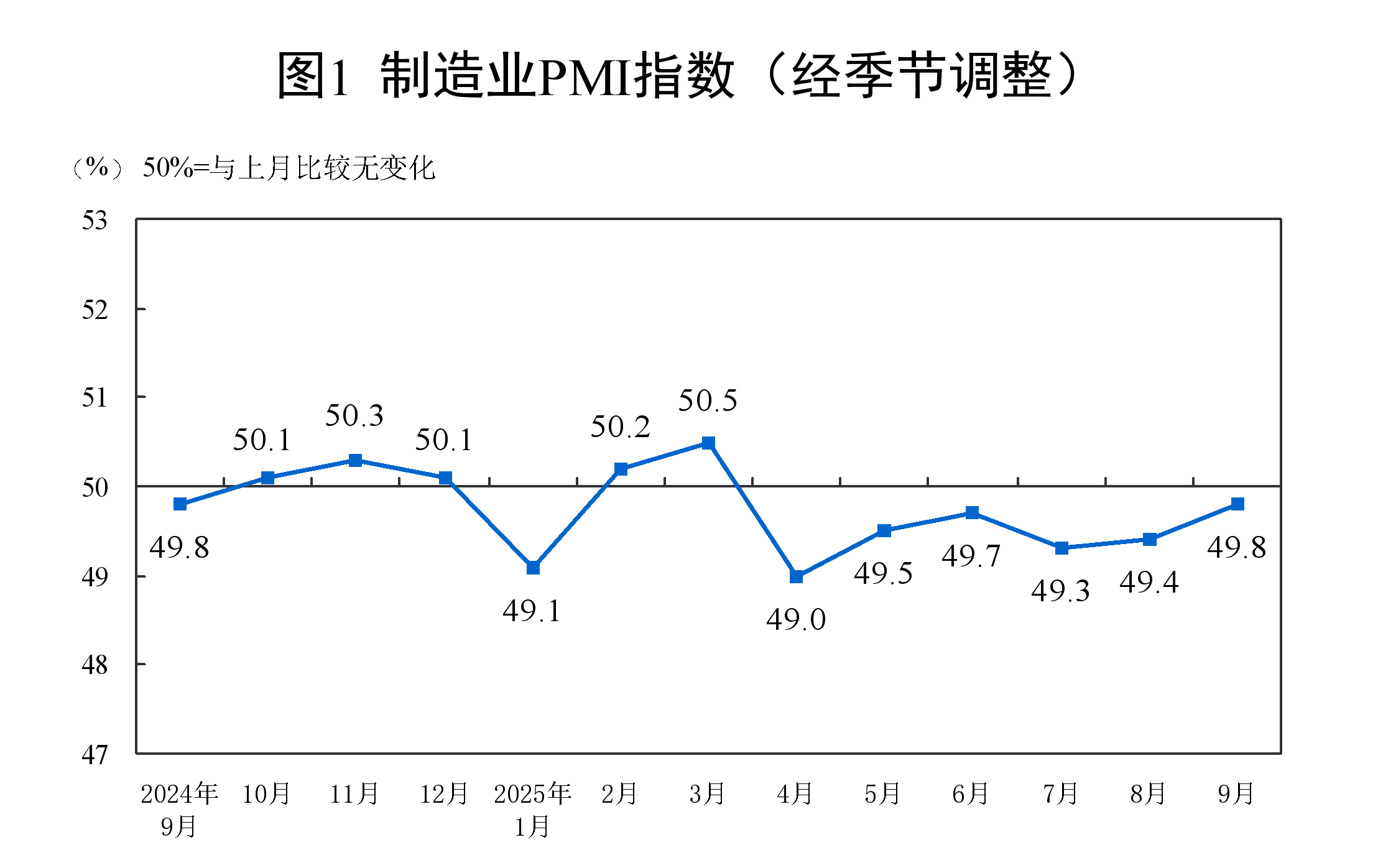

According to data from the National Bureau of Statistics (NBS), the manufacturing PMI was 49.8% in September, up 0.4 percentage points from the previous month, indicating continued improvement in the manufacturing sector's prosperity level.

