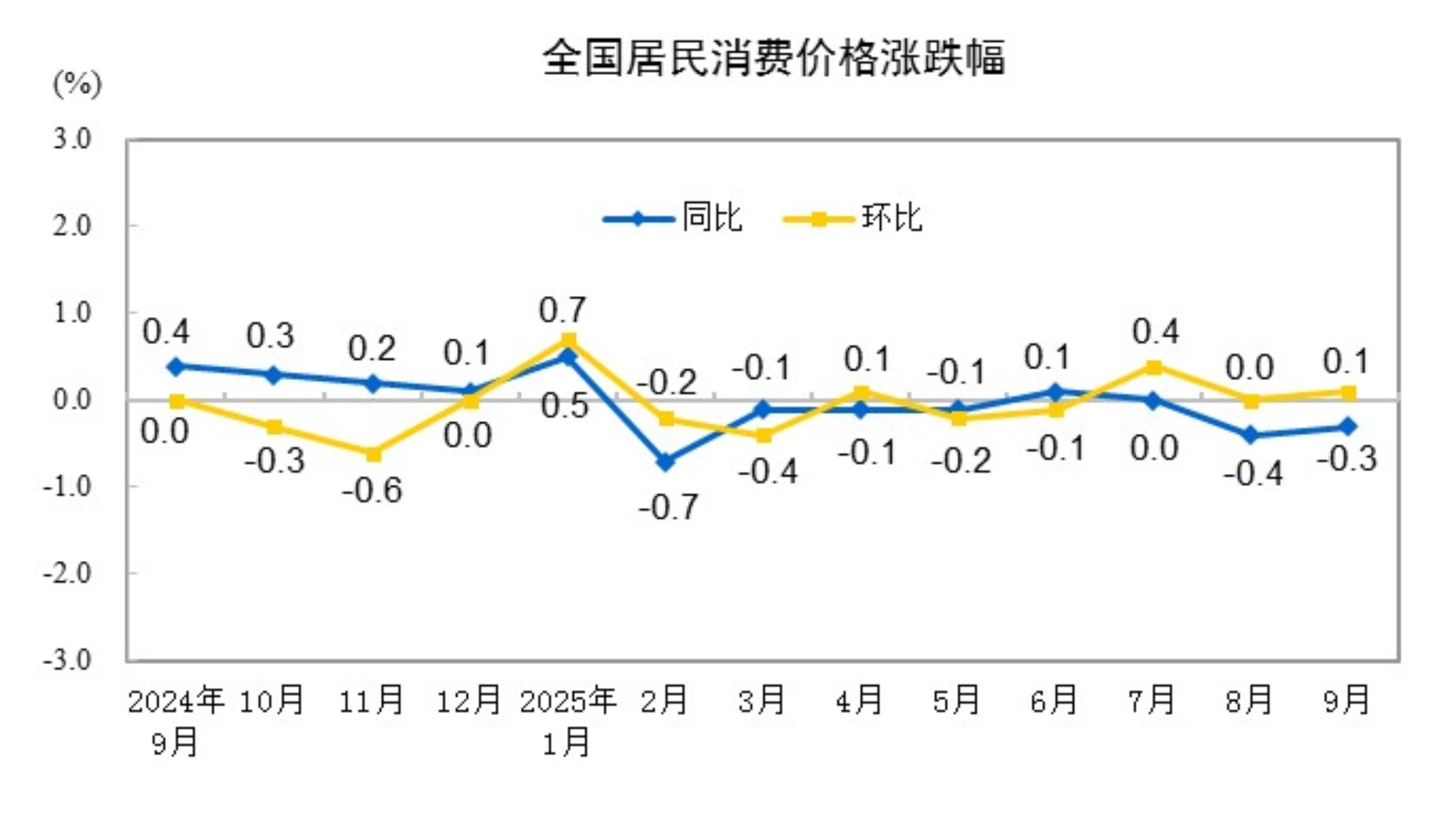

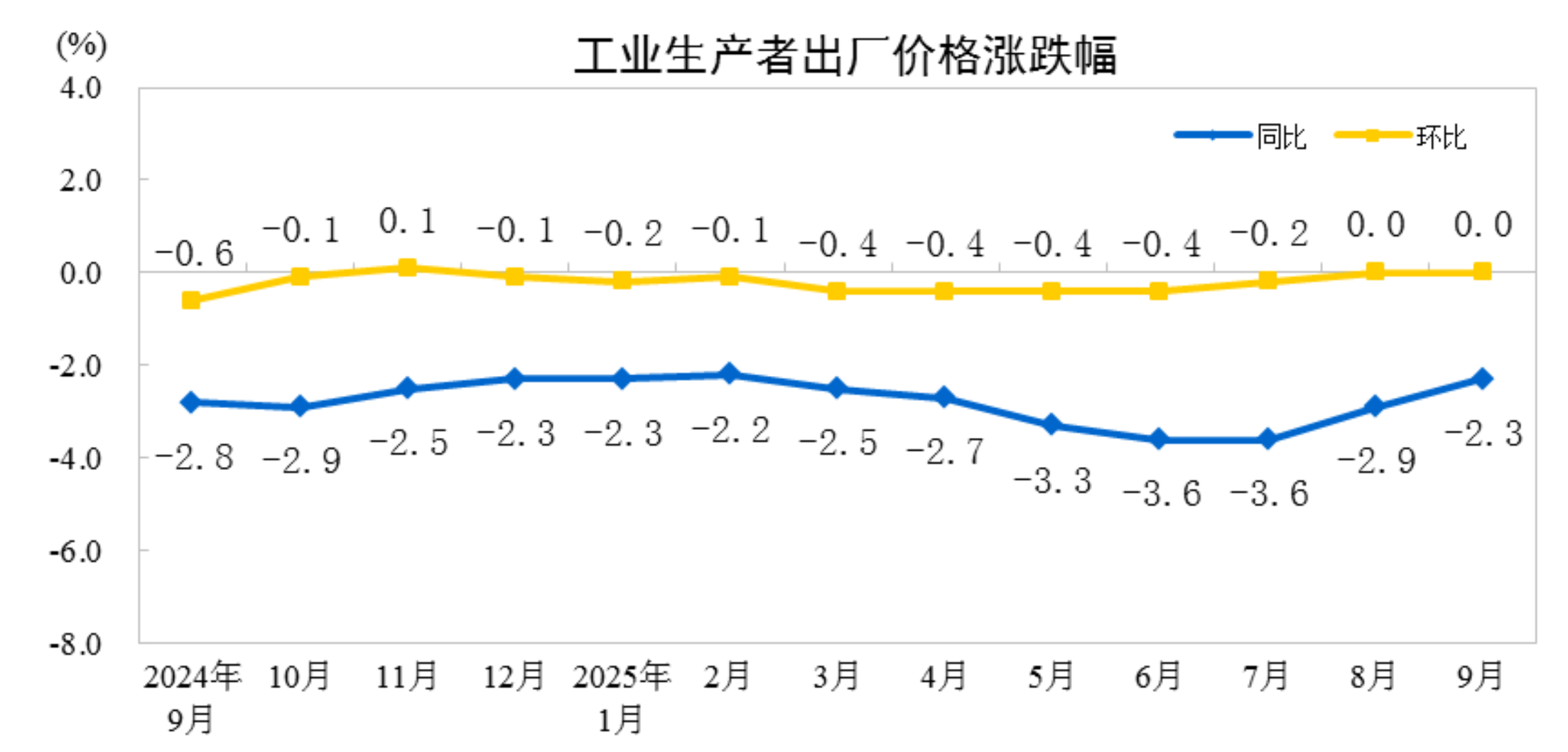

Data from the National Bureau of Statistics (NBS) showed that in September 2025, the national consumer price index (CPI) fell 0.3% year-on-year. Specifically, it declined by 0.2% in urban areas and 0.5% in rural areas; food prices dropped by 4.4%, while non-food prices rose by 0.7%; prices of consumer goods decreased by 0.8%, while service prices increased by 0.6%. On average from January to September, the national consumer price index fell by 0.1% compared with the same period last year. In September, the national consumer price index rose by 0.1% month-on-month. Specifically, it was flat in urban areas and increased by 0.2% in rural areas; food prices rose by 0.7%, while non-food prices fell by 0.1%; prices of consumer goods increased by 0.3%, while service prices decreased by 0.3%. Data from the National Bureau of Statistics also showed that in September 2025, the national producer price index (PPI) for industrial producers fell by 2.3% year-on-year, with the decline narrowing by 0.6 percentage points from the previous month, and remained flat month-on-month. The purchasing prices for industrial producers fell by 3.1% year-on-year, with the decline narrowing by 0.9 percentage points from the previous month, and rose by 0.1% month-on-month. On average from January to September, the producer price index for industrial producers fell by 2.8% compared with the same period last year, while the purchasing prices for industrial producers dropped by 3.2%.

