[SMM Hot Topic] Export Pullback Just an Episode? Where Are November Exports Headed?

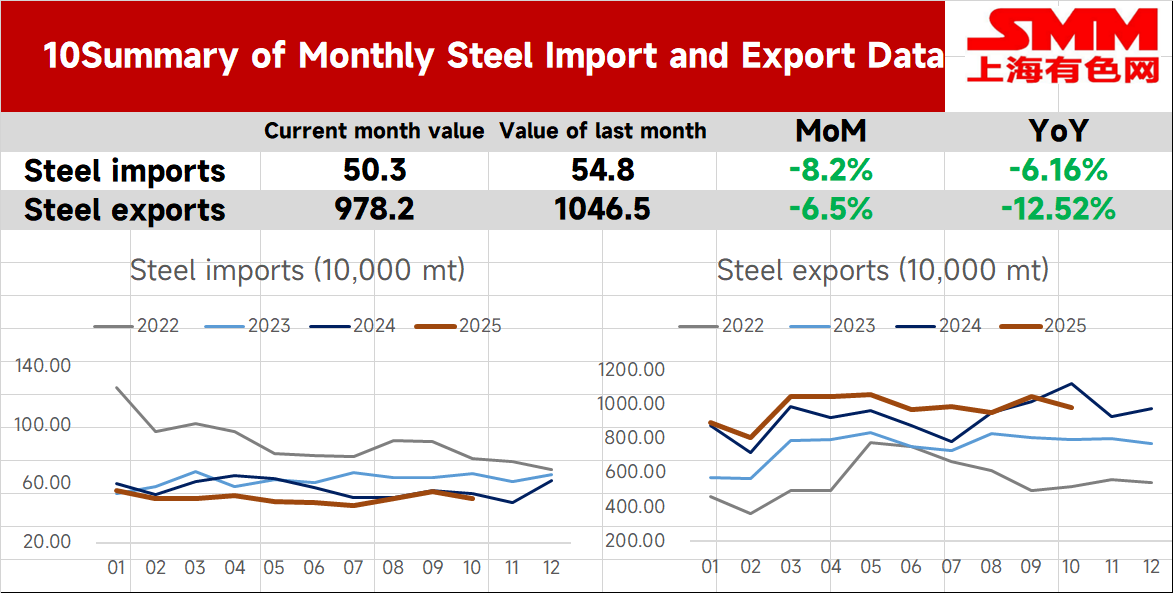

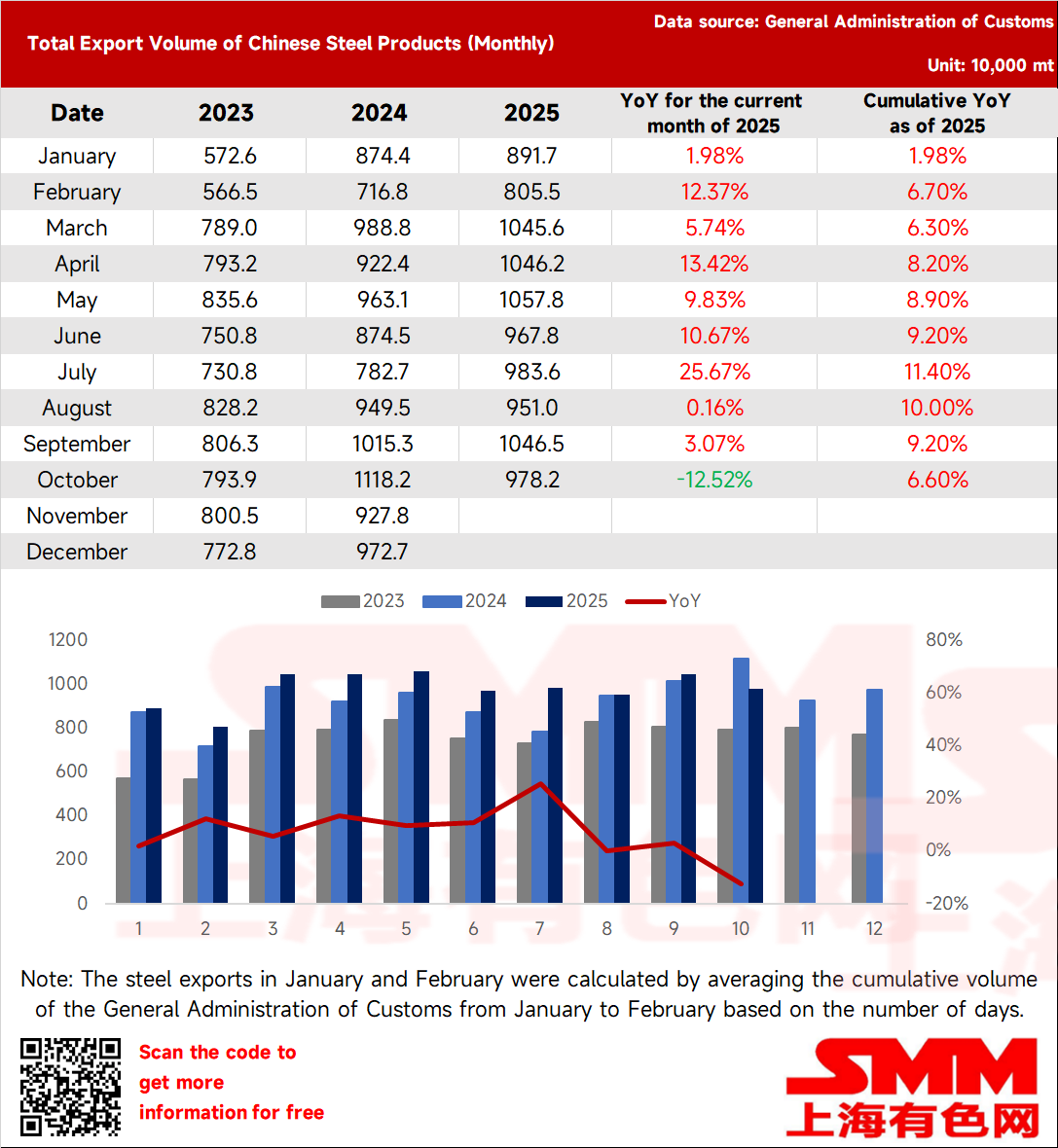

On November 7, data from the General Administration of Customs showed that China exported 9.782 million mt of steel products in October 2025, down 683,000 mt MoM, a decrease of 6.5% MoM. Cumulative exports from January to October reached 97.737 million mt, up 6.6% YoY.

China imported 503,000 mt of steel products in October, down 45,000 mt MoM, a decrease of 8.2% MoM. Cumulative imports from January to October stood at 5.041 million mt, down 11.9% YoY.

Overview of Steel Product Import and Export Data for October

- China's Steel Exports Declined MoM

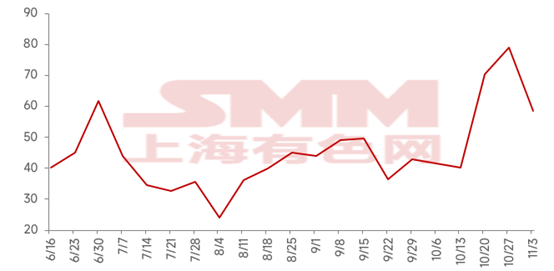

