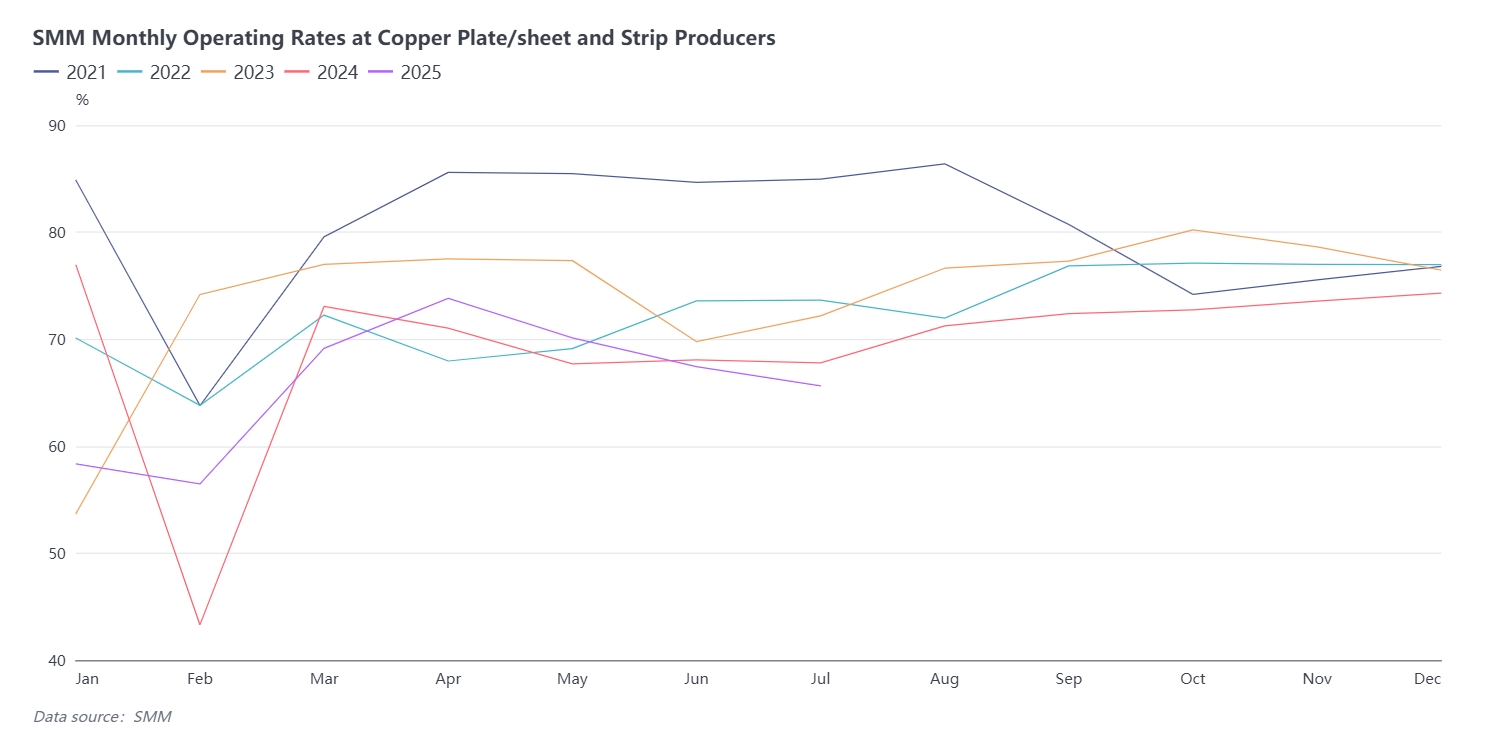

According to SMM, the operating rate of copper plate/sheet and strip enterprises stood at 65.63% in July 2025, down 1.11 percentage points MoM and 2.15 percentage points YoY. Among them, the operating rate of large enterprises was 70.19%, that of medium-sized enterprises was 58.77%, and that of small enterprises was 62.62%.

July is the off-season for copper plate/sheet and strip consumption. The weak demand in terminal home appliance and PV sectors is the main reason dragging down the operating rate of the plate/sheet and strip industry. However, despite the decline in operating rate both MoM and YoY, the actual value was significantly higher than the expected 63.44% in June, with the market performing better than expected. This better-than-expected performance was mainly supported by two factors: on the one hand, the pullback of copper prices from highs released some pent-up purchasing demand, and the growth in short-term orders provided support for the operating pace; on the other hand, the demand in the new energy sector was bright, coupled with the improving demand in the power and high-end electronic components sectors, forming a structural boost.

From the perspective of product types, against the backdrop of weak demand for brass strip, market competition intensified, processing fees were caught in a "rat race" competition, and corporate profit margins continued to be compressed, making it the main variety dragging down the overall performance of the industry. The market performance of copper strip was better than expected, especially with orders showing signs of improvement after mid-July. The recovery in demand drove an acceleration in the production pace, contributing positively to the operating rate. The bronze strip market was slightly mediocre, with a lack of significant incremental demand on the demand side. High-copper alloy plate/sheet and strip, benefiting from the demand support in the high-end manufacturing sector, performed steadily, becoming a bright spot in the industry.

In terms of inventory, the raw material inventory/output ratio of copper plate/sheet and strip sample enterprises in July was 15.52%, up 0.39 percentage points MoM, continuing the mild growth trend of June, reflecting that enterprises still maintained a cautious restocking strategy during the off-season, with raw material inventory fluctuating slightly with the production pace. Finished product inventories showed continuous growth, with the finished product inventory/output ratio reaching 19.6%, up 1.53 percentage points MoM.

The operating rate of the copper plate/sheet and strip industry in August is expected to rebound slightly to 66.92%, up 1.29 percentage points MoM, but down 4.32 percentage points YoY. The main reasons are as follows: the sustained strong demand in the new energy sector and the continued improvement in demand in the power and high-end electronic sectors jointly drove the growth in orders for products such as copper strip and high-copper alloy plate/sheet and strip; some enterprises adjusted their production plans in advance to cope with the potential peak season at the end of Q3, moderately increasing the operating rate. It is worth noting that although the US's recent tariff hike on copper semi-finished products has attracted market attention, the volume of China's copper plate/sheet and strip exports to the US in 2024 was less than 5,000 mt, having a limited impact on the entire plate/sheet and strip industry and being difficult to suppress the overall operating rate. However, demand in traditional sectors such as home appliances and PV remains weak, competition in the brass strip market is fierce, and combined with the impact of the base period in the same period last year, the operating rate is still at a low level YoY, with limited rebound amplitude.