[SMM Analysis] China's September Steel Exports Data Interpretation

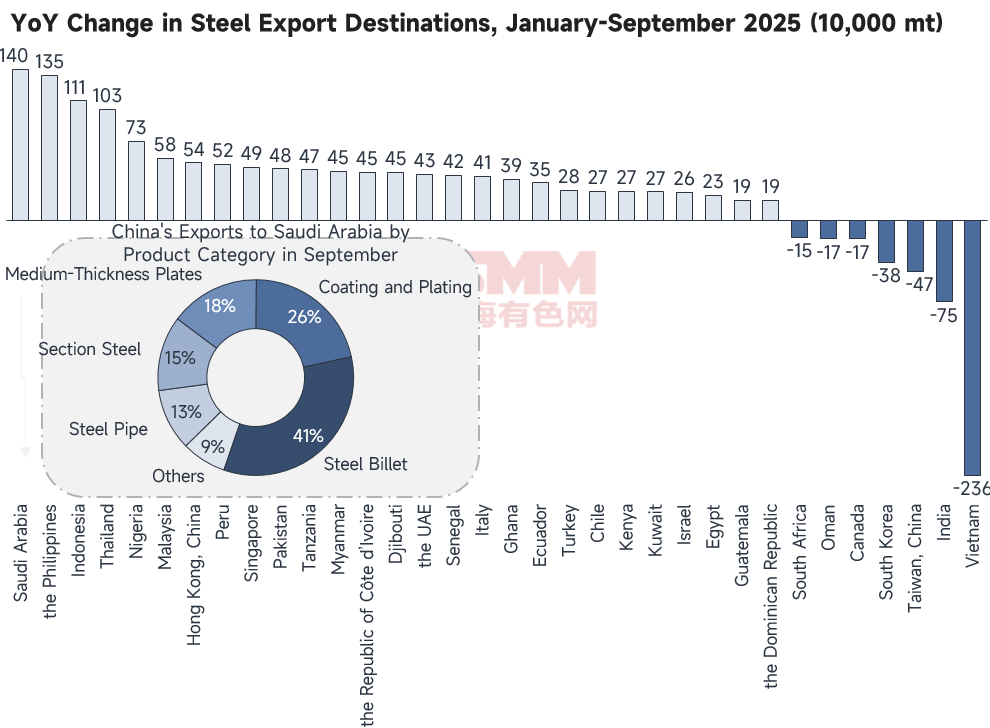

- By Country: Exports to Saudi Arabia Recorded the Largest YoY Increase, While Exports to Vietnam Saw the Largest YoY Decrease

According to data compiled by SMM from the General Administration of Customs, China's cumulative steel export volume from January to September 2025 reached 98.6964 million mt, up 17.14% YoY. Saudi Arabia remained the country with the largest cumulative YoY increase, up 1.4001 million mt, or 41.28% YoY. Specifically, among all steel product categories exported to Saudi Arabia in September, HRC's share expanded again to 45%, accounting for nearly half of the total, followed by steel billet at 19%, while coated/galvanized and medium-thickness plates accounted for 12% and 8%, respectively. Compared with the export product distribution in August, some changes occurred: the shares of medium-thickness plates and coated/galvanized products declined, while the proportions of steel billet and HRC increased again.

Data source: General Administration of Customs, SMM

In terms of cumulative total export volume, Vietnam remained the top destination for China's steel exports, with cumulative exports reaching 7.1204 million mt by September this year. However, it also showed the largest YoY decline, down 24.91%. The primary reason for this change is Vietnam's increasingly stringent anti-dumping measures against Chinese steel products, with five case rulings issued so far this year. Recently, the Vietnamese Ministry of Industry and Trade (MOIT) initiated an anti-circumvention investigation on certain HRC products originating from China. According to the relevant government document (Decision No. 3176/QD-BCT, signed by Vietnamese Vice Minister of Industry and Trade Nguyen Sinh Nhat Tan on October 27), the products under investigation are HRC with widths >1,880 mm and ≤2,300 mm. The specific specifications of the products involved are flat-rolled iron or steel (alloy or non-alloy), hot-rolled, with thicknesses between 1.2 mm and 25.4 mm. However, the following products are excluded from the scope of this investigation: HRC with a carbon content >0.3% by weight; thick plates with thickness ≥10 mm; and HRC products already covered by existing anti-dumping duties. According to the SMM survey, with the ruling outcome still uncertain, some export traders are intensifying efforts to dispatch vessels to Vietnam to mitigate risks, and current wide coil order intake performance is favorable.