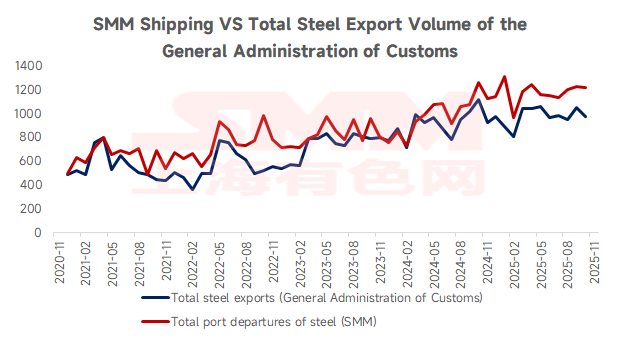

China's total steel exports in October fell 6.5% MoM and were also down 12.52% YoY. The main reasons are twofold. On one hand, the surge in shipments driven by earlier crackdowns on fraudulent export declarations was largely reflected in September's export data. Consequently, subsequent order intake and October shipment volumes decreased compared to previous levels, which can also be observed in the SMM export order survey data and shipping data below.

SMM Steel Export Orders (10kt) — Excerpted from SMM Steel Export Weekly Report

According to SMM shipping data, as of October 31, the total volume of port departures from Chinese ports in October was 12.1656 million mt, down 1.12% MoM compared to September.

