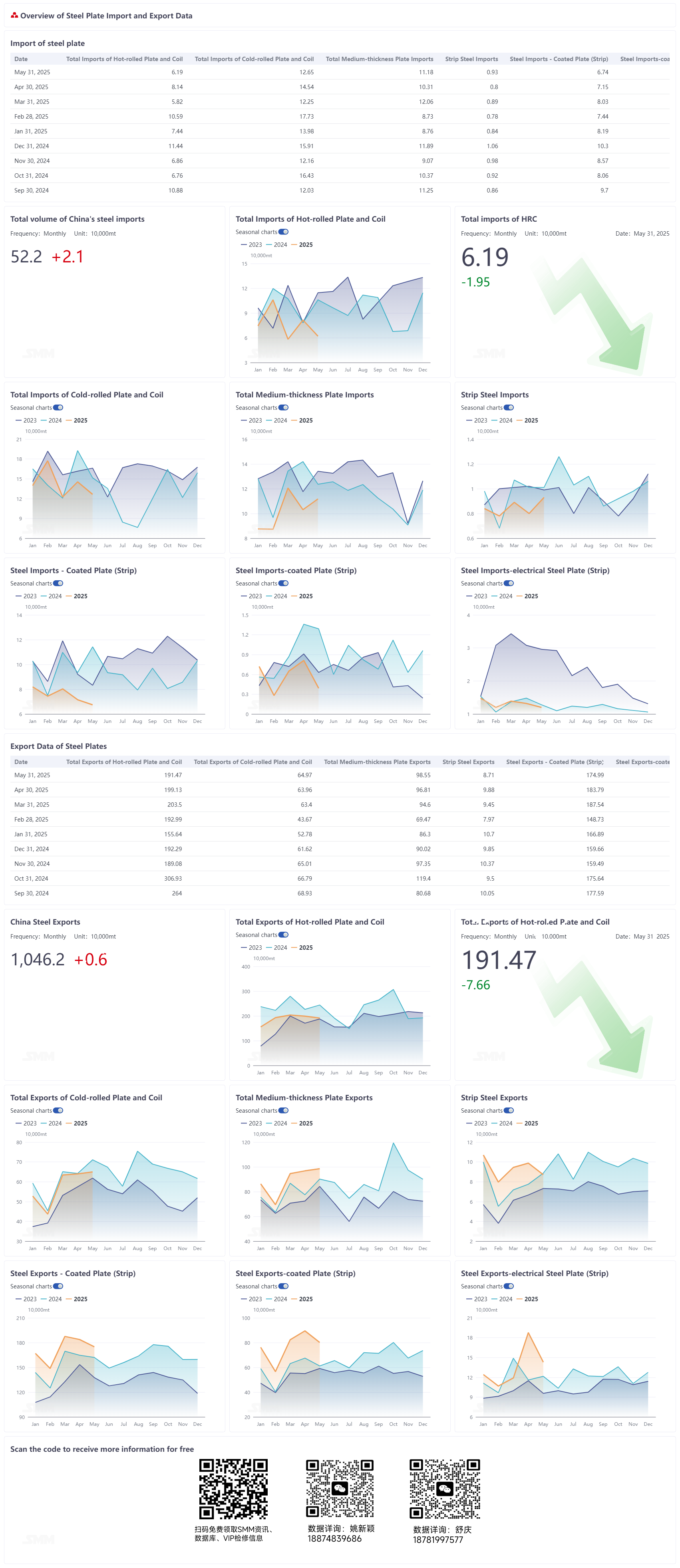

- From January to May, imports of sheets & plates decreased by 16.8% YoY, with significant declines in coated sheets (strips) and HRC.

According to data from the General Administration of Customs, China imported 481,000 mt of steel in May, down 7.9% MoM. From January to May, China imported a cumulative 2.553 million mt of steel, down 16.1% YoY.

From January to May, China imported a cumulative 2.116 million mt of sheets & plates, down 16.8% YoY. By product type, cumulative imports of coated sheets (strips) decreased by 38.3% YoY, cumulative imports of galvanized sheets (strips) decreased by 24.2% YoY, cumulative imports of HRC decreased by 22.5% YoY, and cumulative imports of medium-thickness plates decreased by 18.3% YoY. In addition, cumulative imports of strip steel, cold-rolled steel, and electrical steel sheets (strips) all showed varying degrees of decline YoY.

- From January to May, sheets & plates exports decreased by 0.8% YoY, with HRC exports falling by over 22%.

According to data from the General Administration of Customs, China exported 10.578 million mt of steel in May 2025, up 1.1% MoM. From January to May, cumulative steel exports reached 48.469 million mt, up 8.9% YoY.

From January to May, China's cumulative exports of sheets & plates amounted to 30.387 million mt, down 0.8% YoY. By product type, cumulative exports of HRC decreased by 22.1% YoY, far exceeding the decline of other sheet & plate varieties. Cumulative exports of cold-rolled coil decreased by 5.3% YoY. However, cumulative exports of other varieties, excluding cold-rolled and hot-rolled coils, such as strip steel, medium-thickness plates, coated/galvanized sheets (strips), and electrical steel sheets (strips), all showed varying degrees of YoY growth.

Since 2025, anti-dumping sanctions imposed by overseas markets on ordinary steel products such as HRC from China have escalated. Against the backdrop of a high base in the same period last year, HRC exports have been significantly impacted.

In terms of the proportion of sheet and plate varieties, from January to May 2025, the export share of coated sheet (strip) increased from 25% to 28%, the export share of medium-thickness plates increased from 13% to 15%, the export share of painted sheet (strip) increased from 9% to 13%, and the export share of strip steel increased from 1% to 2%.

However, the export share of hot-rolled coil (HRC) decreased from 40% to 31%, and the export share of cold-rolled coil decreased from 10% to 9%.

Against the backdrop of increasingly fierce competition in exports, the impact of anti-dumping measures continues to rise. In the traditional export structure of steel sheets and plates, the proportion of cold-rolled and hot-rolled coils is gradually declining, while the proportion of relatively high value-added materials such as painted/coated sheet (strip) is gradually increasing.

- Outlook

Overall, while steel exports continued to grow YoY from January to May 2025, the exports of sheets & plates, particularly low-end hot-rolled coil (HRC) sheets & plates, are slowly "receding"... The future of steel exports is fraught with uncertainty, but it is foreseeable that China's steel exports are undergoing a transformation from competing on low prices for volume to increasingly offering high-value-added steel and steel products labeled "Made in China" to the global market.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)