【SMM Analysis】 The Brief Off-season and Long-term Changes in Southeast Asia's Secondary Aluminium Market

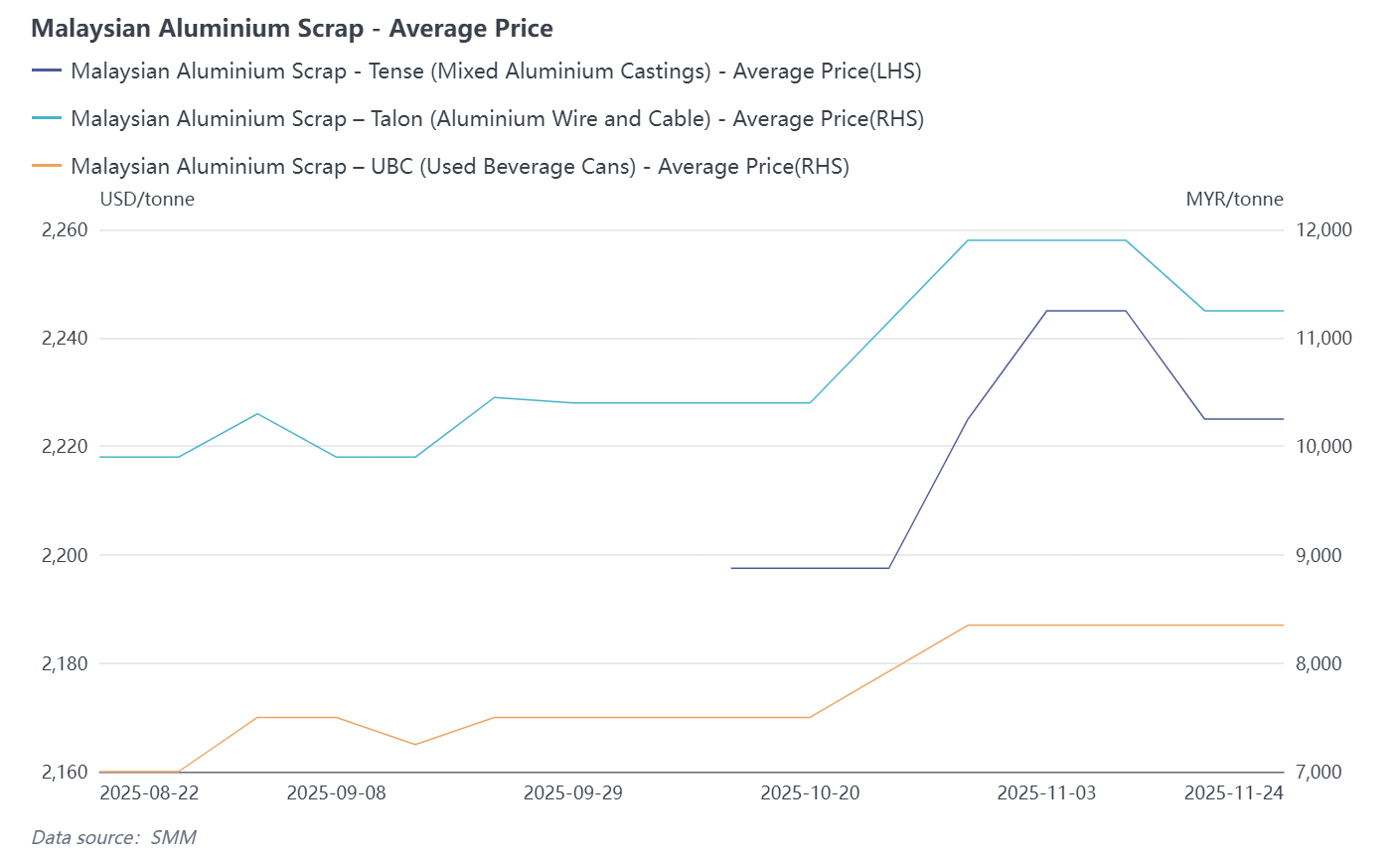

Since the LME aluminum price began its upward trend in October 2025, SMM research shows that the trading volume of scrap aluminum and recycled aluminum alloys in Southeast Asia, especially Thailand and Malaysia, has declined due to factors such as rising aluminum prices and natural disasters. From October 1st to 31st, LME aluminum prices climbed from $2683.5/ton to $2885/ton, and fluctuated between $2840-$2875/ton for most of November, before falling back to $2749.5/ton at the end of the month. Although Southeast Asian scrap aluminum prices are not directly linked to LME prices, their trends are still mainly influenced by LME price fluctuations. Therefore, scrap aluminum prices in Thailand and Malaysia also rose in tandem during October and November. According to SMM survey data:

- The average price of Malaysian Tense mixed aluminum castings rose from $2,197.5/ton at the end of October to $2,245/ton, before slightly declining to $2,225/ton at the end of November;

- The average price of Malaysian Talon aluminum wire and cable increased from RM10,400/ton at the end of October to RM11,900/ton, before falling back to RM11,250/ton at the end of November;

- The average price of Malaysian UBC packaged aluminum cans rose from RM7,500/ton at the end of October to RM8,350/ton;