Huo Lihui, Chief Statistician of the NBS Service Industry Survey Center, interpreted China's Purchasing Managers' Index for September 2025.

Operation of China's Purchasing Managers' Index in September 2025

I. Operation of China's Manufacturing Purchasing Managers' Index

In September, the manufacturing PMI was 49.8%, up 0.4 percentage points from the previous month, indicating continued improvement in the manufacturing sector's prosperity level.

By enterprise size, the PMI for large enterprises was 51.0%, up 0.2 percentage points from the previous month, remaining above the threshold; the PMI for medium-sized enterprises was 48.8%, down 0.1 percentage points from the previous month, below the threshold; the PMI for small enterprises was 48.2%, up 1.6 percentage points from the previous month, still below the threshold.

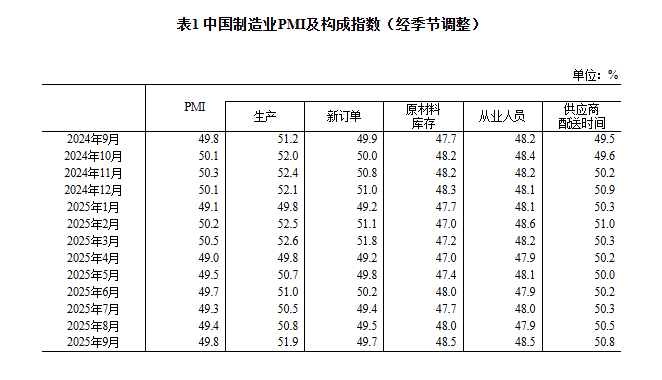

Among the five sub-indices that constitute the manufacturing PMI, the production index and the supplier delivery time index were above the threshold, while the new orders index, raw material inventory index, and employment index were below the threshold.

The production index was 51.9%, up 1.1 percentage points from the previous month, indicating accelerated expansion in manufacturing production.

The new orders index was 49.7%, up 0.2 percentage points from the previous month, indicating continued improvement in the prosperity level of manufacturing market demand.

The raw material inventory index was 48.5%, up 0.5 percentage points from the previous month, indicating a continued narrowing of the decline in the inventory of major raw materials in the manufacturing sector.

The employment index was 48.5%, up 0.6 percentage points from the previous month, indicating improved employment sentiment among manufacturing enterprises.

The supplier delivery time index was 50.8%, up 0.3 percentage points from the previous month, indicating continued acceleration in the delivery times of raw material suppliers to the manufacturing sector.

II. Operation of China's Non-Manufacturing Purchasing Managers' Index

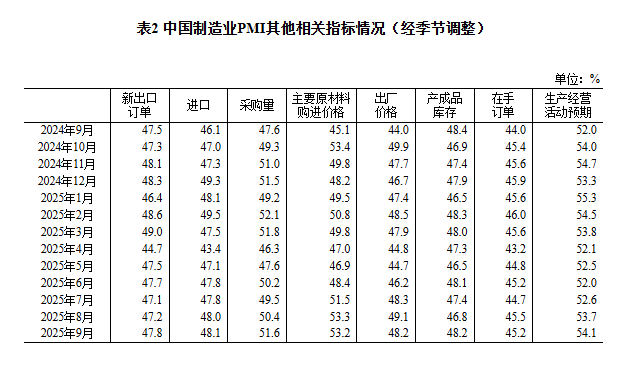

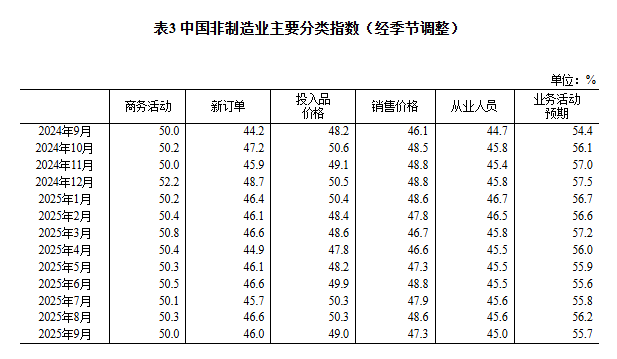

In September, the non-manufacturing business activity index was 50.0%, down 0.3 percentage points from the previous month, standing at the threshold, indicating overall stability in the total business volume of the non-manufacturing sector.