Core CPI YoY Growth Continued to Expand in September 2025

PPI YoY Decline Continued to Narrow

—Dong Lijuan, Chief Statistician of the Department of Urban Socio-Economic Survey of the NBS, Interprets CPI and PPI Data for September 2025

In September, the consumer market operated steadily overall. The consumer price index (CPI) rose by 0.1% month-on-month and fell by 0.3% year-on-year. The core CPI, which excludes food and energy prices, rose by 1.0% year-on-year, with the growth rate expanding for the fifth consecutive month. With the in-depth advancement of the national unified market and continuous optimization of market competition order, the producer price index (PPI) for industrial producers remained flat month-on-month; it fell by 2.3% year-on-year, with the decline narrowing by 0.6 percentage points from the previous month.

I. CPI Turned from Flat to Rising MoM, Core CPI YoY Growth Rebounded to 1%

CPI rebounded somewhat on a monthly basis, turning from flat in the previous month to an increase of 0.1%. Among these, food prices rose by 0.7% month-on-month, with the growth rate expanding by 0.2 percentage points from the previous month, contributing approximately 0.13 percentage points to the monthly CPI increase. Within food items, prices of fresh vegetables, eggs, fresh fruits, mutton, and beef all showed seasonal increases, ranging between 0.9% and 6.1%; meanwhile, pork and aquatic products were in ample supply, with prices falling by 0.7% and 1.8%, respectively. Prices of industrial consumer goods excluding energy rose by 0.5%, contributing approximately 0.12 percentage points to the monthly CPI increase. Among these, domestic gold jewelry prices rose by 6.5% due to the impact of rising international gold prices; with the launch of new autumn clothing, apparel prices increased by 0.8%; prices of recreational durable goods, household appliances, and daily household articles rose by 0.9%, 0.6%, and 0.6%, respectively. Driven by declines in service and energy prices, the CPI increase MoM was slightly below seasonal levels. Service prices fell 0.3%, contributing approximately 0.12 percentage points to the MoM decline in CPI. Among these, due to the end of the summer holiday period and the Mid-Autumn Festival falling in a different month compared to previous years, prices for air tickets, hotel accommodation, and tourism dropped 13.8%, 7.4%, and 6.1% respectively, collectively contributing about 0.17 percentage points to the MoM decline in CPI. Energy prices decreased 0.8%, with domestic gasoline prices falling 1.7% influenced by changes in international oil prices.

