variability is one of the main reasons for its reliance on coal or fossil-fueled electricity. Moreover, India has abundant and easy availability of coal, and thus smelters for decades have coal-integrated power infrastructure. These facilities cannot be retrofitted or replaced overnight. So, what should aluminium industry do now when the nation is eyeing to replace coal-fired power plants with renewable energy capacity?

India’s rapid shift to renewables and mandatory policy push

According to Mr Sinha, India’s target is to let go of coal-fired plants which are more than 40 years old, inefficient, and polluting after the scheduled renewable energy projects come online in next five years. Already India’s non-fossil fuel energy, including renewable and nuclear energy, accounts for more than half of the country’s total installed capacity of 501 GW, as of September 2025. According to the Ministry of Power, India’s non-fossil fuel capacity is 256.09 GW, in contrast to fossil fuel capacity of 244.80 GW, which is 49 per cent of the total.

By 2032, the aim is to take the carbon-free capacity to 615.955 GW, with nuclear contributing 19.680 GW, large hydro 62.178 GW, solar 364.566 GW, wind 121.895 GW, small hydro 54.50 GW, biomass 15.500 GW, and pump storage power of 26.686 GW. In contrast, only 90 gigawatts of additional coal-fired electricity capacity is planned to be added to the existing 244 GW of fossil fuel capacity, while one-fourth of the 290 fossil-fueled electricity plants that are more than 25 years old will be replaced with renewable. In simple terms, India aims to have 900.422 GW of installed power capacity by 2032, of which only 284.467 GW of capacity will be fossil-fueled.

For full access, please log onto AlCircle

Source: https://www.alcircle.com/news/india-aims-for-68-renewable-and-nuclear-power-capacity-by-2032-what-should-aluminium-smelters-do-about-energy-mix-116386