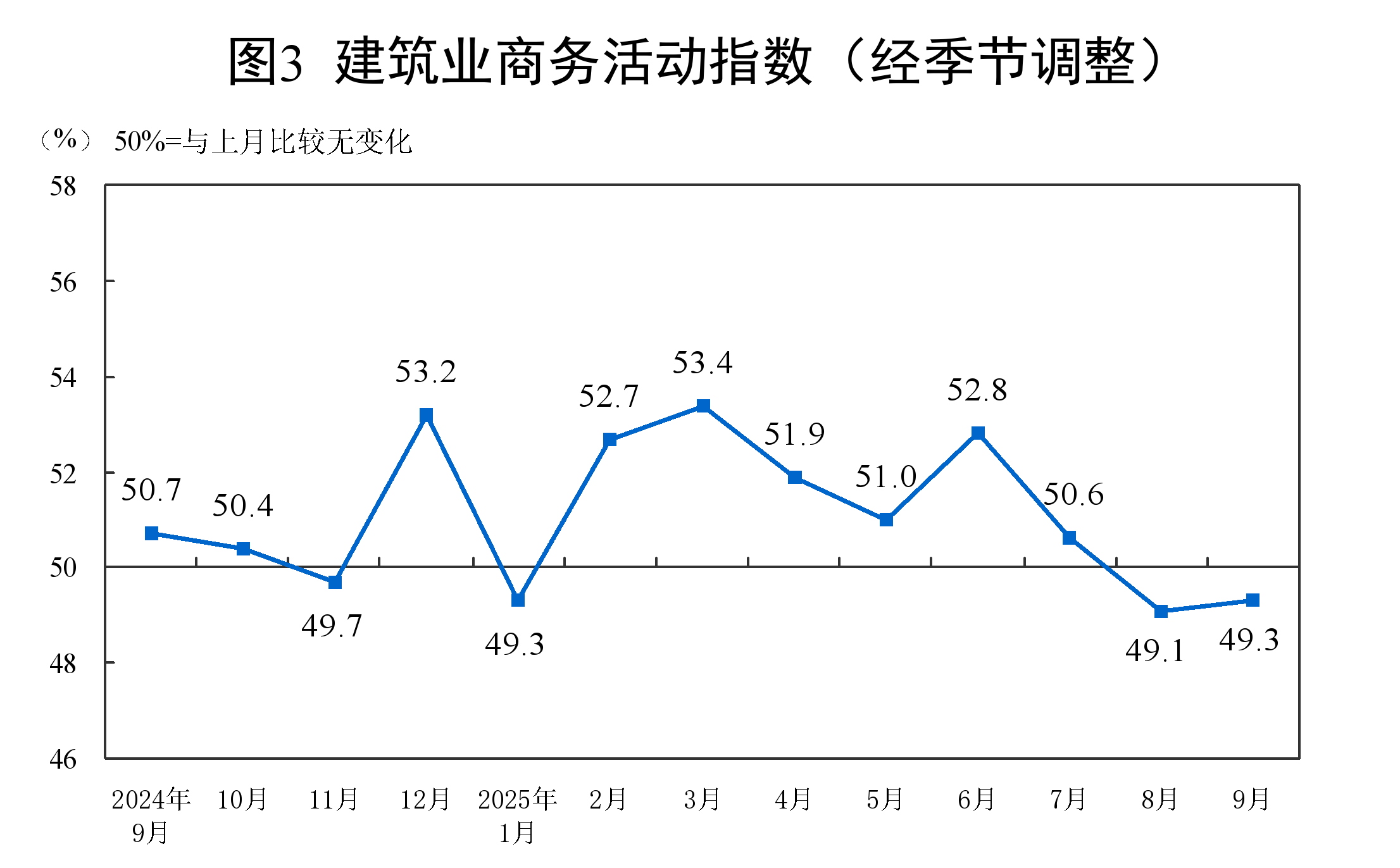

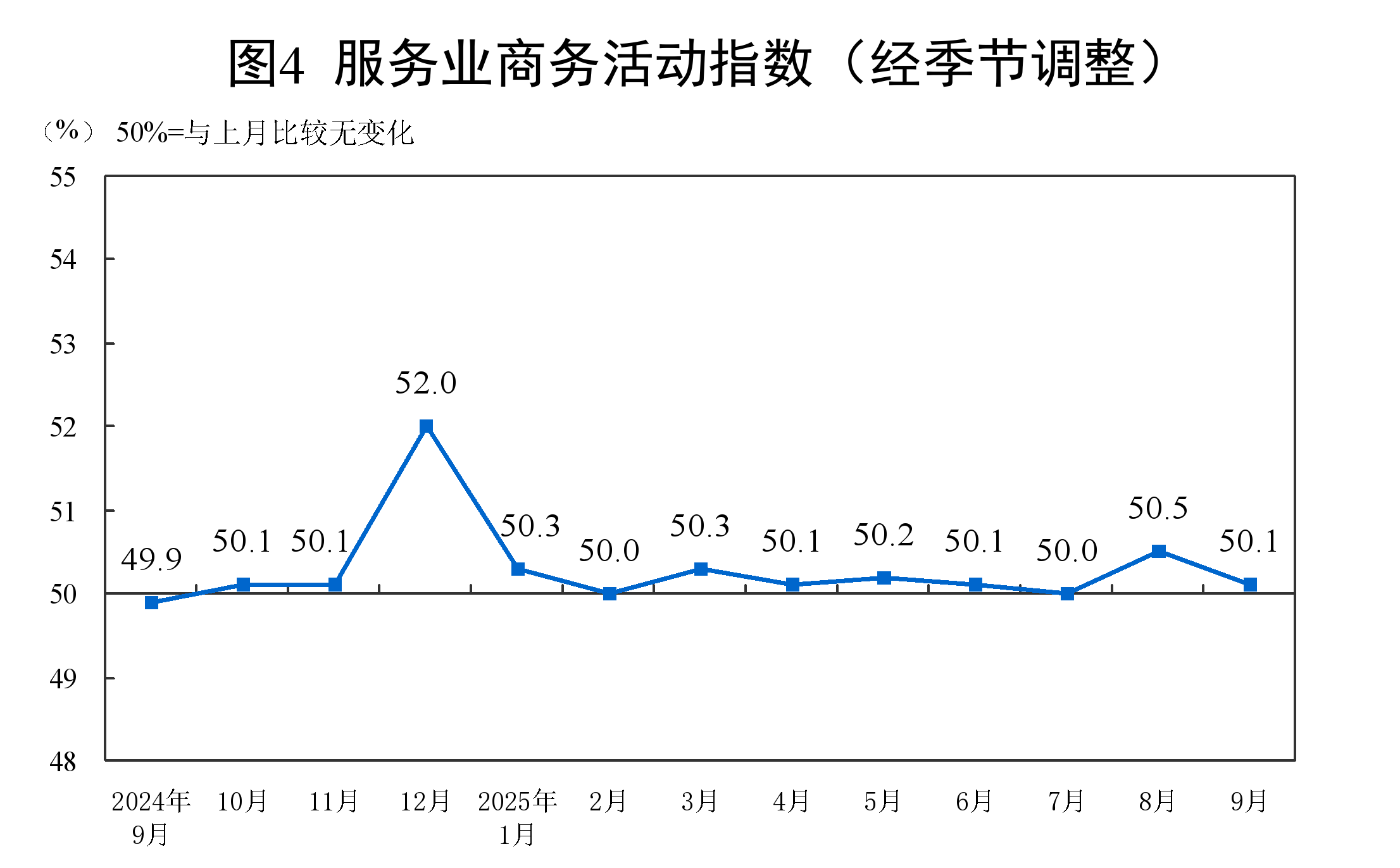

By sector, the business activity index for the construction sector was 49.3%, up 0.2 percentage points from the previous month; the business activity index for the service sector was 50.1%, down 0.4 percentage points from the previous month. Within the service sector, business activity indices for industries such as postal services, telecommunications, radio and television, and satellite transmission services, and monetary and financial services all remained in the high prosperity range above 60.0%; business activity indices for industries such as catering, real estate, culture, sports, and entertainment all remained below the threshold.

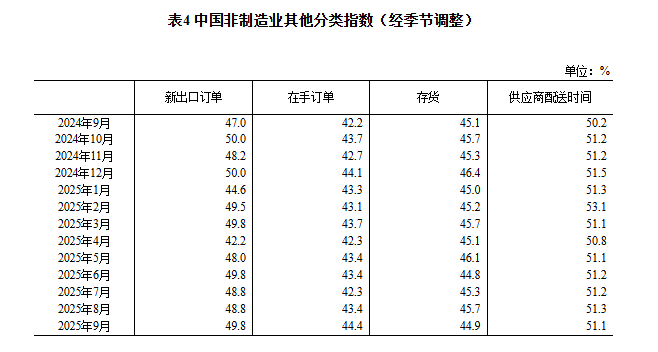

The new orders index was 46.0%, a decrease of 0.6 percentage points from the previous month, indicating a pull back in the demand for non-manufacturing