SMM News on May 22, 2025:

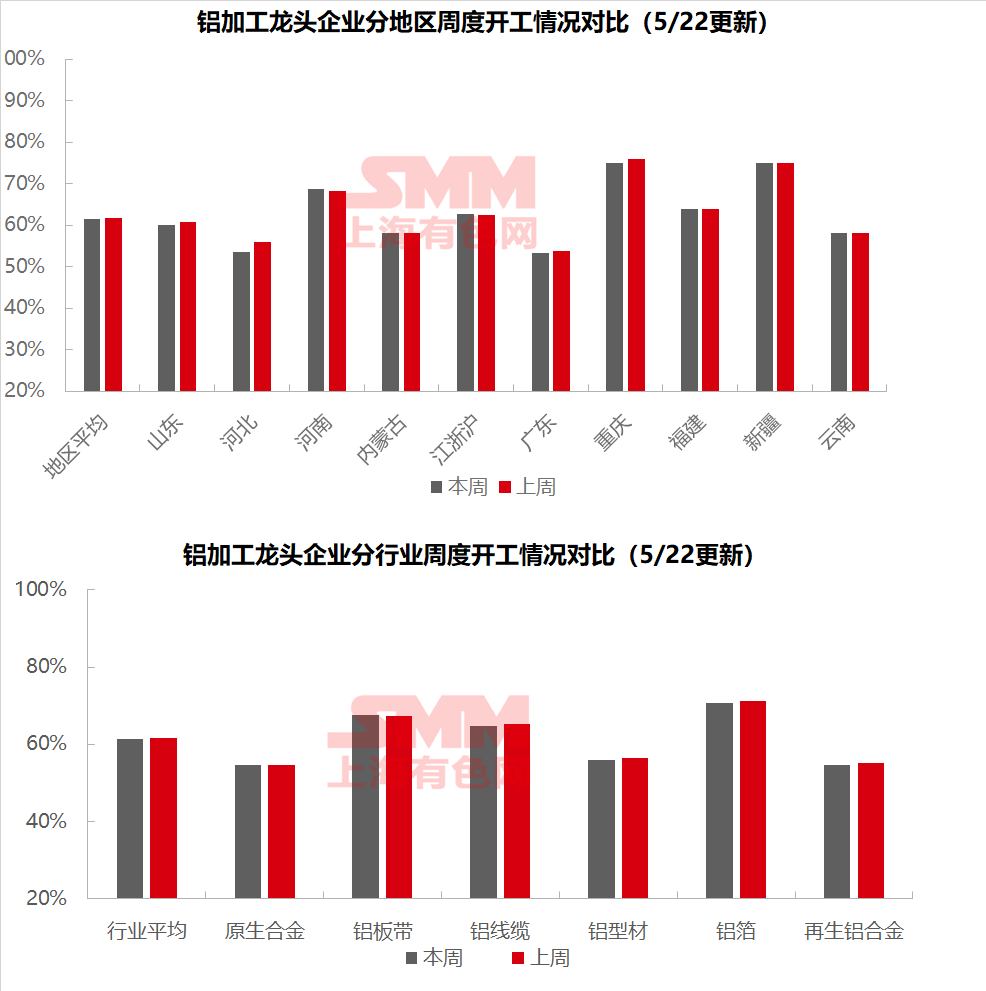

This week, the operating rate of leading enterprises in China's downstream aluminum processing sector declined slightly by 0.2 percentage points MoM to 61.4%, with continued divergence across segments. The operating rate of primary aluminum alloy remained stable, while aluminum wheel hub exports increased by 12.9% YoY but decreased by 0.5% MoM. The share of exports to the US exceeded 30% for the first time, and re-export trade drove a 44% surge in exports to Mexico. Enterprises maintained their production pace supported by mid-year full production targets, but the uncertainty surrounding Sino-US negotiations suppressed the momentum for "rushing exports." The operating rate of aluminum plate/sheet and strip increased slightly by 0.4 percentage points MoM to 67.6%, benefiting from the recovery in exports of home appliances, etc., but intensified competition in domestic can stock processing fees constrained the overall increase. The operating rate of aluminum wire and cable fell slightly by 0.4% MoM but remained at a high level, supported by the rush-to-meet-deadlines cycle and production scheduling, with exports mainly to Southeast Asia and South America. The operating rate of aluminum extrusion decreased by 0.5 percentage points MoM to 56%, with significant regional divergence: infrastructure orders in Shandong remained stable, while production lines for building materials in Southwest China pulled back; the operating rate of PV frame enterprises polarized, with small enterprises struggling to take orders. The operating rate of aluminum foil decreased by 0.5 percentage points MoM to 70.6%, with steady demand for NEV aluminum foil but pressure in traditional sectors. The export window period may become a short-term variable. The operating rate of secondary aluminum continued to decline by 0.4 percentage points MoM to 54.6%, with small and medium-sized enterprises significantly impacted by shrinking orders. SMM expects the operating rate to decline by another 0.2 percentage points MoM to 61.2% next week.

Primary Aluminum Alloy: According to the SMM survey, the operating rate of leading enterprises in the primary aluminum alloy sector remained stable at last week's level this week, slightly exceeding market expectations. The latest customs data showed that aluminum wheel hub exports reached 81,400 mt in April, down slightly by 0.47% MoM but up by 12.92% YoY, highlighting overall resilience. Notably, exports to the US plunged by 18.3% MoM to 5,200 mt, with the share exceeding the 30% threshold for the first time. During the same period, exports to Mexico exceeded 10,000 mt for the first time, increasing by 22.7% MoM and surging by 44% YoY, demonstrating significant re-export trade characteristics. Against the backdrop of fluctuating aluminum prices, orders and operating rates of sampled enterprises remained stable in the second half of May, similar to the mid-month situation: on the one hand, enterprises maintained their existing production pace supported by mid-year full production targets; on the other hand, despite signs of easing in Sino-US trade, the industry generally adopted a wait-and-see approach, lacking the momentum for "rushing exports." Considering that top-tier enterprises are still in the order evaluation period, coupled with off-season factors, SMM expects the industry's operating rate to remain generally stable with a slight fall next week, with a substantive turning point awaiting clarity in Sino-US negotiations.

