Amlogic released its 2024 financial report on the evening of April 10.

The data shows that the company achieved revenue of 5.926 billion yuan in 2024, up 10.34% YoY, and net profit attributable to the parent company of 822 million yuan, up 65.03% YoY, with both annual revenue and net profit reaching record highs.

Regarding the reasons for the performance growth, Amlogic stated that in 2024, the company actively expanded the market externally and continuously improved operational efficiency internally. At the same time, under the sustained high-intensity R&D investment in recent years, multiple new products quickly gained market traction after commercialization.

The annual report shows that in 2024, Amlogic made commercial progress with several strategic new products. Among them, the 6nm chip S905X5 series can perform real-time translation and subtitling locally, enhancing the user experience in cross-language environments. Since its commercialization six months ago, the product has successfully been adopted by existing customers and secured orders from multiple top international operators. Amlogic expects that the 6nm chip could achieve sales of over 10 million units in 2025.

For the 8K chip S928X, it is reported to have captured all shares in domestic operator tenders and secured orders from top overseas operators, with shipments expected to exceed 1 million units.

The Wi-Fi 6 2*2 chip sold over 1.5 million units in 2024 and achieved breakthroughs in the operator market. However, Amlogic also stated that **the actual sales of this series did not meet the company's annual expectations, but based on the experience gained from large-scale commercialization, the market performance of the Wi-Fi 6 2*2 chip is expected to accelerate further in 2025**.

The A311D2 sold over 1 million units in 2024. Amlogic stated that with the application of motion-sensing games on TVs, it has successfully entered the North American and European markets, and this new application scenario is expected to provide sales of over 1 million units in 2025.

Overall, Amlogic currently has over 15 commercial chips equipped with its self-developed intelligent edge computing units, and in 2024, the shipments of chips with these units exceeded 8 million units.

Amlogic stated that the new products it has heavily invested in recent years are mainly targeting potential markets in large, well-defined categories. With clear market demand, these products have formed scale effects after surpassing the million-unit commercialization threshold and are expected to rapidly achieve larger-scale sales in these well-defined markets.

Meanwhile, Amlogic has also made positive progress in its R&D products. The annual report shows that the company's Wi-Fi AP chip has recently completed tape-out, which will help further expand the application areas of the W-series products.

Amlogic expects that with the continuous launch and commercialization of new products and the improvement of operational efficiency, the company's operating performance will further increase YoY in Q1 2025 and throughout 2025. However, specific performance remains uncertain.

Despite achieving its best annual performance in history last year, Amlogic has decided not to distribute profits.

Amlogic stated that the company is currently in a rapid growth phase. To continuously enhance competitiveness, ensure long-term competitive advantages, and increase the long-term value for the company and its shareholders, it needs to maintain high-intensity R&D investment. At the same time, to consolidate and further improve its market share both domestically and internationally, the company needs to further develop new customers, new regions, and new application scenarios. This requires significant investment in advanced technology and product development as well as market expansion, necessitating substantial financial support. Therefore, no profits will be distributed for 2024, and no capital reserve will be converted. However, in 2025, the company will actively advance share repurchase initiatives.

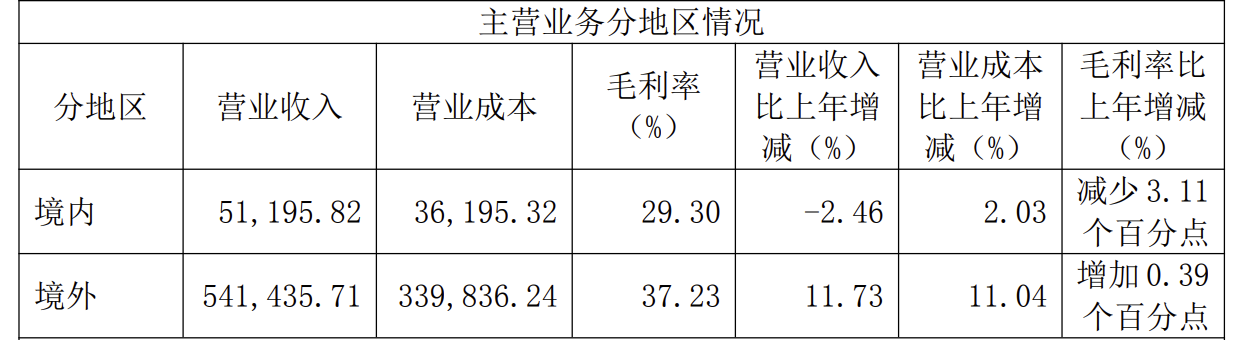

Notably, over 91% of Amlogic's revenue in 2024 came from overseas markets. The company's product sales are mainly handled by its wholly-owned subsidiary, Amlogic Hong Kong, with business coverage across major global economic regions including North America, Europe, Latin America, Asia-Pacific, and Africa.

Regarding the impact of recent geopolitical tariffs, Amlogic recently responded to investors that the company has implemented a global strategic layout for many years, with products sold worldwide, forming a diversified, non-single overseas market and establishing a mature and stable global operation system. The company's export products are not delivered in the US, and this policy has no direct impact on the company.