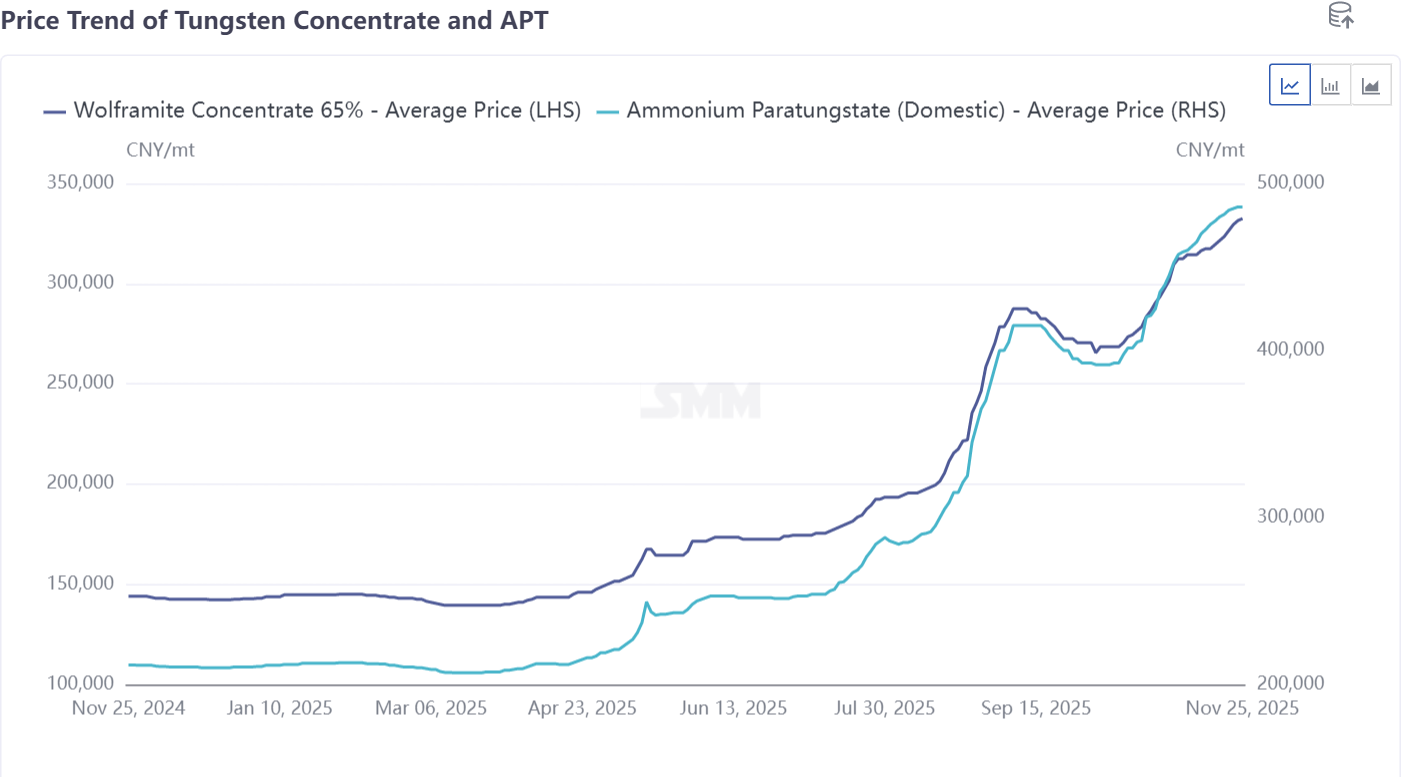

According to SMM surveys, the offered price for European APT CIF Rotterdam has been adjusted upwards to $750-780 per mtu, while the offered price for Ferrotungsten in Rotterdam warehouses has also reached $92-95 per kg tungsten. Within just two weeks, the APT price has increased by $100 per mtu. Although domestic tungsten industry chain prices in China are also rising, the recent price increases in the European market have been significantly sharper than those in China.

The core issue currently facing the European market is no longer just price volatility, but a severe shortage of raw materials. There are currently no continuous spot transactions for APT and tungsten oxide in Europe, with the last traceable transaction price still hovering around $680-700 per mtu. The supply-demand imbalance is the direct driver behind the continuous price increases.

The current raw material shortage primarily stems from three factors:

