》Check SMM lead product quotes, data, and market analysis

》Subscribe to view historical spot prices of SMM metals

SMM News on May 16:

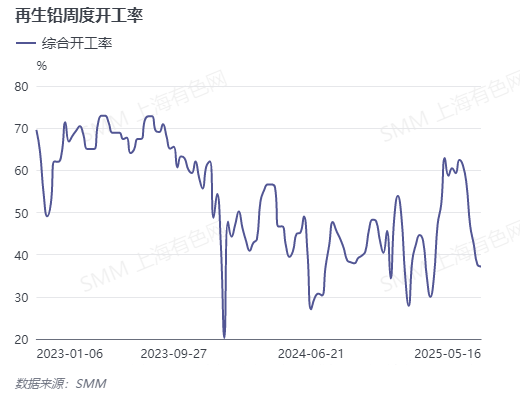

From May 10, 2025 to May 16, 2025, the weekly operating rate of secondary lead in four provinces tracked by SMM was 37.22%, a decrease of 0.43 percentage points WoW.

As can be seen from the chart above, the weekly operating rate of secondary lead has been on a downward trend since April, declining by approximately 30 percentage points. According to SMM, the tight supply of raw materials for secondary lead, leading to high costs, weak end-use consumption and poor sales of lead ingots, and the loss pressure resulting from the combination of these two factors are the key factors suppressing the production enthusiasm of enterprises.

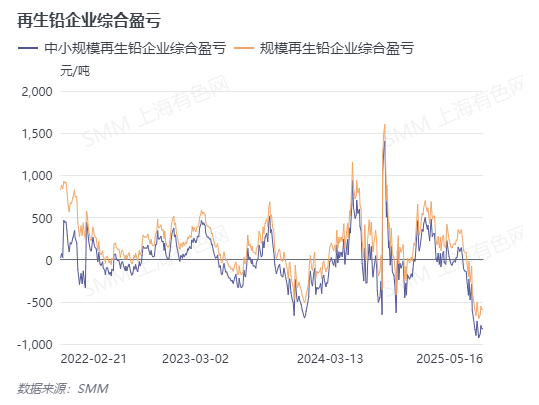

The low scrap volume of waste lead-acid batteries has led to scarce market supply, putting significant pressure on recyclers to purchase materials and resulting in a negative attitude towards delivery. Consequently, the arrival volume of scrap batteries at secondary lead smelters is tight, with low levels of raw material inventory, and procurement quotes remain high and difficult to reduce. Moreover, there is intense competition for raw material procurement among secondary lead smelters, and the practice of offering separate price increases to customers has led to a strong wait-and-see sentiment among recyclers. For example, the current mainstream market price for tax-excluded scrap e-bike lead-acid battery scrap is between 10,050 and 10,100 yuan/mt. A smelter in east China stated that after offering a price of 10,050 yuan/mt, it received no response, as if the offer had "sunk into the sea," with no recyclers willing to report shipments. Some recyclers contacted the smelter to request a price increase of at least 10 yuan/mt. In summary, the tight supply situation in the raw material sector is temporarily difficult to alleviate, and artificial inventory control has exacerbated the tightness.

During the week, lead prices maintained sideways movement, with downstream battery producers showing a strong wait-and-see sentiment, meeting production needs through cargo pick-up under long-term contracts, and having a low willingness to purchase lead ingots through spot orders. Meanwhile, secondary lead smelters, facing cost pressure, have a low willingness to sell and are reluctant to accept large discounts for transactions. Under the sentiment of "upstream suppliers not selling and downstream buyers not purchasing," the trading activity in the spot market for secondary refined lead has been low. In addition, the poor enthusiasm of downstream customers to purchase lead has made it difficult for suppliers of primary lead to sell their inventory, with some brands even offering small discounts against the SMM 1# lead average price. Under such market conditions, secondary lead enterprises are forced to expand discounts for sales, resulting in no profit. As of May 16, 2025, the theoretical comprehensive profit and loss value for large-scale secondary lead enterprises was -592 yuan/mt, and for small- and medium-scale secondary lead enterprises, it was -820 yuan/mt.

This week, the operating rate of secondary lead continued to decline, but finished product inventories maintained an upward trend. Since the current sales quotes for secondary lead are lower than the cost, losses are inevitable once sold; most enterprises prefer to accumulate inventory rather than sell. Given that the current operating rate of secondary lead has fallen below 40%, SMM expects that it may be difficult for finished lead inventories to maintain an upward trend next week. In addition, the volume of scrap batteries arriving at the smelters is low, making it difficult to accumulate raw material inventories. This, combined with weak demand for lead ingots from downstream battery producers, and the sluggish market conditions, has dampened the production enthusiasm of secondary lead smelters. However, as many smelters have already reduced or halted production, the subsequent decline in operating rates may slow down.