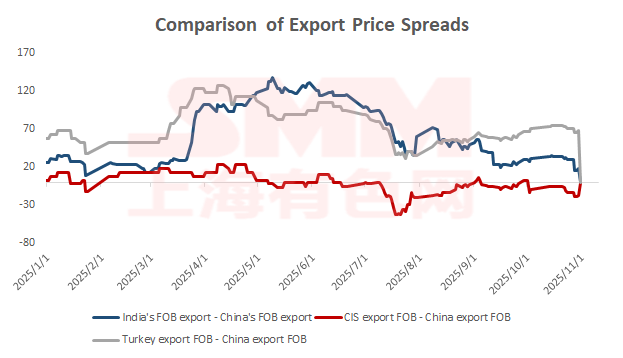

On the other hand, the declining trend can also be attributed to global price spreads. Taking HRC export prices as an example, from September to early October, the competitiveness of China's HRC export quotations compared to markets like India and the CIS weakened, especially as Russian HRC export prices at one point fell below Chinese offers. This led to a pullback in overseas customers' purchase willingness.

- China's Steel Imports Continued to Decline in October

China imported 503,000 mt of steel products in October, down 45,000 mt MoM, a decrease of 8.2% MoM. Cumulative imports from January to October stood at 5.041 million mt, down 11.9% YoY.

- Short-Term Steel Export Outlook

According to the China Federation of Logistics & Purchasing, the global manufacturing PMI was 49.7% in October 2025, flat from the previous month, marking the eighth consecutive month within the 49%-50% range. Based on the composite index changes, global manufacturing continues to stabilize within a certain range, with a relatively steady recovery trend. The recovery momentum since the beginning of this year is slightly better than the same period last year, but still below pre-pandemic levels, indicating a continued slow global economic recovery. Based on China's manufacturing PMI data, the manufacturing PMI was 49.0% in October, down 0.8 percentage points MoM.

According to World Steel Association monitoring data, global crude steel production in September 2025 for the 70 countries/regions included in the World Steel Association statistics was 141.8 million mt, down 1.6% YoY. Production in other regions outside China was 68.31 million mt, a slight increase of 0.6 percentage points MoM.

Based on the latest SMM survey data, domestic steel mills' HRC export plans for November amount to 1.13 million mt, an increase of 138,000 mt from the actual exports in the previous month, up 13.9% MoM. With recent price pullbacks, some new export orders have improved. Meanwhile, certain product categories showed active forging or purchasing customs clearance documents from other import and export firms, with good order performance. Combined with the SMM export order data mentioned above, total steel exports in November are expected to have further growth potential.

Copyright and Intellectual Property Statement:

This report is independently created or compiled by SMM Information & Technology Co., Ltd. (hereinafter referred to as "SMM"), which legally enjoys complete copyright and related intellectual property rights.

All content contained in this report (including but not limited to information, articles, data, charts, images, audio, video, logos, advertisements, trademarks, trade names, domain names, layout design, and any other information) is protected by copyright, trademark rights, domain name rights, commercial data information property rights, and other related intellectual property rights, all of which are owned or held by SMM or its relevant rights holders.

The aforementioned rights are strictly protected by relevant laws and regulations such as the Copyright Law of the People's Republic of China, the Trademark Law of the People's Republic of China, the Anti-Unfair Competition Law of the People's Republic of China, and applicable international treaties.

Without prior written authorization from SMM, no institution or individual may:

1. Use all or part of the content of this report in any form (including but not limited to reprinting, modifying, selling, transferring, displaying, translating, compiling, or disseminating);

2. Disclose the content of this report to any third party;

3. Permit or authorize any third party to use the content of this report.

4. For any unauthorized use, SMM will pursue the legal liability of the infringer in accordance with the law, requiring them to bear legal responsibilities including but not limited to contractual breach liability, restitution of unjust enrichment, and compensation for direct and indirect economic losses.

Data Source Statement:

Except for publicly available information, other data in this report are derived from public information (including but not limited to industry news, seminars, exhibitions, enterprise financial reports, brokerage reports, National Bureau of Statistics (NBS) data, customs import and export data, various data published by major associations and institutions, etc.), market communication, and are obtained through comprehensive analysis and reasonable inference by the research team based on SMM's internal database model. This information is for reference only and does not constitute decision-making advice.

SMM reserves the final right to interpret the terms of this statement and the right to adjust and modify the content of the statement based on actual circumstances.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)