》View SMM Metal Quotes, Data, and Market Analysis

》Subscribe to View Historical Price Trends of SMM Metal Spot

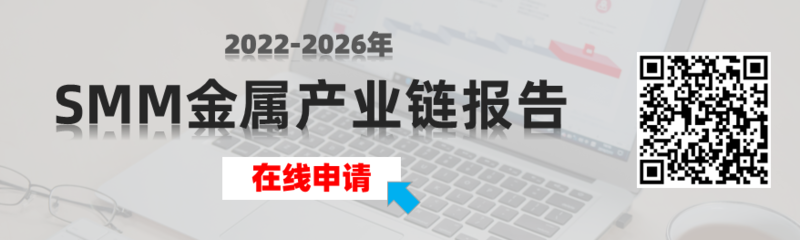

According to SMM data, starting from March 6, 2025, SMM mainstream copper cathode social warehouse inventories began consecutive destocking, with a total reduction exceeding 20,000 mt over the past three statistical periods. As of March 14, 2025, domestic copper cathode inventories totaled 345,500 mt, down 33,600 mt YoY, indicating that the destocking turning point in 2025 arrived earlier than in 2024.

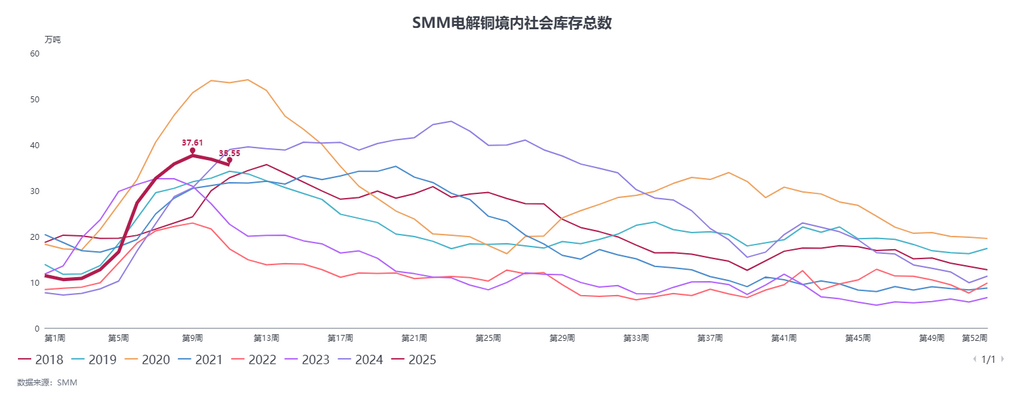

This Friday, copper prices broke through the 80,000 yuan/mt threshold. However, with inventory depletion and the Contango price spread between SHFE copper 2503 and 2504 contracts widening again, spot cargoes continued to be converted into futures warrants by suppliers, reducing the circulation of spot copper. As the delivery date approached, spot traders held firm on spot premiums, with spot discounts narrowing throughout the week until a slight premium was observed.

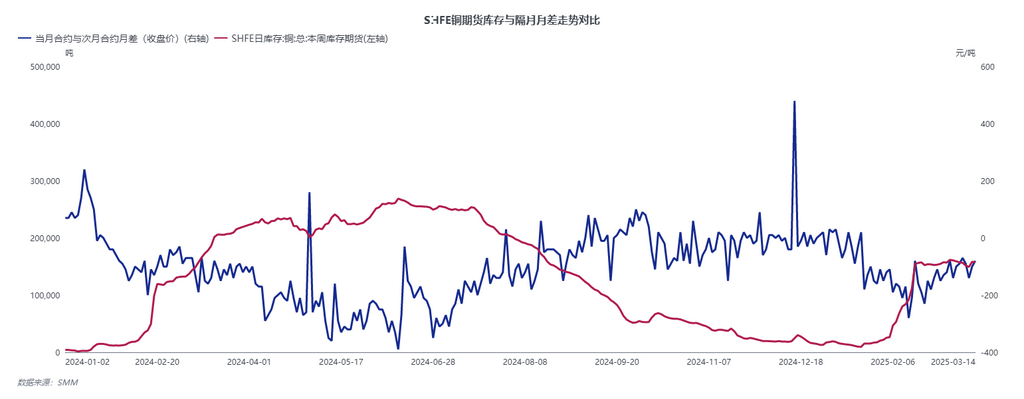

Supply side, export opportunities opened up, and global trade flows shifted due to rising COMEX copper prices. Bonded zone inventories increased, smelter exports grew, and Yangshan copper premiums rose, leading to reduced domestic trade supplies of imported copper. Meanwhile, smelter maintenance reduced supply around east China, and recent inbound inventory volumes declined.

Under the backdrop of copper prices reaching 80,000 yuan/mt, downstream procurement sentiment was significantly suppressed. Large copper rod enterprises, despite having orders, showed weakened demand for copper cathode procurement, focusing on consuming previously stocked low-cost raw materials. Small and medium-sized enterprises primarily relied on long-term contract cargo pick-up for copper cathode procurement. This week, the weekly operating rate (March 7-13) of major domestic copper cathode rod enterprises rose to 75.14%, up 2.01 percentage points MoM but 1.36 percentage points lower than expected. Raw material inventories continued to decline, down 10.50% MoM. Secondary copper raw material suppliers sold at high prices, and secondary copper rod enterprises reported that after the rebound in copper prices, the circulation of secondary copper raw materials in the market was significantly higher than before. It is expected that secondary copper raw materials will partially supplement copper cathode raw materials.

In summary, copper prices suppressed a significant increase in downstream operating rates, with limited growth in new orders. Destocking was mainly driven by reduced smelter supply and decreased replenishment of imported copper. Although raw material inventories at downstream processing enterprises also declined, this was primarily due to the consumption of previously procured low-cost inventories, with no intention of further large-scale copper cathode procurement. Looking ahead to next week, under the pressure of high copper prices, downstream enterprises are expected to continue favoring just-in-time procurement. However, supply reduction remains a persistent issue, and it is anticipated that after the delivery of the SHFE copper 2503 contract, social inventories will continue to decline.

》View SMM Metal Industry Chain Database