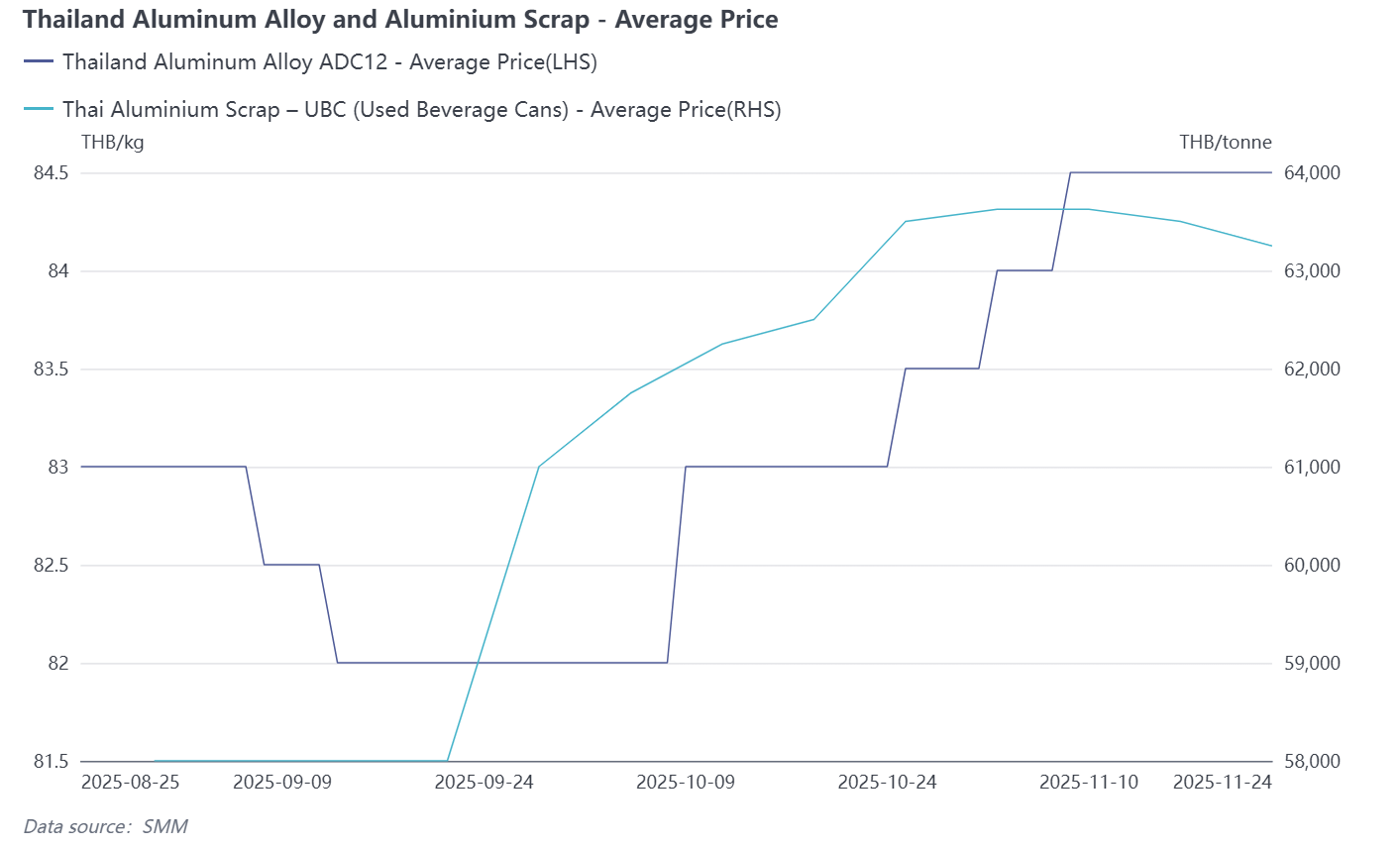

- The average price of Thai UBC packaged aluminum cans continued to rise from 61,000 THB/ton at the beginning of October to 63,625 THB/ton, before slightly adjusting to 63,250 THB/ton at the end of November.

During the same period, the price of recycled aluminum alloy ingots in Southeast Asia also showed a similar trend. SMM research shows that the price of ADC12 in Thailand gradually increased from 82 baht/kg in early October to 83 baht/kg, and then steadily climbed to 84.5 baht/kg between October and November. The rising price of scrap aluminum has increased the cost of recycled aluminum alloys such as ADC12, leading downstream companies in Thailand and Malaysia, especially automobile manufacturers, to reduce their purchases of raw materials such as ADC12. As a result, some ADC12 producers are facing sales pressure and have had to reduce or halt production.

Meanwhile, local scrap aluminum traders began to follow their EU counterparts in adopting a stockpiling strategy, hoping to profit from rising aluminum prices in 2026 when the EU's Carbon Border Adjustment Mechanism (CBAM) and scrap aluminum export tariffs drive up prices. Although LME aluminum prices saw a significant correction at the end of November, the continuous heavy rainfall brought by the northeast monsoon caused flooding in many parts of Thailand and Malaysia, severely restricting and even delaying trading activities in scrap aluminum and recycled aluminum alloys. Looking ahead, SMM expects trading volume in Southeast Asia to see a slight rebound in December 2025, but overall it will still be significantly constrained by LME aluminum price fluctuations. More traders may be inclined to continue stockpiling in anticipation of rising aluminum prices in 2026, while buyers will maintain reduced or suspended production due to sluggish trading in both upstream and downstream sectors. With the formal implementation of the EU CBAM policy in 2026, scrap aluminum, due to its low-carbon properties, is expected to return to high-frequency trading, but global export restrictions and conservative trade policies in Europe and the US may bring uncertainty to overall import and export opportunities.