Affected by tight tungsten supply, multiple tungsten enterprises raised their long-term contract quotes for the first half of July, with prices of tungsten industry chain products showing an overall upward trend since July. Bao Gang United Steel and China Northern Rare Earth announced an increase in the associated transaction price of rare earth concentrate for Q3 2025, marking the fourth consecutive quarterly rise (QoQ) since Q4 2024. The rare earth price hike, coupled with China Northern Rare Earth's sharply improved performance forecast and bullish market expectations for future rare earth demand, drove strong performance of rare earth stocks. These factors triggered a surge in the minor metal sector, which rose 4.59% as of 13:37 on July 11. Key gainers included: China Northern Rare Earth (limit-up), Huayang New Materials (limit-up), Shenghe Resources (limit-up), Zhongke Magnetic Industry (+15%+), Earth-Panda, China Rare Earth, JL MAG Rare-Earth, Zhenghai Magnetic Material, Yunnan Germanium, Xiamen Tungsten, and China Tungsten High-Tech.

News Highlights

[SMM Commentary: Up 1.51% MoM! Bao Gang United Steel and China Northern Rare Earth Raise Q3 Rare Earth Concentrate Prices Again!] China Northern Rare Earth announced on the evening of July 10: Based on the rare earth concentrate pricing methodology and Q2 2025 rare earth oxide prices, after calculation and approval at the company's 11th General Manager Office Meeting in 2025, the Q3 2025 rare earth concentrate transaction price was adjusted to 19,109 yuan/mt (dry basis, REO=50%). For every 1% change in REO content, the price changes by 382.18 yuan/mt (tax excluded). The 19,109 yuan/mt price represents a 284 yuan/mt increase from Q2 2025's 18,825 yuan/mt, equivalent to a 1.51% MoM rise. The Q3 transaction price continues the upward trend seen in Q1 and Q2 this year. Q1 2025 saw a 4.7% QoQ increase, followed by a 1.11% QoQ rise in Q2, and now a 1.5% QoQ increase in Q3. Reviewing 2024 price changes: Q1 2024 showed slight QoQ growth, Q2 2024 saw a notable QoQ decline, Q3 2024 had marginal QoQ decrease (near flat), and Q4 2024 returned to QoQ growth. 》Click for Details

[China Northern Rare Earth's H1 Net Profit Expected to Surge 1,882.54%-2,014.71% YoY] China Northern Rare Earth announced on the evening of July 9: Preliminary estimates by the financial department indicate projected net profit attributable to shareholders for H1 2025 will reach 900 million to 960 million yuan, representing an increase of 855 million to 915 million yuan compared to the same period last year (statutory disclosed data),Z11/>equivalent to a 1,882.54% to 2,014.71% YoY surge . It is expected that the net profit attributable to the parent company's owners, excluding non-recurring gains and losses, for the first half of 2025 will reach 880 million yuan to 940 million yuan, representing an increase of 865 million yuan to 925 million yuan compared with the same period last year (statutory disclosure data), up 5538.33% to 5922.76% YoY.

[Zhangyuan Tungsten Raises Long-Term Contract Quotations for First Half of July]According to Chongyi Zhangyuan Tungsten Co., Ltd.'s announcement on July 7: The company's long-term contract procurement quotations for the first half of July are as follows: 1. 55% black tungsten concentrate: 172,000 yuan/mt, up 2,000 yuan/mt from the previous round; 2. 55% white tungsten concentrate: 171,000 yuan/mt, up 2,000 yuan/mt from the previous round; 3. Ammonium paratungstate (APT, national standard Grade 0): 252,500 yuan/mt, up 1,500 yuan/mt from the previous round.

Jiangxi Tungsten Industry Holding Group Co., Ltd. set the guidance price for national standard Grade 1 black tungsten concentrate at 173,000 yuan/mt for the first half of July 2025, up 1,000 yuan/mt from the guidance price for the second half of June.

Spot Market

Rare Earth Spot MarketZ18/>》Click to view SMM Rare Earth Spot Prices

》Subscribe to view SMM Metal Spot Price History

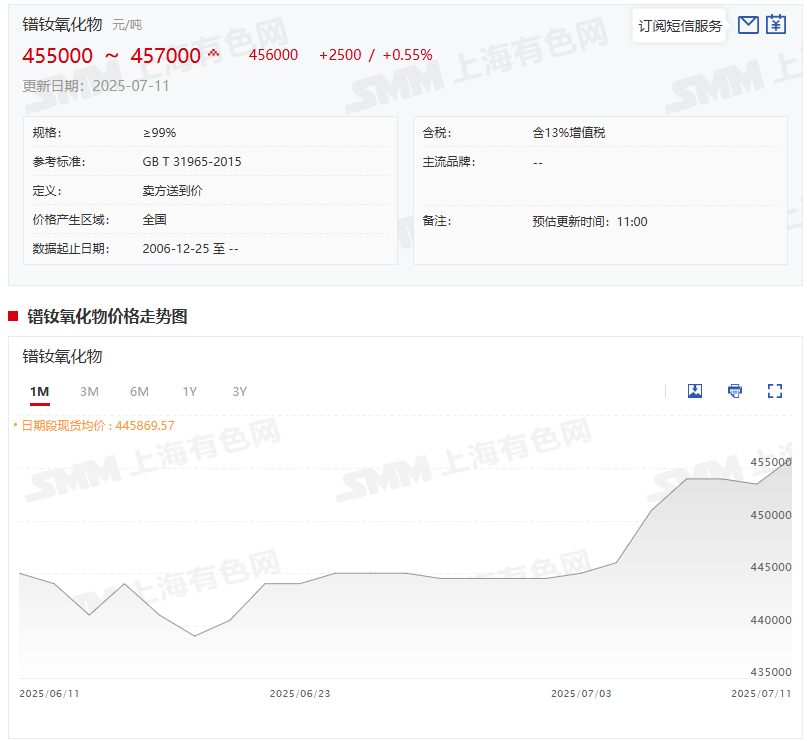

On July 11, SMM's quotation range for Pr-Nd oxide stood at 455,000-457,000 yuan/mt, with an average price of 456,000 yuan/mt, up 0.55% from the previous trading day. Bolstered by the quarterly price increases in rare earth concentrate transactions between China Northern Rare Earth and Bao Gang United Steel since Q4 2024, the rare earth industry chain showed overall gains on July 11. Currently, market concerns persist over potential oxide production cuts due to temporary shutdowns at some rare earth enterprises, while Southeast Asia remains in the rainy season—a weather factor that may reduce ion-adsorption ore imports without signs of improvement. Coupled with optimistic demand expectations for the traditional peak season, multiple market participants believe rare earth prices are likely to continue holding up well. Future developments warrant monitoring of magnetic material manufacturers' procurement tenders.

Tungsten Spot Market:

》Click to view SMM Tungsten Spot Prices

》Subscribe to view SMM Metal Spot Price History

On July 11, SMM's price for black tungsten concentrate (≥65%) stood at 175,000-176,000 yuan/mt, with an average price of 175,500 yuan/mt—unchanged from the previous trading day but up 3,000 yuan/mt or 1.74% from the 172,500 yuan/mt low on June 27. Affected by tight tungsten raw material supply, mine suppliers are reluctant to lower prices, making low-priced cargo scarce in the market. Since July, tungsten prices have maintained an upward trajectory. Z25/>Recommended Reading: