》View SMM Lead Product Quotes, Data, and Market Analysis

》Order and View SMM Metal Spot Historical Prices

SMM March 26 News:

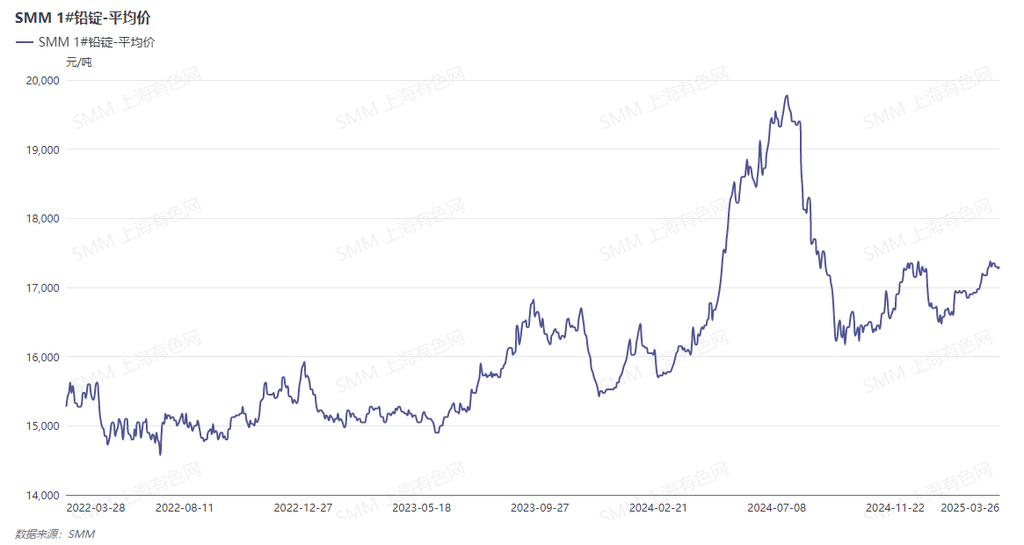

Driven by improved supply-demand dynamics and a favorable macroeconomic environment, the lead price center in March 2025 showed a significant upward shift compared to February.

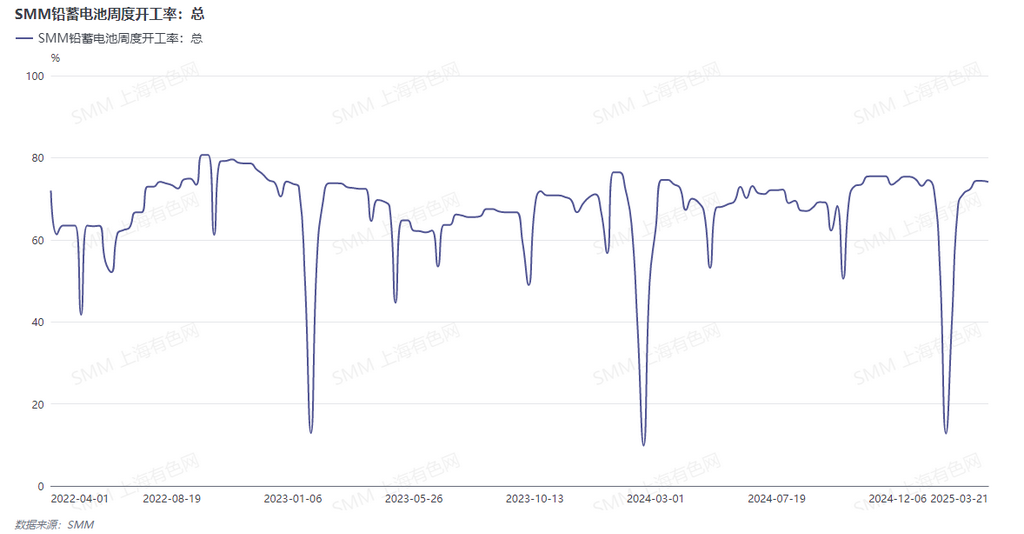

In early March, the US tariff hike news continued to ferment, increasing market concerns and suppressing the performance of non-ferrous metal futures. After the conclusion of China's Two Sessions, a series of consumption-boosting policies were proposed, creating a favorable macro environment. However, the lead ingot supply increase coexisted with raw material supply imbalances, leading to a stalemate in the SHFE lead futures market, with the price center hovering around 17,250 yuan/mt. In the spot market, end-use consumption in the lead-acid battery sector remained stable, with large enterprises maintaining steady production and a weekly operating rate of 70-80%. As the traditional off-season approached, dealers adopted a cautious purchasing approach, especially e-bike battery dealers, who actively maintained low inventory levels. Some producers reported a slowdown in new orders, and if battery inventories rise further, production cuts or holidays may be considered in late March. Due to significant price increases in metals like antimony and tin, lead-acid battery production costs have risen. Some companies intend to raise battery selling prices, but weak end-use consumption has kept most firms in a wait-and-see mode.

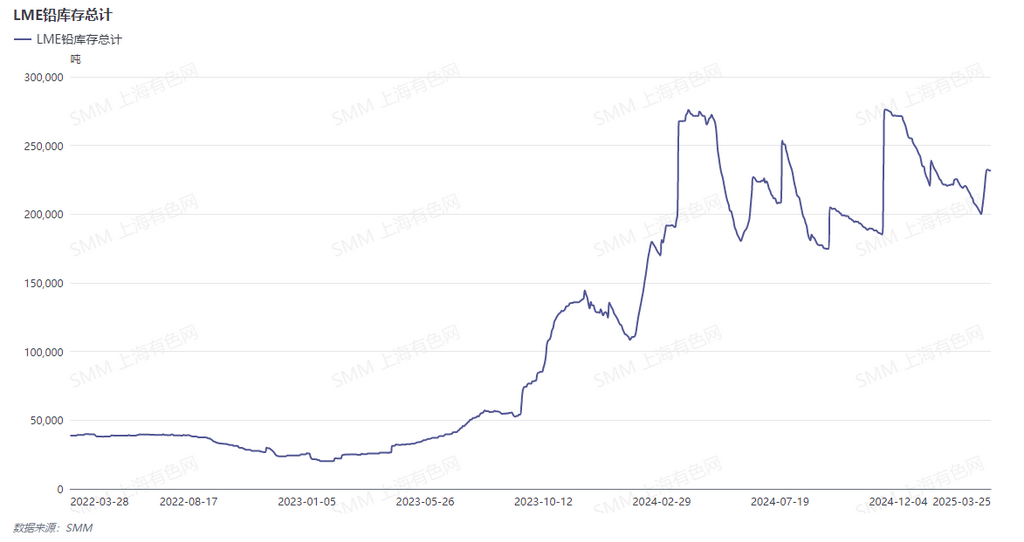

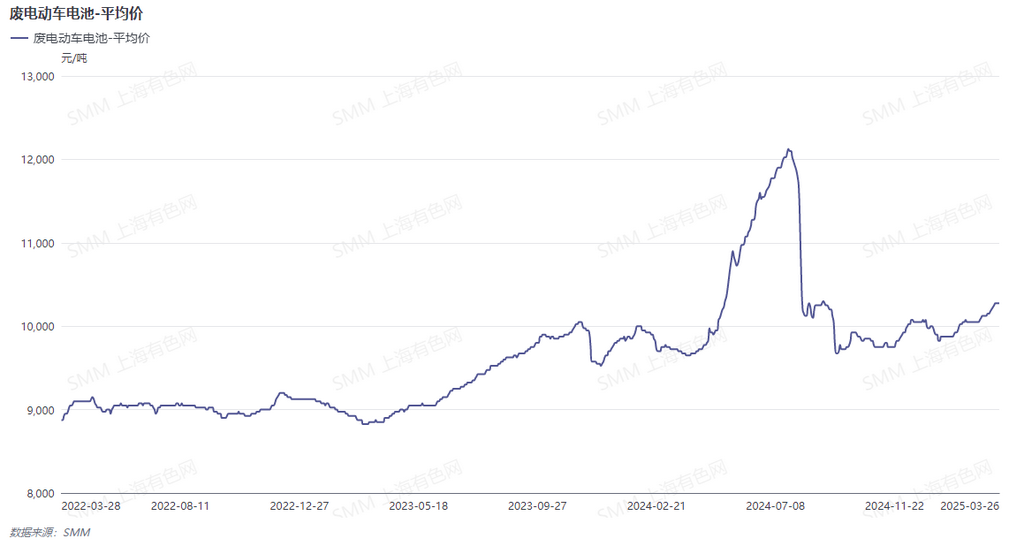

In mid-March, data released by the US Labor Department showed that February CPI inflation was below expectations, alleviating some market concerns and providing the US Fed with more room for interest rate cuts. Meanwhile, overseas lead inventories declined for three consecutive weeks, driving LME lead prices upward. Domestically, after the conclusion of China's Two Sessions, the People's Bank of China held an expanded meeting, indicating the implementation of a moderately loose monetary policy and the possibility of RRR and interest rate cuts, which boosted non-ferrous metals. The lead market in March saw both supply and demand increase, with no strong bearish factors emerging. During this period, heavy pollution weather warnings in the Beijing-Tianjin-Hebei region and surrounding areas were lifted, while environmental protection inspections were conducted in Anhui. New secondary lead capacity in Jiangsu was put into operation as scheduled, leading to periodic fluctuations in supply. Influenced by favorable macro sentiment, domestic environmental protection-driven production restrictions, and rising secondary lead raw material prices, SHFE lead prices also fluctuated upward. The lead ingot import window briefly opened. Primary lead production remained stable with a slight increase, while the delivery of the SHFE front-month contract reduced short-term market circulation, maintaining spot premium trading. In the secondary lead sector, stronger lead prices improved smelter profitability, with mainstream ex-factory quotes for secondary refined lead expanding from a 50 yuan/mt discount to a 100 yuan/mt discount against the SMM 1# lead average price. However, weak end-use consumption in the lead-acid battery market and rising raw material prices for lead, antimony, and tin have increased cost pressures for battery manufacturers, leading to raw material purchasing as needed.

In late March, LME lead inventories reversed their downward trend, with weekly inventories increasing by 27,000 mt from March 17-21, dragging LME lead prices down after an initial jump. Domestically, after the delivery of the SHFE lead 2503 contract, lead ingot warehouse transfers slowed, reducing their impact on lead prices. Imported lead arrived at ports and entered the spot circulation market, injecting new supply into the lead market. After domestic lead prices pulled back on March 21, scrap battery supply imbalances intensified, significantly reducing smelting profits and even turning them into losses, providing some cost support for lead prices. On March 24, lead prices rebounded after a large lead smelter in Henan revealed maintenance plans. Additionally, some smelters in Hunan reduced production due to insufficient raw materials, and a water pollution environmental incident led to inspections extending to Guangxi and Guangdong, though no significant production impact has been observed. However, market sentiment drove capital inflows, with the most-traded SHFE lead 2505 contract reaching 17,805 yuan/mt, a six-month high, before pulling back and fluctuating upward around 17,550 yuan/mt. The lead ingot import window briefly opened. On the consumption side, active trade-in activities in the e-bike and automotive markets improved sales of some vehicles and their battery counterparts, easing producers' concerns about the off-season. Lead-acid battery production remained stable, and some companies engaged in buying the dip after lead prices fell, though overall purchasing willingness was moderate. Recently, after lead prices rebounded and fluctuated at highs, battery production costs rose. Some companies kept production lines at full capacity to reduce unit consumption costs, while taking 1-2 days off within the month to balance finished product inventories. The expanded SHFE/LME price ratio has negatively impacted lead-acid battery exports, with export-oriented companies in Guangdong and Zhejiang reporting poor orders. Operating rates for these companies' production lines were mostly 60-70%, with a few considering halting production at month-end.

Looking ahead to April, spot supply from primary and secondary lead production is expected to decline, especially with maintenance at delivery brand companies, reducing lead ingot supply in mainstream production areas. Smelters may maintain firm quotes. The secondary lead market may diverge, with some smelters holding firm on quotes due to high scrap battery prices, while others receiving imported crude lead may continue to sell at large discounts. Meanwhile, persistently high scrap battery prices could squeeze smelting profits if lead prices weaken, pushing secondary lead companies close to breakeven and potentially leading to significant production cuts. Additionally, imported lead arriving at ports will continue to flow into the domestic market, partially offsetting raw material supply gaps, potentially leading to regional price spread expansions for secondary refined lead. On the consumption side, March-April is the traditional off-season for e-bike and automotive battery replacement markets, with major producers likely maintaining a produce-based-on-sales approach. Overall, the short-term lead market will continue to trade around supply changes and secondary production costs.