Data source: General Administration of Customs, SMM

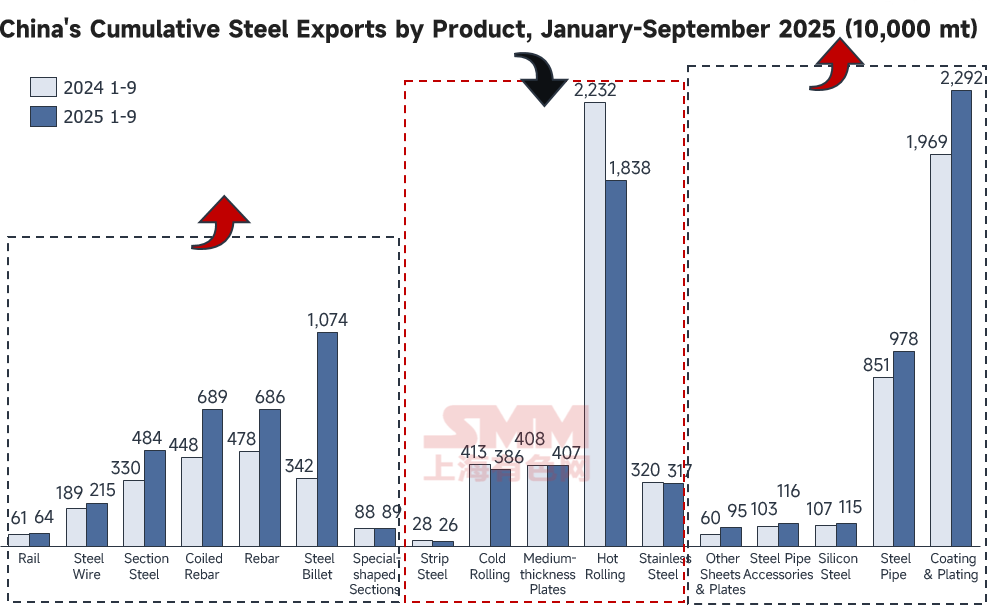

Ø By product category, steel billet recorded the largest increase, while hot-rolled products saw the largest decline.

Based on data compiled by SMM from the General Administration of Customs, China exported 11.9593 million mt of steel products in September 2025, including 1.4943 million mt of steel billets, accounting for 12.49% of the country's total exports. Although the proportion is relatively small, the cumulative increase from January to September reached 214.4% YoY (slowing from the 291% growth in the January-August period). Steel billets still face relatively few trade remedy measures, with no more than five cases initiated since 2023. The latest related case notification involves Egypt's initiation of a safeguard investigation on imported steel billets. China's steel billet exports to Egypt from January to September totaled 394,300 mt, accounting for only 3.7% of China's total billet exports, a relatively small share. Therefore, even if subsequent sanctions are implemented, the actual impact on China's steel billet exports is expected to be limited, and excessive concern is unwarranted. Combining SMM's export market survey with customs data analysis reveals that Chinese exporters continue to actively diversify export product categories and markets in response to increasingly stringent international trade barriers.

Data source: General Administration of Customs, SMM

Copyright and Intellectual Property Statement:

This report is independently created or compiled by SMM Information & Technology Co., Ltd. (hereinafter referred to as "SMM"), and SMM legally enjoys complete copyright and related intellectual property rights.

The copyright, trademark rights, domain name rights, commercial data information property rights, and other related intellectual property rights of all content contained in this report (including but not limited to information, articles, data, charts, pictures, audio, video, logos, advertisements, trademarks, trade names, domain names, layout designs, etc.) are owned or held by SMM or its related right holders.

The above rights are strictly protected by relevant laws and regulations of the People's Republic of China, such as the Copyright Law of the People's Republic of China, the Trademark Law of the People's Republic of China, and the Anti-Unfair Competition Law of the People's Republic of China, as well as applicable international treaties.

Without prior written authorization from SMM, no institution or individual may:

1. Use all or part of this report in any form (including but not limited to reprinting, modifying, selling, transferring, displaying, translating, compiling, disseminating);

2. Disclose the content of this report to any third party;

3. License or authorize any third party to use the content of this report;

4. For any unauthorized use, SMM will legally pursue the legal responsibilities of the infringer, demanding that they bear legal responsibilities including but not limited to contractual breach liability, returning unjust enrichment, and compensating for direct and indirect economic losses.

Data Source Statement:

(Except for publicly available information, other data in this report are derived from publicly available information (including but not limited to industry news, seminars, exhibitions, corporate financial reports, brokerage reports, data from the National Bureau of Statistics, customs import and export data, various data published by major associations and institutions, etc.), market exchanges, and comprehensive analysis and reasonable inferences made by the research team based on SMM's internal database models. This information is for reference only and does not constitute decision-making advice.

SMM reserves the final interpretation right of the terms in this statement and the right to adjust and modify the content of the statement according to actual circumstances.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)