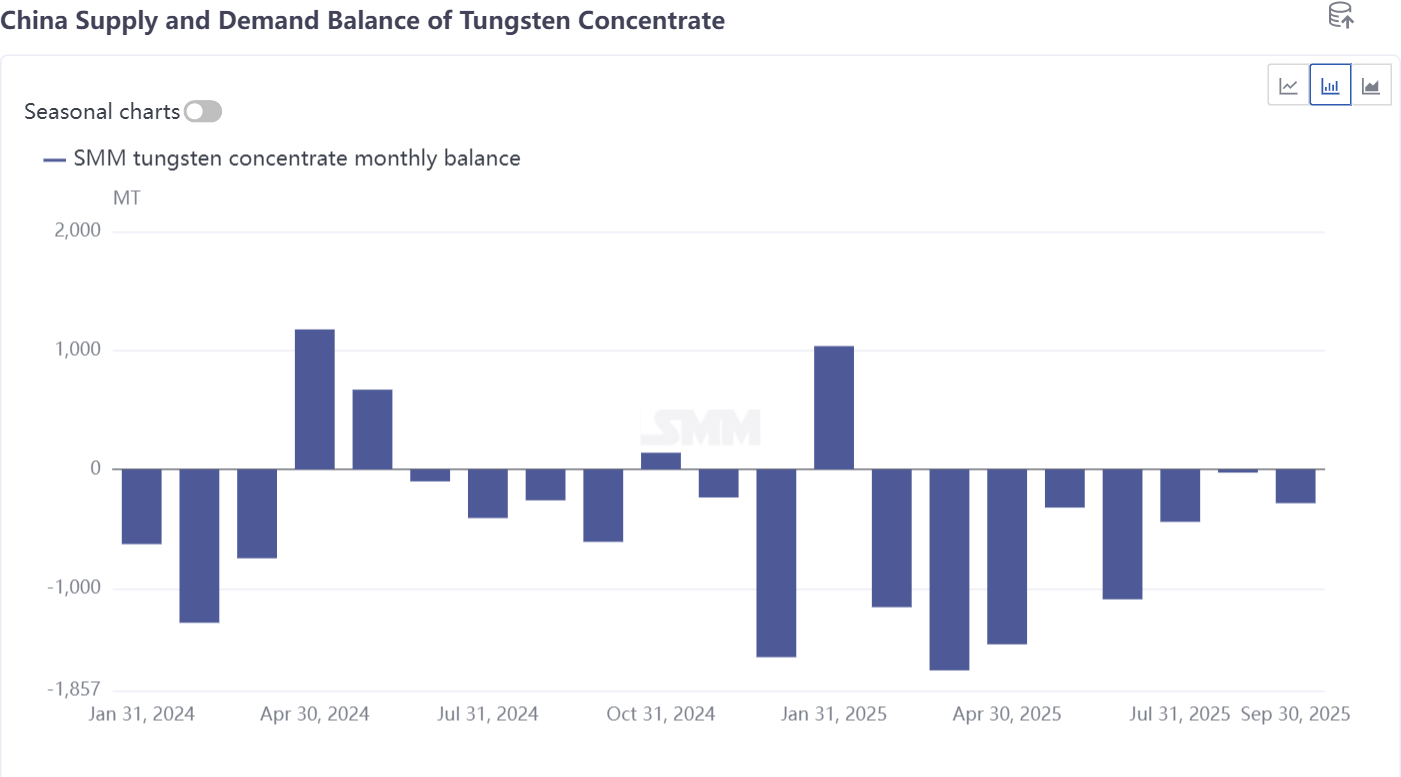

China Export Controls Disrupt APT Supply: Since the implementation of export controls in China in April, exports of APT and intermediate products from China have plummeted. October customs data showed Chinese APT exports had fallen to zero. Although products like ferrotungsten are not explicitly controlled, they still face strict export restrictions. According to SMM surveys, currently only a few qualified large enterprises can obtain export licenses, and each transaction requires going through cumbersome approval processes, taking approximately four months from declaration to completed shipment. China's export restrictions have become the primary factor for the spot shortage in Europe.

Overseas Smelters Face Raw Material Challenges: Smelters outside China are also encountering supply issues. SMM understands that some established smelters in Asia are experiencing shortages of mine supply, and overseas mine prices are rising in line with the market. This threatens the APT supply Europe receives from other regions, with many previous orders failing to be delivered on time. As these companies face spot shortages, they have correspondingly raised their offered prices for APT CIF Rotterdam.

Difficulty Overcoming European Domestic Resource Bottlenecks: The fundamental problem for the European domestic smelting sector is the lack of mine resources. Although several tungsten mining projects are actively advancing in Europe, it takes 3-5 years from mine development to stable supply, making these projects unlikely to alleviate the current shortage in the short term. Against this backdrop, European smelter production primarily relies on tungsten scrap recycling. However, tungsten scrap resources are also becoming increasingly tight, and their prices have been pushed to high levels in the European market. Currently, European smelters are basically only able to meet their own needs and fulfill long-term contracts. The volume of raw materials like APT and ferrotungsten available for external sales continues to shrink, further tightening raw material supply in the European spot market.

This leads to a question: Given the clearly diverging supply-demand structures between the Chinese and European tungsten markets, why do European price trends still closely follow fluctuations in the Chinese market?

The reason is that global mine resources are increasingly flowing to China. As China's tungsten industry chain model restructures and the share of domestic mines shrinks, domestic production's reliance on imported concentrate has significantly increased. Customs data shows that China's total tungsten concentrate imports from January to October 2025 were approximately 15,809 tonnes, a substantial increase of 61.4% year-on-year. The continuous expansion of China's demand share for imported tungsten concentrate directly impacts the ability of other regions to access overseas mine resources. In the absence of new project supply increments, price fluctuations originating from the mine level in China are being transmitted to the global market, driving synchronized price volatility for products like APT and ferrotungsten.

Based on the current market structure, international tungsten prices are forecast to maintain their high level through 2026. As previously analyzed, the new industry chain pattern requires support from mine raw materials, while supply-demand dynamics are also being reconfigured—these factors will continue to provide strong support for prices.

It is recommended the market focus on the following three directions: First, the supply-demand changes and price trends within China's industry chain. Second, the supply-demand situation in the overseas tungsten scrap market, where reliance on scrap tungsten is expected to increase significantly. Third, changes in the flow of global mine resources and the progress of new projects, with expectations that some mine supply will gradually shift towards European and American markets.