Aluminum Plate/Sheet and Strip: This week, the operating rate of leading enterprises in the aluminum plate/sheet and strip sector increased by 0.4 percentage points MoM to 67.6%. Last week, the Sino-US trade war cooled, with the suspension of reciprocal tariffs. Terminal aluminum finished products, such as home appliances, electronics, and kitchen and bathroom products, regained some lost export ground, boosting the export-related operating rates of upstream aluminum plate/sheet and strip enterprises. Domestic consumption: Some can-making enterprises will initiate a new round of tendering and procurement work. The processing fees for can stock, which recently increased collectively, may be further discounted, triggering a new round of intense competition in the can stock market. Overall, thanks to the lull in the Sino-US trade war, the operating rate of aluminum plate/sheet and strip has slightly increased. However, the export recovery still struggles to offset the seasonal decline in overall domestic consumption, and the operating rate of aluminum plate/sheet and strip is expected to remain in the doldrums in the following period.

Aluminum wire and cable: This week, the operating rate of leading enterprises in China's aluminum wire and cable industry was recorded at X%, a slight decrease of 0.4% MoM. This was mainly due to the slight suppression of enterprises' production enthusiasm caused by the rebound in the center of aluminum prices. However, against the backdrop of the rush-to-meet-deadlines cycle, production could still be maintained at highs, showing resilience. Recently, aluminum wire and cable manufacturers have been producing as planned. Last week, due to the considerable profit margins from order price spreads, there was a stocking demand for raw materials. End-users maintained a steady cargo pick-up pace, and manufacturers' finished product inventories remained low. In the past week, Sino-US trade relations have eased, but the export business of leading aluminum wire and cable manufacturers has almost no correlation with the US, having no impact on the exports of the aluminum wire and cable industry. The industry still mainly exports to Southeast Asia and South American enterprises. Considering enterprises' production schedule expectations and the attractiveness of orders, the industry's operating rate is expected to remain stable.

Aluminum extrusion: This week, the national operating rate of extrusion decreased slightly by 0.5 percentage points MoM to 56%. In the building materials sector, the overall operating rate was basically flat compared to last week, but there were significant regional disparities. According to the SMM survey, leading enterprises in Shandong and central China regions have maintained production relying on existing infrastructure orders, while in south-west China, due to product structure adjustments, the operating rate of building materials production lines has significantly pulled back. In the industrial materials sector, this week, the operating rate exhibited structural characteristics. In east China, the extrusion production lines maintained an operating rate of 70%, and the finishing processes operated at full capacity to ensure the supply of high value-added products. In contrast, south-west China showed the opposite trend, with the extrusion capacity operating rate reaching 80%, but the finishing production lines operating at less than 50%. This week, the operating rates of PV frame sample enterprises continued to diverge. In east China, the operating rates of some leading enterprises dropped to 70%. According to the SMM survey, some small and medium-sized enterprises in Anhui reported that their PV frame orders mainly came from existing long-established customers, and they had suspended taking orders from new customers. Meanwhile, the operating rates of small and outsourced enterprises in east China and Henan still hovered at a low level of 40%. This week, the automotive extrusion sector operated relatively smoothly. Some enterprises in east China and central China reported that their existing orders for NEVs and traditional fuel vehicles were being produced in an orderly manner. However, the sluggish growth in new orders prompted enterprises to accelerate the exploration of new order channels. SMM will continue to monitor the actual implementation progress of orders in various sectors.

Aluminum foil: This week, the operating rate of leading aluminum foil enterprises decreased by 0.5 percentage points MoM to 70.6%. Specifically, the production pace of aluminum foil products (battery foil/brazing foil) related to the new energy vehicle industry chain remained relatively stable, mainly due to the continuous growth in production and sales of end-user automakers driving upstream production. However, it is necessary to be vigilant as power battery and parts enterprises have gradually shown signs of weakening demand. In traditional consumer sectors, double zero foil and air-conditioner foil were constrained by weak domestic market demand, coupled with intense price competition in the processing sector, significantly increasing the operational pressure on enterprises. In the international market, with the phased easing of tariff barriers between China and the US, export-oriented sectors such as home appliances and electronics may experience a concentrated shipping window in the short term, which is favorable for the release of domestic aluminum foil export capacity. Overall, the aluminum foil industry is currently in its traditional off-season. Despite the demand support from high-end products, the overall market is still in a state of contraction. It is expected that the industry's operating rate will maintain a fluctuating downward trend.

Secondary Aluminum Alloy: This week, the operating rate of leading secondary aluminum enterprises declined by 0.4 percentage points MoM to 54.6%. Entering mid-May, the end-use demand for secondary aluminum remained weak. Some die-casting enterprises reported a 30% MoM decline in orders in May, with purchasing mainly done as needed. Coupled with the bearish sentiment among some downstream enterprises, the overall purchasing enthusiasm was low. The supply side showed a divergent trend, with large enterprises maintaining relatively stable production and limited reductions in operating rates, while the operating rates of small and medium-sized enterprises declined significantly. Some enterprises were basically in a state of shutdown in May due to insufficient orders and losses. In the short term, the impact of the seasonal off-season persists, and it is expected that the subsequent operating rate of secondary aluminum will continue to decline weakly.

》Click to view the SMM Aluminum Industry Chain Database

(SMM Aluminum Team)