》Check SMM aluminum spot quotes, data, and market analysis

》Subscribe to view historical price trends of SMM metal spot prices

July 1, 2025, SMM

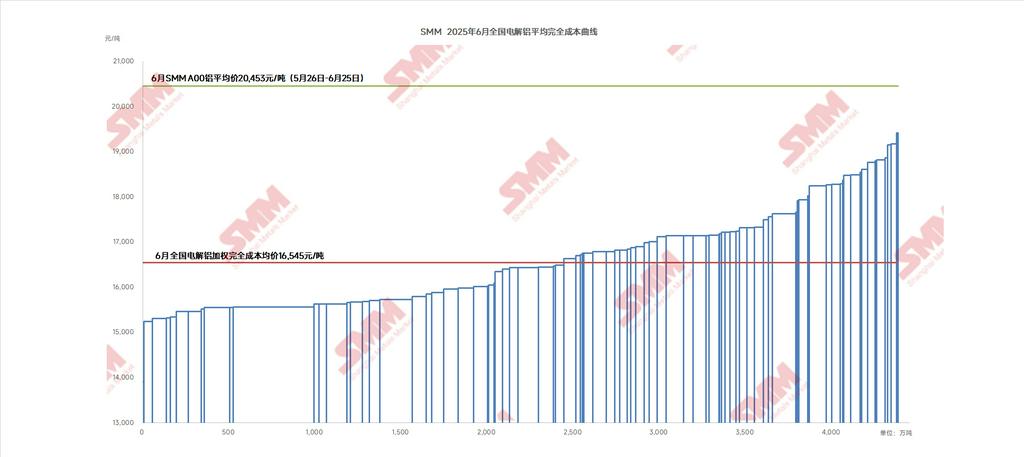

According to SMM data, the average tax-inclusive full cost of China's aluminum industry in June 2025 was 16,545 yuan/mt, up 1.3% MoM and down 6.4% YoY. Despite alumina prices jumping initially and then pulling back during the period, they remained above 3,100 yuan/mt, leading to a MoM increase in the monthly average price and driving up aluminum costs. SMM data showed that the monthly average SMM alumina index was 3,235.7 yuan/mt from May 26 to June 25, up 9.3% MoM. The SMM A00 aluminum ingot average spot price in June 2025 was approximately 20,453 yuan/mt (from May 26 to June 25), with an average profit of about 3,908 yuan/mt in China's aluminum industry.

As of the end of June 2025, the operating capacity of China's aluminum industry reached 43.82 million mt, and the industry's highest full cost rose to 19,416 yuan/mt. If the monthly average price is used for measurement, 100% of the domestic aluminum operating capacity was profitable in June.

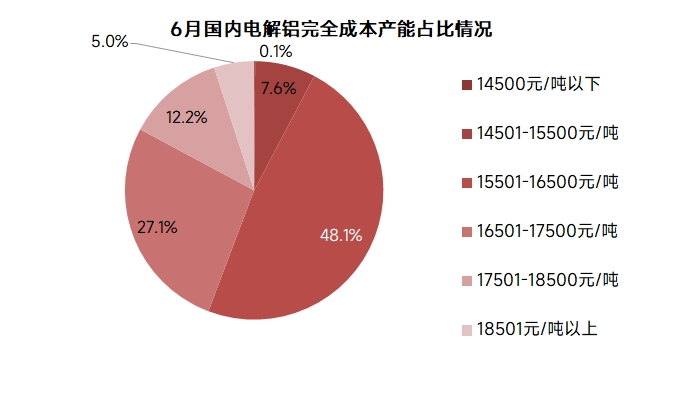

From the perspective of the cost distribution range of aluminum capacity: The lowest full cost of aluminum in June 2025 was about 13,906 yuan/mt, and the highest full cost was about 19,416 yuan/mt. The capacity distribution was as follows:

In June, the capacity with a full cost below 14,500 yuan/mt accounted for 0.1%;

The capacity with a full cost in the range of 14,501-15,500 yuan/mt accounted for 7.6%;

The capacity with a full cost in the range of 15,501-16,500 yuan/mt accounted for 48.1%;

The capacity with a full cost in the range of 16,501-17,500 yuan/mt accounted for 27.1%;

The capacity with a full cost in the range of 17,501-18,500 yuan/mt accounted for 12.2%;

The capacity with a full cost exceeding 18,501 yuan/mt accounted for 5.0%.

From the perspective of cost breakdown:

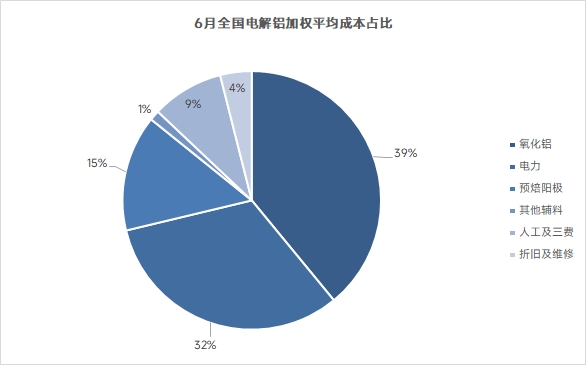

On the alumina raw material side, according to SMM data, the monthly average SMM alumina index in June was 3,235.7 yuan/mt (from May 26 to June 25). The weighted average cost of alumina in China's aluminum industry increased by 9.0% MoM, accounting for 39% of the aluminum cost. Alumina prices pulled back from highs in June, and due to increased transfer to delivery warehouse demand at month-end, alumina spot supply tightened temporarily, causing alumina spot prices to stop falling. Subsequent trends need to be monitored for changes in supply and demand. The monthly average alumina price in July is expected to fall MoM compared to June.

In the auxiliary material market, the domestic market price of prebaked anode remained stable in June. The raw material market continued to weaken due to downstream weakness, and cost support weakened, making it difficult for prebaked anode prices to rise. For aluminum fluoride, amid a weak supply and demand scenario, the mixed performance of raw material prices failed to provide effective cost support, leading to a continuous decline in aluminum fluoride prices in June. Overall, the auxiliary material sector's support for aluminum smelter costs weakened. Entering July, the prebaked anode market continued to decline, and the aluminum fluoride market extended its downward trend. Overall, the auxiliary material market remained in a weakening state and was unlikely to provide effective cost support for aluminum smelters in the short term.

Regarding electricity prices, they pulled back in June, mainly due to the onset of the rainy season, which led to a decrease in electricity prices in south-west China. The national average electricity price fell by 5.6% MoM in June, with electricity costs accounting for 32% of the aluminum smelter's total cost. Entering July, the rainy season continued in south-west China, keeping electricity prices stable, but there might be adjustments in peak and off-peak electricity prices in Sichuan, leading to a slight increase in electricity prices for aluminum smelters. SMM will continue to monitor changes in electricity fees.

Entering July 2025, alumina and auxiliary materials are expected to pull back, while power costs remain stable. It is anticipated that aluminum smelter costs will pull back. Overall, SMM expects the average tax-inclusive full cost of the domestic aluminum industry to be around 16,100-16,300 yuan/mt in July 2025.

Data source: SMM Click on the SMM industry database for more information.