Guinea, a West African country bordered on the west by the Atlantic Ocean, has an economy that is profoundly intertwined with its bauxite mining industry, which serves as a cornerstone of national economic activity, export earnings, and foreign investment. Recently (May 2025), Guinea announced the repossession of 51 mining licenses, including those for bauxite, citing non-compliance with development timelines and operational requirements. This includes licenses for companies like Kebo Energy SA and Emirates Global Aluminium, specifically due to their failure to fulfil commitments to build local alumina refineries. This serves as a strong warning to other major operators.

But why is the country, whose economic development largely depends on bauxite trade, taking such an eccentric decision?

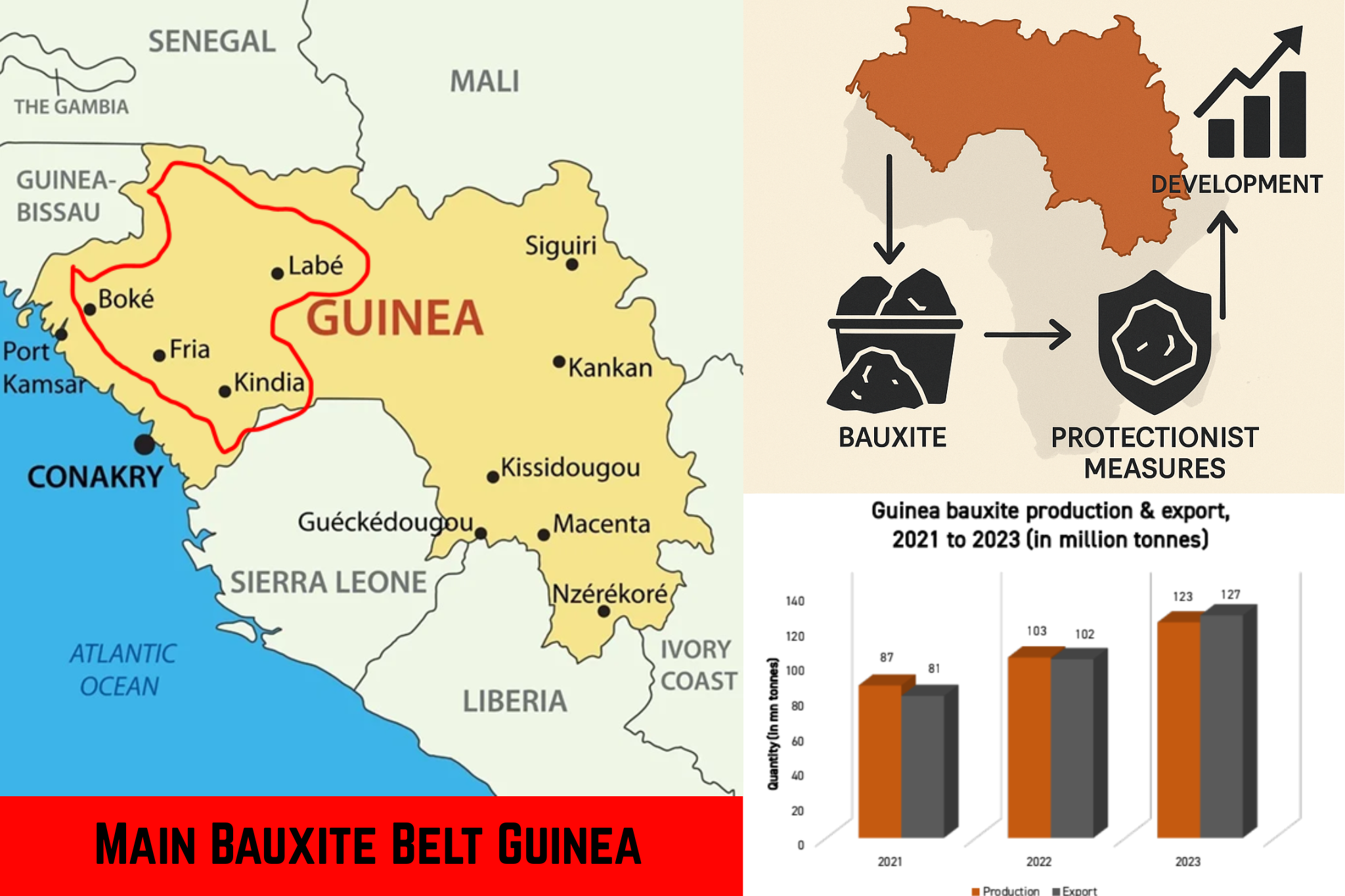

Bauxite is one of the most exploited mining resources in Guinea, accounting for 33.7 per cent of Guinea’s exports in 2021. Guinea exported over 102 million tonnes of bauxite in 2022, becoming the world’s second-largest bauxite exporter. The Ministry of Mines reported a 19 per cent increase in bauxite exports in 2022 compared to 2021.

Bauxite is one of the most exploited mining resources in Guinea, accounting for 33.7 per cent of Guinea’s exports in 2021. Guinea exported over 102 million tonnes of bauxite in 2022, becoming the world’s second-largest bauxite exporter. The Ministry of Mines reported a 19 per cent increase in bauxite exports in 2022 compared to 2021.

The mining sector, including bauxite, consistently contributes a substantial portion to Guinea’s GDP. Recent figures show that it contributes around 18-22 per cent of GDP. For instance, in 2021, mining accounted for 21 per cent of GDP, and in 2022, it was 20.01 per cent. In 2023, Guinea’s economy experienced a growth rate of 7.1 per cent, primarily driven by a 22 per cent surge in bauxite production. The mining sector, encompassing bauxite, gold, and iron ore, contributed approximately 18 per cent to the nation’s GDP.

The reliance is even more pronounced in exports, with the mining sector accounting for a massive 80-90 per cent of Guinea’s total export earnings. Bauxite alone makes up about 63 per cent of total mineral production.

Guinea holds an estimated quarter to one-third of the world’s proven bauxite reserves, making it the country with the largest reserves. With approximately 7.4 billion tonnes of bauxite reserves (USGS, 2023), Guinea holds the world’s largest deposits. China imports roughly 60 per cent of its bauxite from Guinea (UN Comtrade, 2024), making it the primary supplier to the world’s largest aluminium producer. Russia imports approximately 18 per cent of Guinea’s bauxite output (Rosstat, 2024), creating additional geopolitical complexity.

Guinea bauxite is easy to mine by a surface miner and/or drilling–blasting technique. The direct bauxite mining cost is normally less than USD 3 per tonne, and raw bauxite can be exported after simple crushing. Guinea has about 9 to 10 well-developed operating bauxite mines, and each mine is different in terms of specific bauxite quality, infrastructure, road/rail network, and port/river jetty.

The extractive sector, with bauxite at its core, contributed over 24 per cent to government revenues in 2021. However, challenges such as underpricing and transfer mispricing have historically limited revenue potential. To address this, Guinea implemented a reference pricing mechanism in 2022 to ensure fairer returns from bauxite exports.

Despite its robust growth and significant contribution to GDP and exports, the mining sector’s weak linkages to the domestic economy have limited its impact on job creation and poverty reduction.

Log in https://www.alcircle.com/news/mine-here-refine-here-is-guineas-underlying-approach-for-50-external-miners-but-guinea-is-not-alone-in-this-bargain-114151 to read the full story for FREE