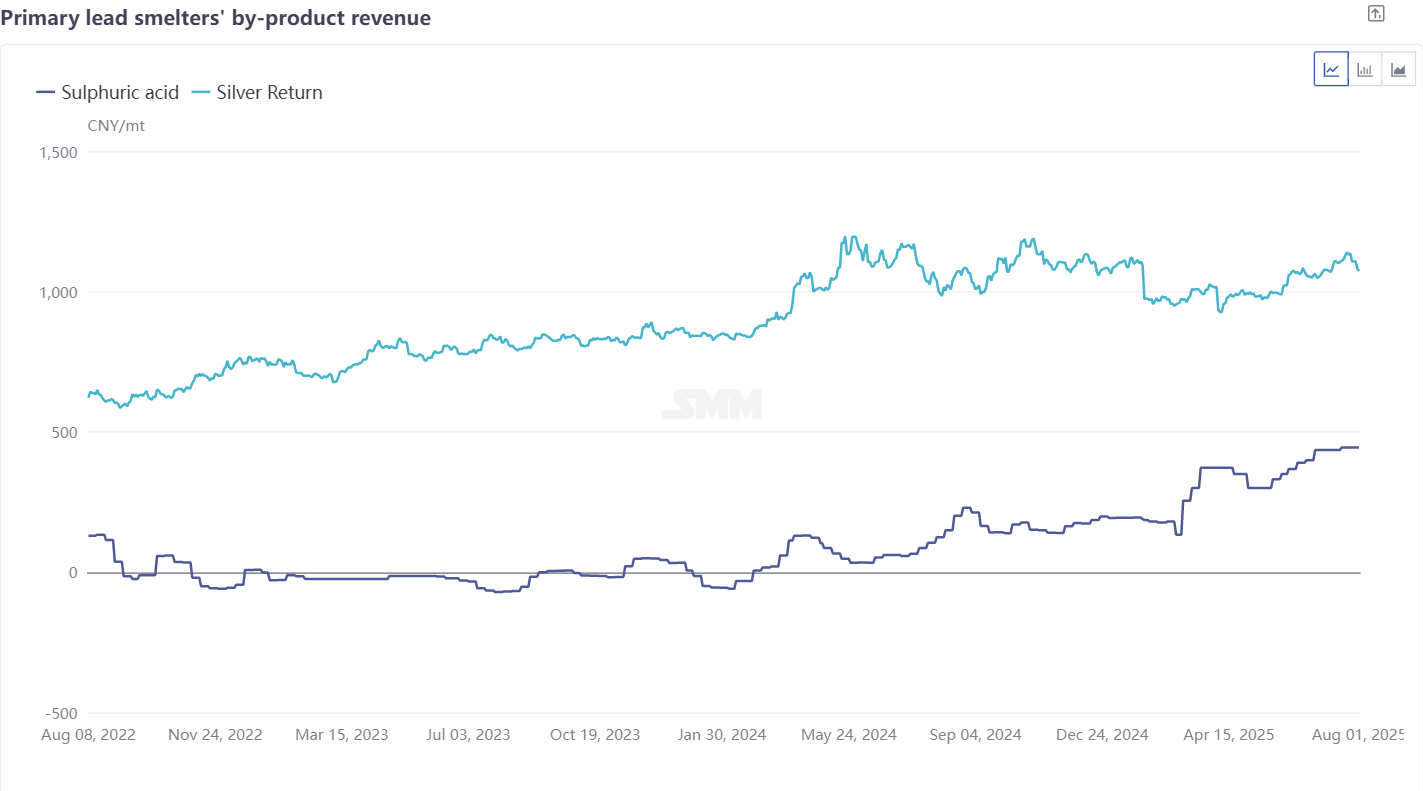

In July 2025, silver production continued its upward trend, increasing by approximately 1.4% MoM from June. As silver prices reached new highs in July, the by-product revenue from lead smelters was substantial, leading to positive growth in silver by-product production from lead smelters.

In terms of the operation of refined silver smelters in July, after the maintenance recovery of a large-scale smelter in Guangxi, production resumed and increased, contributing significantly to the overall production growth. A smelter in Hunan increased its silver production in July due to adjustments in raw material grade. Additionally, the associated silver production from copper, lead, and zinc smelters in Shaanxi, Gansu, Inner Mongolia, and other regions also increased marginally.

However, entering August, the declining processing fees for high-silver lead ores and crude silver materials may limit the continued growth trend of silver production at smelters. Some smelters mentioned that August production may not remain stable, and the risk of silver prices jumping initially and then pulling back also makes smelters cautious in purchasing high-grade silver-bearing raw materials amid fears of a price drop. Furthermore, the subsequent regular maintenance of lead smelters in autumn may also similarly limit the steady growth of refined silver.

After silver prices reached new multi-year highs in July and experienced a brief pullback as bulls took profits and exited in August, expectations for US Fed interest rate cuts boosted the precious metals market, and silver prices once again held up well. From a medium and long-term perspective, the long-term tight supply and demand in the silver market and the global trend of silver ingot destocking provide support for prices. The significant uncertainties surrounding inflation prospects and the implementation of tariff policies have driven up the demand for gold and silver as safe-haven assets. Despite the more likely-to-fall-than-rise trend in processing fees for silver-bearing raw materials, smelters have stated that the revenue from refining precious and rare metals far outweighs the decline in processing fees. Therefore, during periods of strong precious metals prices, smelters maintain high production enthusiasm.

![This Week, Platinum and Palladium Experienced Significant Pullbacks, End-Use Demand Recovered, and Spot Market Trading Was Normal [SMM Platinum and Palladium Weekly Review]](https://imgqn.smm.cn/usercenter/obeMy20251217171735.jpg)

![Silver Prices Continue to Pull Back, Suppliers Remain Reluctant to Sell, Spot Market Premiums Hard to Decline [SMM Daily Review]](https://imgqn.smm.cn/usercenter/LVqfJ20251217171736.jpg)