- Background

The Department of Foreign Trade (DFT) of Thailand announced the initiation of an anti-circumvention investigation on cold-rolled steel sheet products (coiled and non-coiled (CRS and CRC)) imported from China. This investigation was initiated in response to a complaint from Thai Cold Rolled Steel Sheet Public Company Limited, a domestic producer, which alleged that Chinese exporters were circumventing anti-dumping duties, thereby causing material injury to the domestic industry. The Chinese exporters accused of circumventing anti-dumping measures include Baoshan Iron & Steel Co., Ltd., Baogang Group, and Ma'anshan Group. The products under investigation fall under Thailand's customs tariff code 7225.50.90.090.

- The trend of exports of the involved varieties to Thailand is consistent with the total domestic export value, with an 11.52% MoM increase in the 2025 monthly average

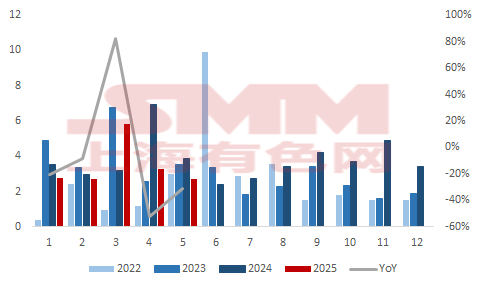

Figure 1 - China's Total Exports of the Involved Varieties and YoY Growth from 2022 to May 2025 (10,000 mt)

According to data from the General Administration of Customs, since 2022, the export volume of the involved products in China has shown a trend of year-on-year growth. By 2024, the annual export volume of the involved products reached 452,600 mt. As of May this year, the export volume was 173,100 mt, down 17.31% YoY (the export volume in the same period of 2024 was 204,700 mt), with a monthly average of 34,600 mt.

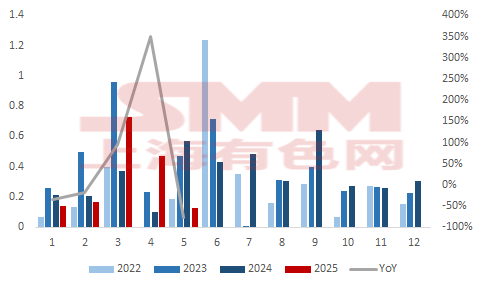

Figure 2 - China's Total Exports of the Involved Varieties to Thailand and YoY Growth from 2022 to May 2025 (10,000 mt)

The total cold-rolled steel exports from China to Thailand first increased and then decreased, rising from 33,000 mt/year in 2022 to 45,700 mt/year in 2023, and then declining to 41,600 mt/year in 2024. Based on the data for the first five months of this year, China exported a total of 16,300 mt of HRC to Thailand, up approximately 11.52% YoY (the export volume in the same period of 2024 was 14,600 mt). However, in absolute terms, the monthly average for the first four months was 3,300 mt, accounting for 9.39% of the monthly average of domestic cold-rolled steel coil exports.

- The proportion of China's exports of the involved products to Thailand is as high as 9.39%, but the absolute value is relatively small

Table 1 - The Ratio of the Total Volume of the Involved Varieties to Thailand to China's Total Export Volume from 2022 to May 2025

Based on the data of the total volume of the involved varieties exported to Thailand as a proportion of China's total export volume, the overall proportion fluctuates between 9% and 12%, which is relatively large. In 2025, the trend of the total volume of the involved varieties exported to Thailand is consistent with the trend of the total export volume of the involved varieties.

Overall, although this is the first time that Thailand has initiated an anti-circumvention investigation on cold-rolled steel from China, in fact, an anti-dumping investigation on cold-rolled steel products from China was initiated as early as August 2012, followed by a final ruling on a sunset review, and on January 23, 2025, a sunset review case was filed again. According to the timeline, a final ruling on the review may be made in early 2026. Considering that anti-dumping measures have been in place for many years and involve a wider range of products, the actual impact of anti-dumping on the involved varieties has already been reflected in previous years.

However, due to the claim by Thai Cold Rolled Steel Sheet Public Company Limited, a domestic producer in Thailand, that Chinese exporters are circumventing anti-dumping duties, an anti-circumvention investigation has been initiated against China again. According to data from the General Administration of Customs, the total volume of the involved varieties exported from China to Thailand in the first five months of 2025 was 16,300 mt, accounting for 9.39% of China's total export volume of the involved varieties, which has a relatively large overall impact. In extreme cases, this may lead to a decrease of 81,500 mt in China's total export volume in 2026.

Data shows that the top five countries in terms of China's export volume of the involved varieties are Colombia, Indonesia, Brazil, Thailand, and Oman. Thailand ranks high, but compared to the high base of China's total steel exports, this value may be temporarily insignificant and will only affect domestic export varieties. The channel for exporting cold-rolled steel products to Thailand may be further obstructed.

SMM will track in real time the progress and impact of overseas anti-dumping investigations on steel. Please stay tuned for relevant reports. For more information, follow SMM's official account~

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)