- In January-September, steel product exports increased 9% YoY, while sheet and plate exports decreased 2% YoY

According to data from the General Administration of Customs, China exported 10.465 million mt of steel products in September 2025, an increase of 955,000 mt from the previous month, up 10.0% MoM. Cumulative exports from January to September reached 87.955 million mt, up 9.2% YoY.

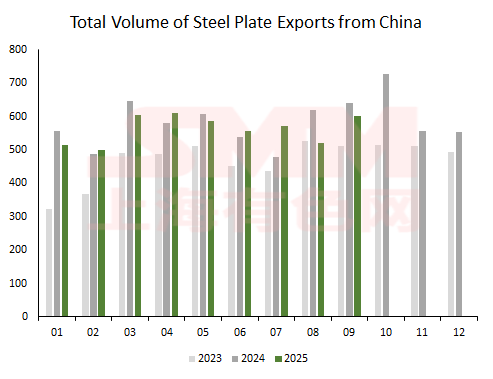

Among these, China exported 6.0085 million mt of steel sheets and plates in September 2025, an increase of 804,800 mt from the previous month, up 15.5% MoM. Cumulative exports from January to September totaled 50.4611 million mt, down 1.8% YoY.

In terms of share, China's exports of steel sheets & plates accounted for approximately 51% of total steel exports (including steel billet) from January to September 2025, down about 10 percentage points compared to the same period in 2024. Meanwhile, exports of rebar, coiled rebar, and steel billet accounted for around 25% of total steel exports (including steel billet) in the first nine months of this year, up about 10 percentage points year-on-year.

- From the export structure perspective, coated and galvanized products firmly hold the "top spot" in China's steel exports by product category.

Affected by the ongoing rise in overseas anti-dumping measures, China's hot-rolled exports decreased significantly this year. Meanwhile, the export volume and proportion of coated and plated products increased markedly, making them the top category in China's steel exports.

From January to September 2025, the total export volume of coated and plated coil reached 22.9158 million mt, an increase of 3.2294 million mt compared with the same period in 2024, up 16%. In terms of flow direction, exports to the top 20 countries accounted for 63% of the total coated and plated exports from January to September this year. The leading countries were mainly from Southeast Asia, South America, the Middle East, East Asia, and Europe, with the Philippines, Thailand, and South Korea remaining the top three destinations for China's coated and plated exports.

- Why Does the Philippines Consistently Rank as the Top Destination for China's Coated and Galvanized Steel Exports?

The Philippines is the fifth-largest economy in ASEAN. According to the latest data, its crude steel capacity is approximately 2 million mt. In terms of product structure, construction materials and section steel account for a relatively high share of production, while sheets & plates make up about 15%. Domestic production capacity and output of construction materials are significantly higher than those of sheets & plates. This is partly due to the relatively backward production technology for sheets & plates in local steel mills, which limits capacity utilization. On the other hand, it is linked to the Philippines' vigorous development of its construction industry. Relevant data show that in 2024, the construction sector's contribution to GDP reached 8.1%, an 80% increase compared to 2020. Among basic construction materials such as steel and cement, import dependency is as high as 65%. The booming construction industry has driven the growth in both capacity and output of construction materials. However, the gap between domestic steel capacity and demand has led to a high reliance on imports.

In addition, the high-grade quality of China's coated and plated products and their price advantage compared to other countries are also important reasons for the increase in China's coated and plated exports to the Philippines.

With the successful commissioning of the Panhua Group's integrated steel plant in Maasim, Sarangani Province, the Philippines, it is expected that the Philippines' domestic capacity will significantly increase by 2026. The re-shifting of the supply-demand pattern will also bring new changes to the future coated and plated exports between China and the Philippines.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)