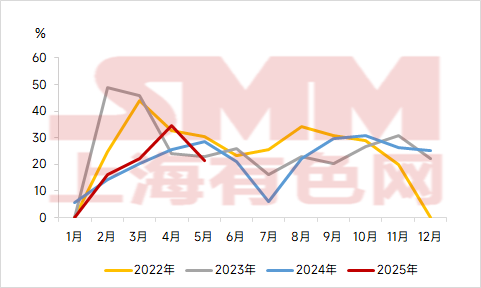

[Operating Rate of Steel Mills Using Externally Purchased Billets (SMM Survey)] According to the SMM survey, as of May 30, the operating rate of steel mills using externally purchased billets, which mainly produce construction steel, stood at 21.57%, down 13.07 percentage points from the end of April and 7.14 percentage points YoY. In May, the price trend of construction steel nationwide fluctuated downward, with prices falling 107 yuan/mt MoM. Domestic macro policies entered a vacuum period, and market sentiment was low, with futures continuously hitting new lows.

Cost side, the coke price cut was implemented. Given that the recent decline in coal prices far exceeded that of coke, the production enthusiasm of coke enterprises remained unabated. However, with the arrival of the off-season for steel consumption, there is a possibility of further declines in raw material prices, and the cost support for steel may continue to weaken.

Supply side, in May, the export situation of steel billets was moderate. Some blast furnace steel mills had already received full orders for June-July. If the price of construction steel continues to weaken, there is an expectation of a reduction in construction steel production in the later period. Currently, the profits of EAF steel mills continue to shrink, and many electric furnace steel mills have reduced their operating hours. With the approaching plum rain season and an increase in rainy weather, the progress of construction projects for construction steel may slow down. Electric furnace steel mills will also reduce cost expenditures by lowering their operating rates to maintain corporate operations and profit levels. In May, the decline in the spot price of rebar was greater than that of steel billets. The profitability of steel mills using externally purchased billets was poor, and they reduced their operating hours. Two steel mills using externally purchased billets have halted production this month.

Demand side, as the traditional off-season deepens, with an increase in hot and rainy weather, the capital availability rate at construction sites has not changed much. Additionally, with the approaching senior high school entrance examinations and college entrance examinations, some construction sites will prohibit operations during specific time periods, strengthening the expectation of weakening marginal demand.

Overall, with the continuous decline in construction steel prices, the poor profitability of steel mills using externally purchased billets, and the increase in steel billet export orders making it more difficult to source billets, the operating rate of steel mills using externally purchased billets declined this month. As the plum rain season approaches, the progress of project construction will slow down, and demand will further shrink. There are still plans for some steel mills using externally purchased billets to halt production. Therefore, it is expected that the operating rate of steel mills using externally purchased billets may decline slightly in June.

Chart-1: Trend Chart of Operating Rate of Steel Mills Using Externally Purchased Billets, 2022-2025

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)