activities. By industry, the new orders index for the construction sector was 42.2%, an increase of 1.6 percentage points; and for the service sector, it was 46.7%, a decrease of 1 percentage point.

The input prices index stood at 49.0%, down 1.3 percentage points from the previous month, showing a decline in the overall level of input prices used by non-manufacturing enterprises in their business operations. By industry, the input prices index for the construction sector was 47.2%, a drop of 7.4 percentage points; and for the service sector, it was 49.3%, a decrease of 0.2 percentage points.

The selling price index was 47.3%, a fall of 1.3 percentage points from the previous month, below the critical point, indicating that the overall level of selling prices in the non-manufacturing sector continued to decline. By industry, the selling price index for the construction sector was 48.1%, a decrease of 1.6 percentage points; and for the service sector, it was 47.2%, a drop of 1.3 percentage points.

The employment index was 45.0%, a decrease of 0.6 percentage points from the previous month, suggesting a pull back in the employment situation for non-manufacturing enterprises. By industry, the employment index for the construction sector was 39.7%, a drop of 3.9 percentage points; and for the service sector, it remained unchanged at 45.9% compared to the previous month.

The business activity expectations index was 55.7%, a decrease of 0.5 percentage points from the previous month, still within a high range, indicating that most non-manufacturing enterprises maintained an optimistic outlook on market development. By industry, the business activity expectations index for the construction sector was 52.4%, an increase of 0.7 percentage points; and for the service sector, it was 56.3%, a decrease of 0.7 percentage points.

