SMM reported on June 6 that today, the SS futures market continued to exhibit in the doldrums. This week marks the first week after the Dragon Boat Festival holiday, coinciding with the traditional consumption off-season for stainless steel in June, resulting in a sluggish market atmosphere. During the holiday, news of stainless steel mills lowering prices exacerbated market pessimism. This week, spot transactions remained sluggish, with downstream buyers adopting a cautious wait-and-see attitude, and only just-in-time procurement remained active. Market monitoring indicated a significant increase in social inventory at major distribution centers such as Foshan and Wuxi during the week, due to high arrivals and slow shipments, leading to severe inventory backlogs. Traders faced increased pressure to sell, and despite proactively offering discounts, market response was tepid, with no improvement in transactions observed.

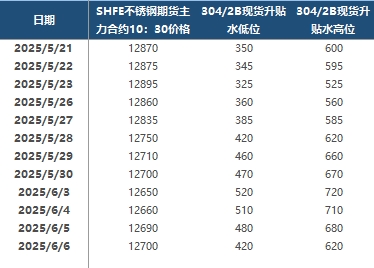

In the futures market, the most-traded contract 2507 was in the doldrums. At 10:30 a.m., SS2507 was quoted at 12,700 yuan/mt, up 10 yuan/mt from the previous trading day. In the Wuxi region, the spot premiums/discounts for 304/2B ranged from 420 to 620 yuan/mt. In the spot market, cold-rolled 201/2B coils in Wuxi and Foshan were both quoted at 7,850 yuan/mt; cold-rolled trimmed 304/2B coils had an average price of 13,050 yuan/mt in Wuxi and the same in Foshan; cold-rolled 316L/2B coils were priced at 24,050 yuan/mt in Wuxi and the same in Foshan; hot-rolled 316L/NO.1 coils were quoted at 23,350 yuan/mt in both regions; and cold-rolled 430/2B coils were priced at 7,500 yuan/mt in both Wuxi and Foshan.

Currently, the stainless steel market is fully entrenched in the challenges of the traditional consumption off-season, with downstream demand remaining persistently sluggish. Despite consecutive declines in stainless steel production since March, due to a relatively large base in the early period, production still remains at historically high levels. This has exacerbated the significant surplus in market supply, and the issue of high social inventory is unlikely to be effectively alleviated in the short term. Although stainless steel enterprises are generally facing losses and multiple steel mills have announced production cuts, under the dual immense pressures of weakening market demand and high inventory, these production cut measures have not yet effectively boosted the spot market. From the raw material side, influenced by expectations for production cuts at stainless steel mills, the price of high-grade NPI struggles to rise, while the price of high-carbon ferrochrome has shown a clear pullback, leading to a continuous weakening of cost support for stainless steel. If the subsequent production cut efforts fall short of expectations, against the backdrop of the consumption off-season, stainless steel prices may continue to remain in the doldrums in the short term, and the road to market recovery remains long and fraught with challenges.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)