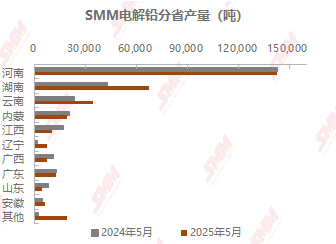

SMM, May 30: In May 2025, the national production of primary lead showed a slight upward trend, increasing by 2.39 percentage points MoM and 14.66 percentage points YoY. The cumulative production of primary lead from January to May 2025 increased by 8.41 percentage points YoY.

It is understood that in May, primary lead smelters resumed production in a relatively concentrated manner after completing maintenance in April, with smelters in central, southern, and south-west China regions all experiencing certain increases in output. Among them, smelters in southern China saw a significant increase in output, mainly due to the conclusion of environmental protection inspections last month and the replenishment of raw material shortages, enabling smelters to resume production as scheduled, resulting in a substantial increase in output. Although smelters in east, north-west, and south-west China regions entered routine maintenance or made short-term production adjustments during this period, the impact on output was limited and did not alter the upward trend in primary lead production for the month.

Looking ahead to June, more primary lead smelters are expected to undergo maintenance, mainly concentrated in south-west, east, and north China regions. On the one hand, primary lead smelters typically enter a routine maintenance period from June to August each year, with some enterprises undergoing maintenance as planned. Most of these enterprises are expected to halt equipment operation after mid-June, with a relatively significant reduction in output anticipated in late June. On the other hand, the price center of lead gradually shifted downward in late May, and spot lead prices fell below 16,500 yuan/mt by month-end, dampening the production enthusiasm of smelters. Additionally, factors such as tightening lead concentrate supply and high scrap battery prices have led some enterprises to make certain production adjustments. Overall, it is expected that primary lead production will decrease by approximately 3 percentage points MoM in June.