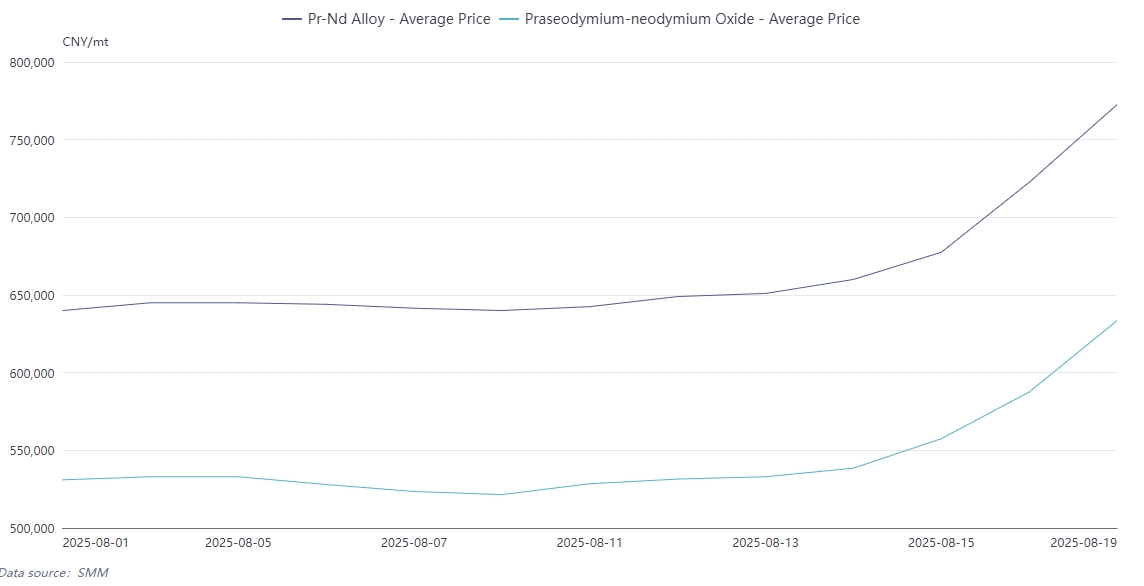

From August 15 to 19, the Pr-Nd market experienced a rare sharp rise — the average price of Pr-Nd oxide surged from 557,500 yuan/mt to 633,500 yuan/mt, a weekly increase of 13.6%; the average price of Pr-Nd alloy jumped from 677,500 yuan/mt to 772,500 yuan/mt, an increase of 14%.

Tracing back to the beginning of the year, the cumulative increase in Pr-Nd oxide prices exceeded 40%, with the high pressure of prices continuously eroding the safety margin of the midstream of the industry chain. This article will explain from the demand side the intrinsic driving forces supporting whether this price can be sustained in the long term and the difficult situation of magnetic material and motor factories under the current price.

I. Suffocating Squeeze on Midstream Enterprises

Magnetic material and motor factories are facing a "double squeeze" survival crisis:

Magnetic Material Factories Near Profit Margins Red Line: When Pr-Nd oxide prices reach 550,000 yuan/mt, the gross margin of magnetic material factories is only 8%-10%. The current price of 630,000 yuan/mt has pushed small and medium-sized enterprises into comprehensive losses.

To protect themselves, companies generally adopt a "suspend quotations, refuse new orders" strategy. Top-tier enterprises can maintain production through long-term contracts, but small and medium-sized producers without bargaining power are forced to stop orders to cut losses.

Motor Factories Stuck in Pricing Deadlock: Rare earth permanent magnets account for over 30% of the cost of permanent magnet motors, but end-user vehicle manufacturers, mired in price wars (with an average price drop of 15% for new energy vehicles), refuse to bear the increased cost of raw materials.

Although ferrite magnets have become substitutes in the low and mid-end markets, high-grade NdFeB is still required for high-end applications such as new energy vehicle drive motors and robotic servo motors. Technological constraints prevent motor factories from reducing the use of core materials, compressing profit margins to a critical point.

II. Demand-Side Support and Overdraw Risks

Short-term demand appears robust, but long-term risks exist:

"Panicked Stockpiling" by Overseas Buyers Boosts Orders: Producers in Europe and the US placed orders in advance for various reasons, accelerating stockpiling. Major magnetic material manufacturers have production schedules extending to mid-October, supporting short-term prices.

Domestic Demand Overdrawn in Advance: The 25% increase in new energy vehicles in 2025, driven by policy incentives, is essentially "borrowing from the future," with some consumption originally belonging to 2026 being locked in early. In Q4, as demand for home appliances and elevators weakens, coupled with the overseas clients' vacation period from November-December, orders will significantly decline.

Emerging Demands Struggle to Fill the Gap: If global production of humanoid robots (each consuming 2 kg of Pr-Nd) reaches 500,000 units in 2025, it would only add 1,000 mt of new demand, less than 1.5% of total NdFeB demand; the expected increase in magnetic materials for the low-altitude economy is under 500 mt, insufficient to offset the contraction in traditional sectors.

III. The Inevitable Path of Price Regression

The current high prices are essentially a short-term phenomenon driven by "policy intervention + sentiment speculation":

End-user consumption is unable to sustain: NEV manufacturers' gross margins have been squeezed to 3%-5%, completely breaking the cost transfer chain within the industry. Motor producers are forced to adopt cost-reduction strategies through technology: companies like Innuovo are optimizing magnetic circuit designs to reduce the amount of magnetic material used per unit; some motor factories are developing high-efficiency permanent magnet motors that cut usage by 20% or seeking alternatives in certain areas, indirectly reducing demand.

The global inventory cycle is expected to reverse: after the overseas restocking wave ends, China's magnetic material exports will pull back, and it will be difficult for there to be new orders from abroad.

![Overseas Pr-Nd offers surged rapidly, countries accelerated rare earth mine development [SMM Rare Earth Overseas Weekly Review]](https://imgqn.smm.cn/usercenter/wHkop20251217171744.jpeg)