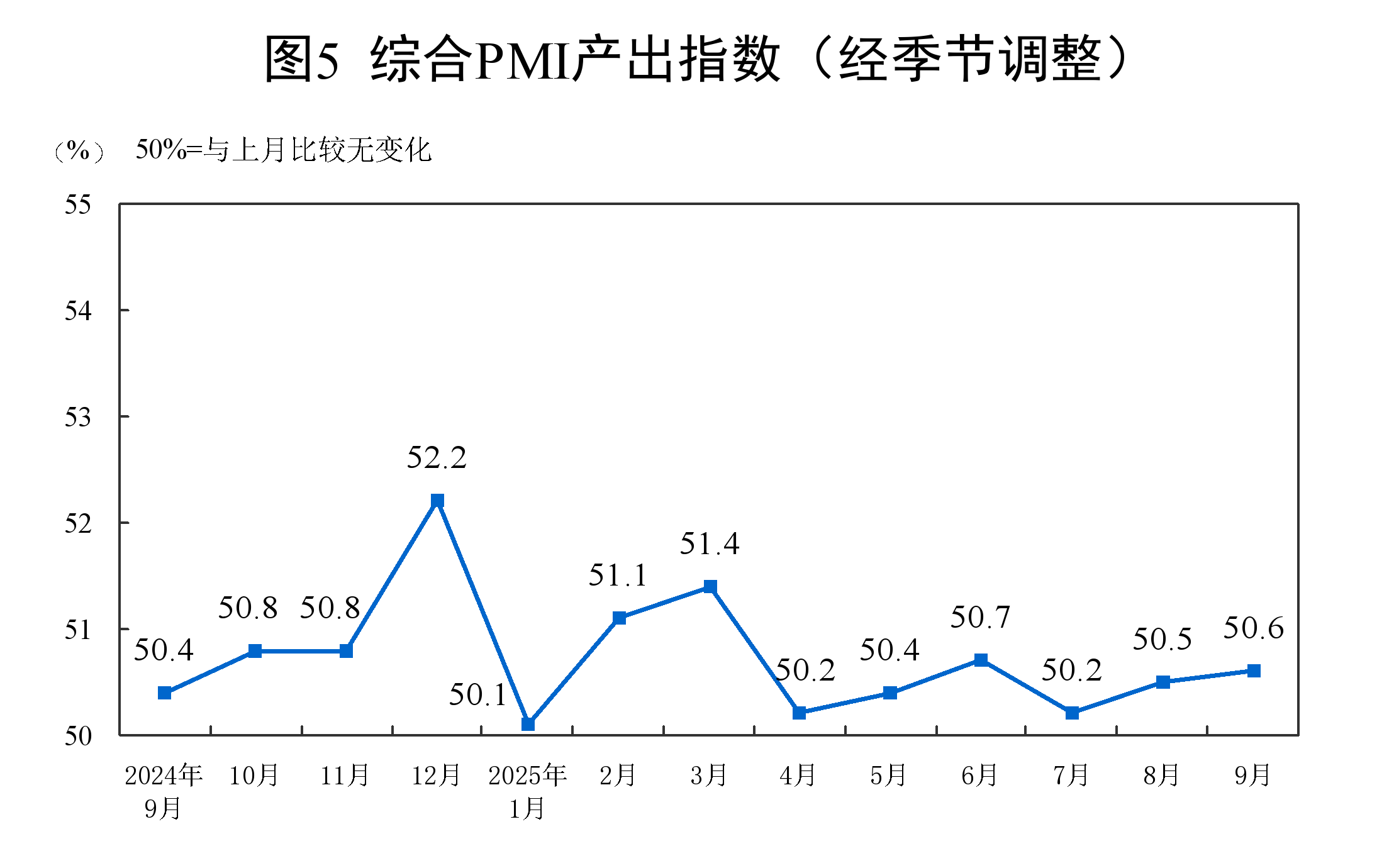

III. Operation of China's Composite PMI Output Index

In September, the composite PMI output index was 50.6%, up 0.1 percentage points from the previous month, remaining above the critical point, indicating that the overall expansion of business activities in China accelerated slightly.

In September, the manufacturing PMI continued to rebound

—Interpretation by Huo Lihui, Chief Statistician of the NBS Service Survey Center, on China's PMI for September 2025

On September 30, 2025, the NBS Service Survey Center and the China Federation of Logistics and Purchasing released China's PMI. In response, Huo Lihui, Chief Statistician of the NBS Service Survey Center, provided an interpretation.

In September, the manufacturing PMI was 49.8%, an increase of 0.4 percentage points from the previous month; the non-manufacturing business activity index was 50.0%, a decrease of 0.3 percentage points; and the composite PMI output index was 50.6%, up 0.1 percentage points, indicating a slight acceleration in the overall economic output expansion in China.