CPI fell 0.3% YoY, with the decline narrowing by 0.1 percentage points from the previous month. The YoY decline in CPI was mainly due to the carryover effect. Of the 0.3% YoY change in CPI this month, the carryover effect was approximately -0.8 percentage points, while the new impact from price changes this year was about 0.5 percentage points. By category, food and energy prices declined. Food prices dropped 4.4%, with the decline widening by 0.1 percentage points from the previous month, contributing approximately 0.83 percentage points to the YoY decline in CPI, making it the primary factor driving the decrease. Within food, prices for pork, fresh vegetables, eggs, and fresh fruit fell 17.0%, 13.7%, 13.5%, and 4.2% respectively, collectively contributing about 0.78 percentage points to the YoY decline in CPI; prices for beef and mutton rose 4.6% and 0.8% respectively, with mutton prices increasing for the first time after 44 consecutive months of decline. Energy prices decreased 2.7%, contributing approximately 0.2 percentage points to the YoY decline in CPI. Core CPI, which excludes food and energy, rose 1.0% YoY, marking the fifth consecutive month of expanding growth and the first time in nearly 19 months that the growth rate returned to 1%. Among these, prices for industrial consumer goods excluding energy increased 1.8%, expanding for the fifth consecutive month. Within industrial consumer goods, prices for gold jewelry and platinum jewelry rose 42.1% and 33.6% respectively, while prices for household appliances, daily household necessities, and communication tools increased 5.5%, 3.2%, and 1.5% respectively, all with expanding growth rates. Service prices rose 0.6%, remaining relatively stable, with prices for medical services and household services increasing 1.9% and 1.6% respectively, while prices for hotel accommodation and air tickets fell 1.5% and 1.7% respectively.

II. PPI Was Flat MoM, YoY Decline Continued to Narrow

PPI was flat MoM for the second consecutive month. The main characteristics of PPI's MoM performance this month were: First, improvements in the supply-demand structure drove significant price stabilization in some sectors. Coal processing prices rose 3.8% MoM, coal mining and washing prices increased 2.5%, and ferrous metals smelting and rolling processing prices rose 0.2%, all up for two consecutive months; PV equipment and components manufacturing prices shifted from a 0.2% decline last month to a 0.8% increase. Non-metallic mineral products industry prices and lithium-ion battery manufacturing prices fell 0.4% and 0.2% respectively, with the declines narrowing by 0.6 and 0.3 percentage points from the previous month. Second, imported factors led to a MoM decline in domestic petroleum-related industry prices. Falling international crude oil prices drove down domestic petroleum-related industry prices MoM. Specifically, petroleum extraction prices fell 2.7%, refined petroleum product manufacturing prices fell 1.5%, organic chemical raw material manufacturing prices fell 0.6%, and chemical fiber manufacturing prices fell 0.2%.

The PPI fell 2.3% YoY, with the decline narrowing by 0.6 percentage points from the previous month. Besides the impact of a lower comparison base from the same period last year, the effects of China's macro policies continued to manifest, with some industries showing positive price changes. First, the deepening advancement of building a unified national market contributed to a narrowing of the YoY decline in prices for related industries. Capacity management in some sectors showed results, market competition order continued to improve, and the YoY price declines narrowed. The price declines for coal processing, ferrous metals smelting and pressing, coal mining and washing, PV equipment and components manufacturing, battery manufacturing, and non-metallic mineral products narrowed by 8.3, 3.4, 3.0, 2.4, 0.5, and 0.4 percentage points, respectively, from the previous month. These six industries reduced the downward drag on the PPI YoY by about 0.34 percentage points compared to the previous month. Second, industrial structure upgrading and the release of consumption potential drove YoY price increases in related industries. The accelerated construction of a modern industrial system, positive trends in high-end, intelligent, and green development of manufacturing, and steadily expanding market demand led to a 1.4% YoY increase in aircraft manufacturing prices, a 1.2% rise in electronic specialty material manufacturing prices, a 0.9% increase in waste resource comprehensive utilization industry prices, and a 0.1% rise in wearable smart device manufacturing prices. The effects of policies to boost consumption continued to appear, with quality and upgrading consumer demand being released, leading to a 14.7% YoY increase in arts, crafts, and ceremonial product manufacturing prices, a 4.0% rise in sports ball manufacturing prices, and a 1.8% increase in nutritional food manufacturing prices.

Recommended Reading: