SMM, September 9:

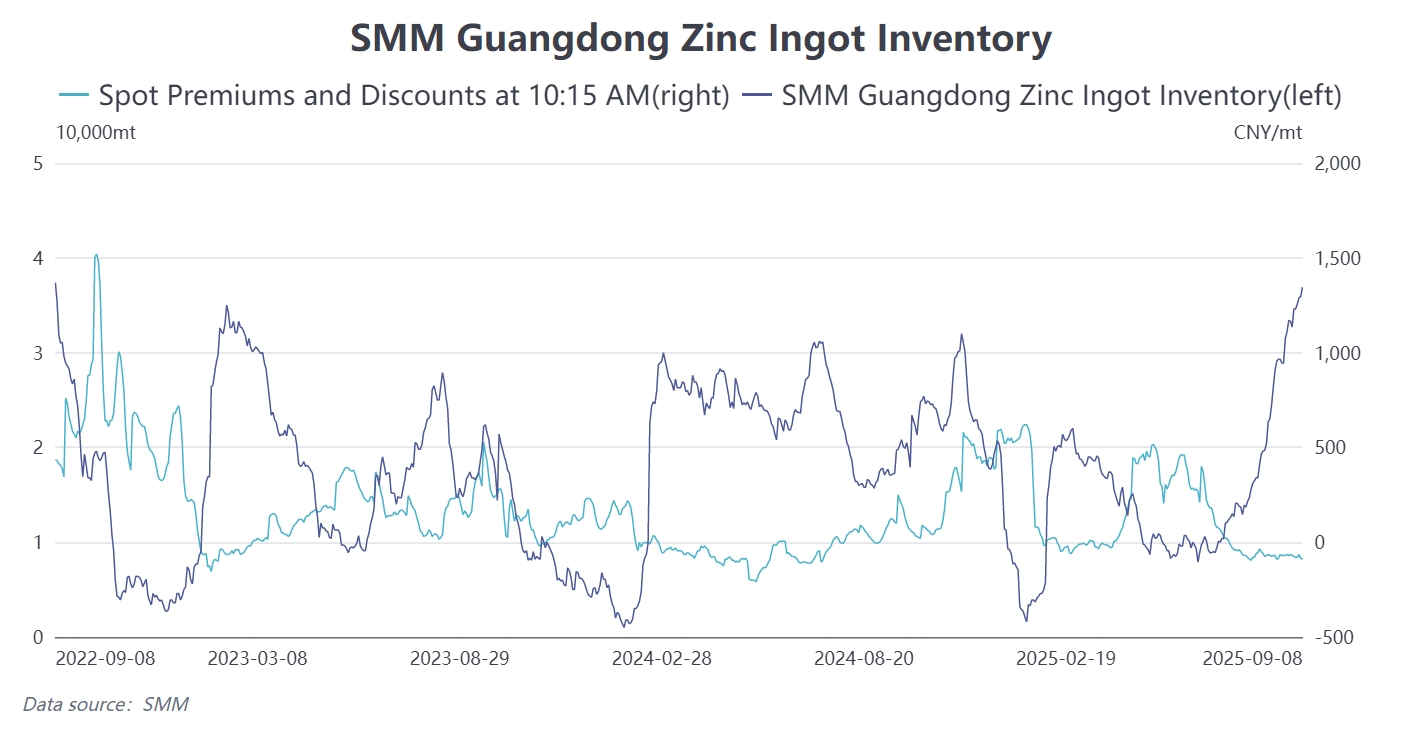

According to SMM data, zinc ingot inventory in Guangdong continued to climb to a yearly high as of Monday, reaching 36,900 mt. The substantial pressure from high inventory directly impacted trading sentiment and pricing trends in the spot market, causing premiums and discounts to fluctuate at lows recently, which has become a focal point for market attention. Below, we will analyze the future development of premiums and discounts in Guangdong from both supply and demand perspectives.

Supply side: Capacity continued to expand, maintaining supply pressure

In H1, production resumptions at some smelters in south China drove continuous capacity release on the supply side. The notable inventory buildup was primarily attributable to persistently loose supply conditions.

China's zinc ingot production reached 626,200 mt in August, hitting a three-year high. September output is projected to dip slightly by 16,400 mt to 609,800 mt. Although some smelters underwent production halts and maintenance, overall domestic zinc ingot volumes remained at a relatively high level. Coupled with favorable profitability in minor metals and by-products, smelters retained moderate production incentives. Stable domestic zinc ingot output ensured sustained shipments to consumption hubs, including Guangdong.

Demand side: September peak season characteristics remain subdued, short-term inventory digestion proves challenging.

Guangdong, a major hub for downstream zinc consumption, hosts concentrated distribution of die-casting zinc alloy, galvanizing, and brass enterprises. End-use demand performance remains pivotal in determining inventory digestion and the potential rebound of premiums and discounts.

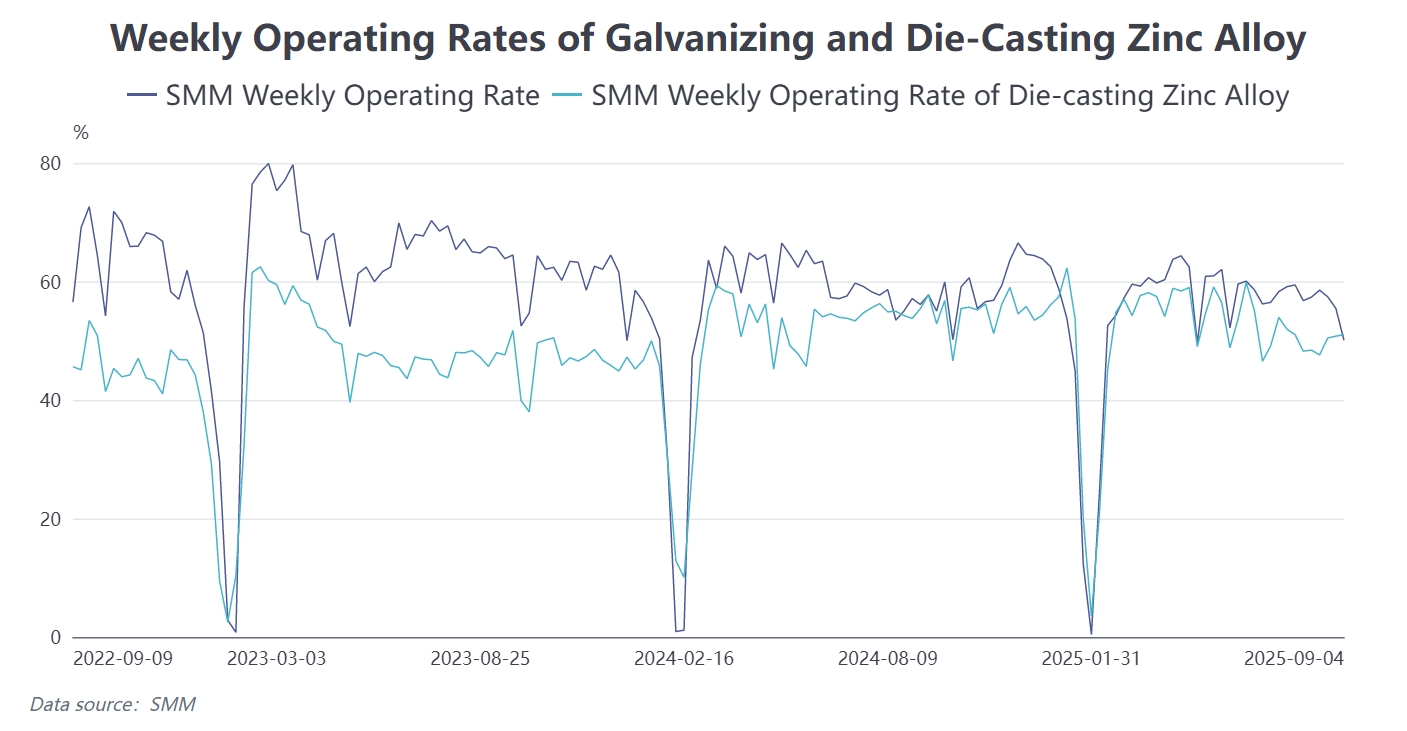

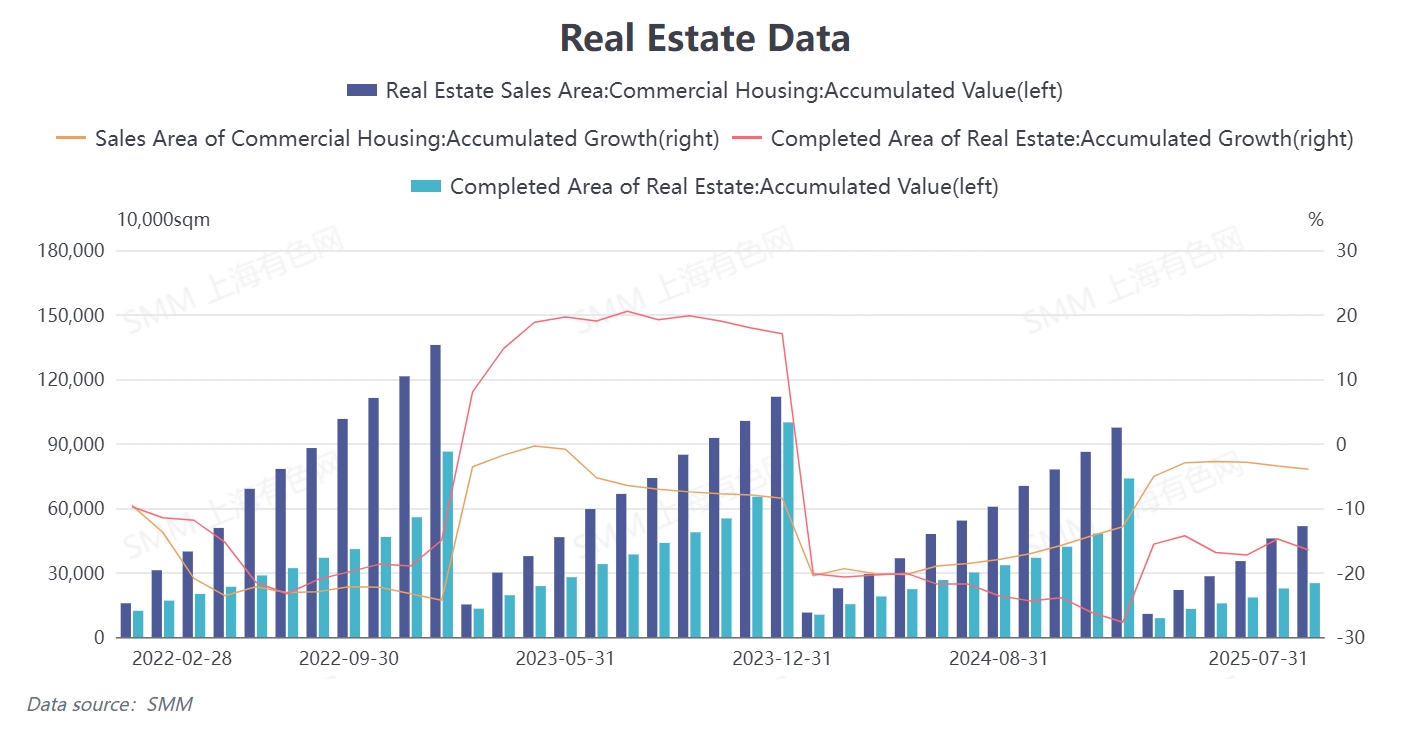

Currently, the traditional September-October peak season has commenced, yet downstream consumption shows no significant improvement. This is further corroborated by operating trends in zinc-intensive sectors like die-casting and galvanizing. For the real estate sector, which accounts for a substantial portion of zinc demand, China’s cumulative sales and completed area of commercial housing in July remained in negative growth year-to-date. The persistently weak performance of the traditional real estate industry has provided limited demand boost for hardware fittings, architectural galvanized pipes, and structural components.

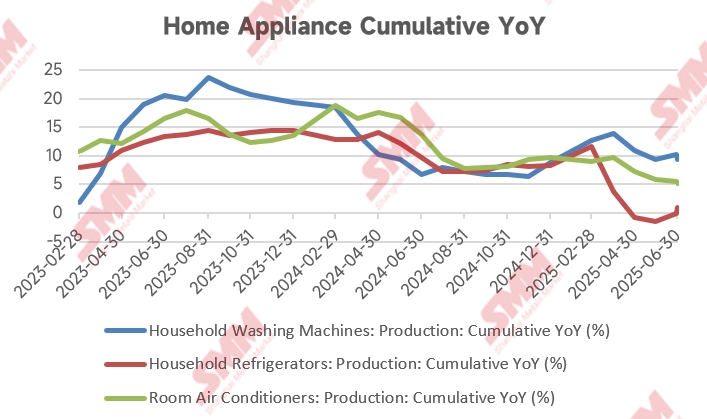

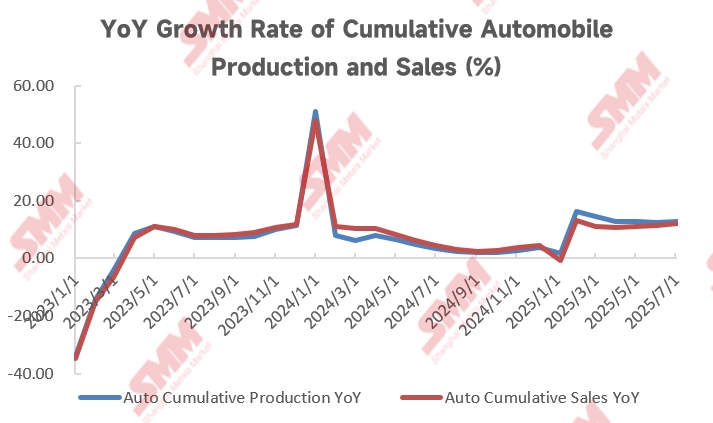

Furthermore, judging from the home appliance and automotive data, development in both sectors remained relatively stable overall under the trade-in policy subsidies. In July, China's cumulative production of washing machines, refrigerators, and air conditioners recorded 9.4%, 0.9%, and 5.1% respectively, while cumulative automotive production and sales rose 12.7% and 12% YoY. Both sectors are currently in positive growth territory. However, according to SMM, domestic auto dealers face significant inventory pressure, posing certain challenges to future zinc demand.

Additionally, from the perspective of product exports, numerous die-casting zinc alloy enterprises in Guangdong produce goods for export. Although the "window period" for China-U.S. tariffs still exists, no large-scale export rush has been observed in the current market, and there are also doubts about the subsequent development of exports.

Overall, the core contradiction in spot premiums and discounts in Guangdong lies in the interplay between "high inventory" and "weak demand." Under the absolute pressure of high inventory, suppliers actively offload cargo, while downstream purchasing remains sluggish, making it difficult to alter the market's oversupply situation. This is further corroborated by recent warehouse movements in Guangdong. Until clear and robust signals of demand recovery emerge, supply pressure will remain the "Sword of Damocles" hanging over the market. Consequently, the weak trend in premiums and discounts is unlikely to reverse in the short term, with expectations of continued discounts or fluctuations at lows.

![[SMM Analysis] Zinc Prices Hit Over Three-Year High in January, How Will They Perform in February?](https://imgqn.smm.cn/production/admin/news/cn/thumb/ulXYWdqBsTfPSImAeYVe20170628015555.jpg?imageView2/1/w/176/h/110/q/100)

![Domestic Consumption Weakens, SHFE Zinc Center Declines [SMM Zinc Futures Brief Review]](https://imgqn.smm.cn/usercenter/nlmjY20251217171755.jpg)