I. Manufacturing PMI Continues to Rebound

In September, manufacturing production activities accelerated, with the PMI rising to 49.8%, indicating continued improvement in the level of business activity.

(I) Accelerated Expansion of Enterprise Production. The production index stood at 51.9%, up 1.1 percentage points from the previous month, reaching a near six-month high, reflecting relatively active manufacturing production activities; the new orders index was 49.7%, up 0.2 percentage points from the previous month, showing some improvement in market demand conditions. By sector, industries such as food and refined tea & alcoholic beverages, automobiles, and railway, ship, aerospace equipment had both production and new orders indices above 54.0%, indicating rapid release of production and demand; industries such as wood processing & furniture, petroleum, coal and other fuel processing, and non-metallic mineral products had both indices below the threshold. Driven by the rebound in manufacturing production, enterprises accelerated raw material procurement, with the purchasing volume index rising to 51.6%.

(II) PMI of Small Enterprises Rebounded. The PMI for large enterprises was 51.0%, up 0.2 percentage points from the previous month, remaining above the threshold and showing steady expansion; the PMI for medium-sized enterprises was 48.8%, slightly down 0.1 percentage points from the previous month, with business activity levels largely stable; the PMI for small enterprises was 48.2%, up 1.6 percentage points from the previous month, indicating some improvement in business activity levels.

(III) Three Key Industries Expanded Rapidly. The PMI for equipment manufacturing, high-tech manufacturing, and consumer goods industries were 51.9%, 51.6%, and 50.6%, respectively, all significantly higher than the overall manufacturing PMI. Additionally, both the production and new orders indices for these key industries were in expansion territory, indicating active supply and demand sides for enterprises; the PMI for energy-intensive industries was 47.5%, down 0.7 percentage points from the previous month.

(IV) Market Expectations Continue to Improve. The production and business activity expectations index was 54.1%, up 0.4 percentage points from the previous month, marking a rebound for three consecutive months, indicating that manufacturing enterprises have positive expectations for recent market development. By sector, industries such as agricultural and food processing, automobiles, and railway, ship, aerospace equipment had production and business activity expectations indices above 57.0%, reflecting strong confidence among related enterprises in industry development.

II. Non-Manufacturing Business Activity Index at the Threshold

In September, the non-manufacturing business activity index was 50.0%, down 0.3 percentage points from the previous month, remaining at the threshold, indicating overall stability in the total business volume of the non-manufacturing sector.

(I) Service Sector Business Activity Index Remains in Expansion. The service sector business activity index was 50.1%, continuing to stay in expansion territory. From an industry perspective, the business activity indices for postal services, telecommunications, radio and television broadcasting, and satellite transmission services all remained in a high prosperity range above 60.0%, with total business volume maintaining rapid growth. Meanwhile, affected by the waning of the summer vacation effect, the business activity indices for catering, culture, sports, and entertainment industries, which are closely related to residents' travel and consumption, fell below the critical point. In terms of market expectations, the business activity expectation index stood at 56.3%, remaining in a relatively high prosperity range above 55.0% since the beginning of the year, indicating that service enterprises have stable and optimistic expectations for the development of the industry.

(2) The construction industry's business activity index saw a slight rebound. The construction industry's business activity index was 49.3%, up 0.2 percentage points from the previous month, marking a small improvement in the industry's prosperity level. In terms of market expectations, the business activity expectation index was 52.4%, up 0.7 percentage points from the previous month, suggesting that construction enterprises have improved confidence in the recent market development.

III. The composite PMI output index maintained expansion

In September, the composite PMI output index was 50.6%, up 0.1 percentage points from the previous month, indicating that China's enterprise production and operation activities continued to accelerate overall. The manufacturing production index and non-manufacturing business activity index, which make up the composite PMI output index, were 51.9% and 50.0%, respectively.

Recommended reading: