》View SMM Copper Quotes, Data, and Market Analysis

》Subscribe to View SMM Historical Spot Metal Prices

》Click to Access the SMM Copper Industry Chain Database

Weekly Copper Premiums and Market Snapshot (July 21–25)

-

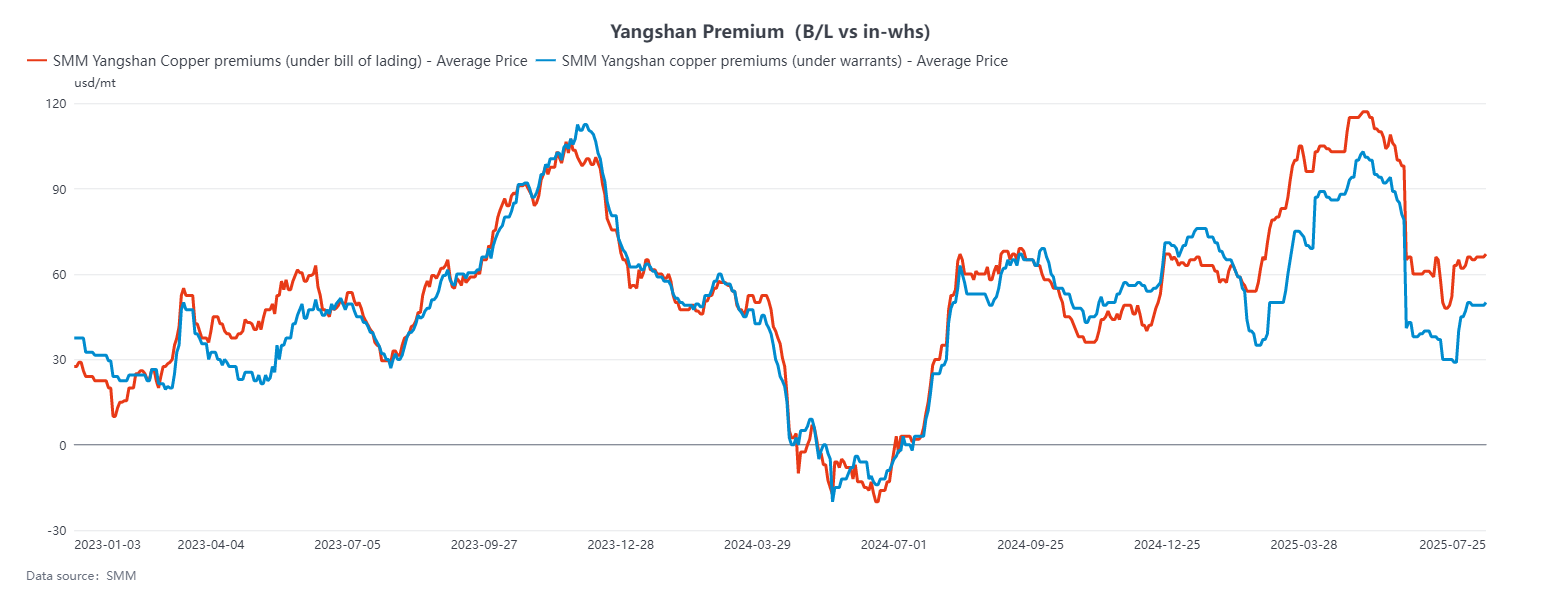

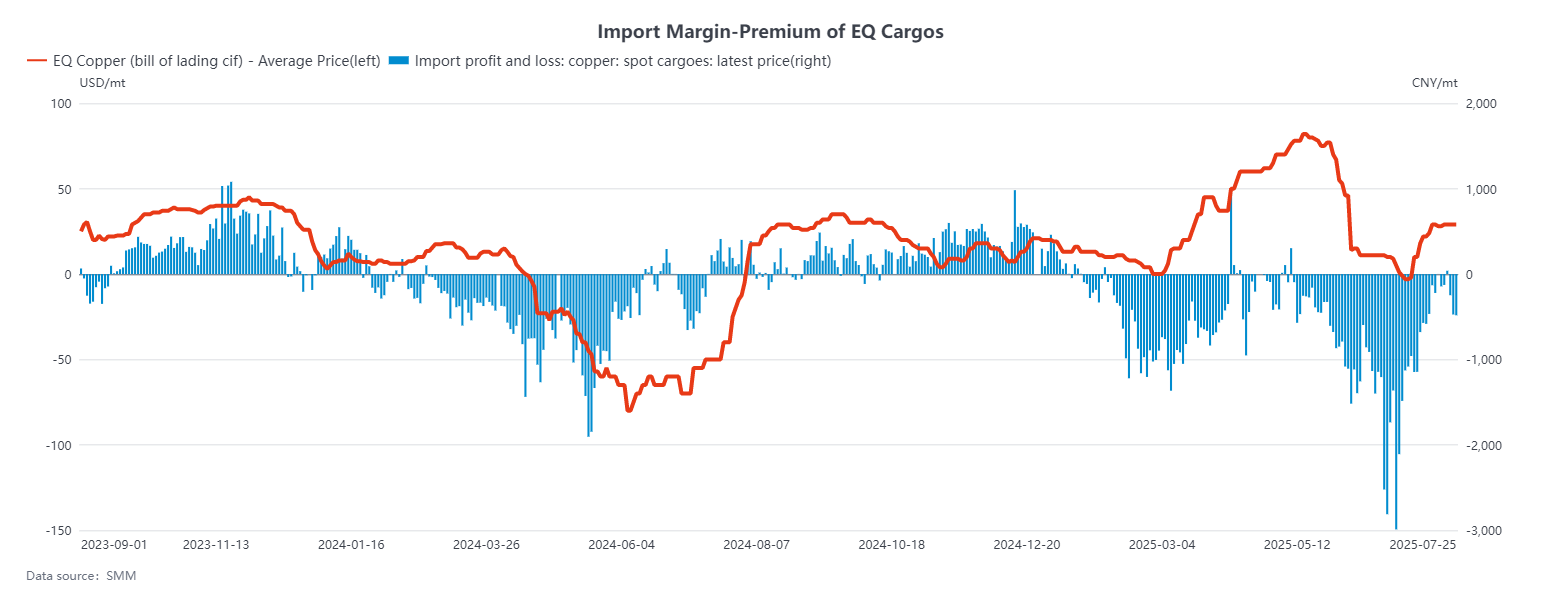

Yangshan Premiums: Spot landed premiums averaged USD 66.2/t (range USD 56.4–76.0) for QP August, up USD 1.2/t week-on-week. Warehouse warrant premiums averaged USD 49.2/t (44.2–54.2), up USD 0.2/t. EQ-grade CIF premiums averaged USD 29.0/t (22–36), rising USD 1.4/t.

-

LME/SHFE Metrics: As of July 25, the LME/SHFE ratio for SHFE 2508 was 8.0474, with import arbitrage losses near RMB –800/t. LME 3M-Aug remained in contango at USD 20.25/t, with the Aug–Sep spread at about USD 20/t.

Spot Market Conditions

Spot trading was very muted. Premium blister copper warrants traded at USD 55/t (domestic 44–50), and shipments at USD 74/t (domestic 55–65); acid-grade supplies were scarce. Two main factors weighed on liquidity: first, the imminent U.S. tariff implementation on August 1 prompted mid-July registration cargoes to be shipped directly to Hawaii, leaving few domestic offers; second, a key African refinery faced a shipment ban, cutting expected August arrivals further. With U.S. tariff details still pending, lift-and-delay phenomena on long-dated shipments are becoming pronounced, creating a supply “vacuum” through late July and early August.

Looking ahead, market participants will closely watch U.S.–China and Chile–U.S. tariff negotiations. Although the export window has slightly reopened—prompting some smelters to ship to bonded warehouses—downstream demand remains weak. Despite ongoing declines in domestic stocks, spot premiums are unlikely to rebound, and the dollar-denominated copper market is expected to stay in its seasonal trough.

Bonded-Zone Inventory

According to SMM, bonded-zone copper stocks rose from 78.8 kt on July 17 to 82.2 kt on July 24—Shanghai up to 74.0 kt, Guangdong to 8.2 kt. With LME prices climbing and import spreads narrowing, more cargoes are entering bonded storage and fewer are cleared onshore. Inventory is likely to accumulate modestly into late July and early August.