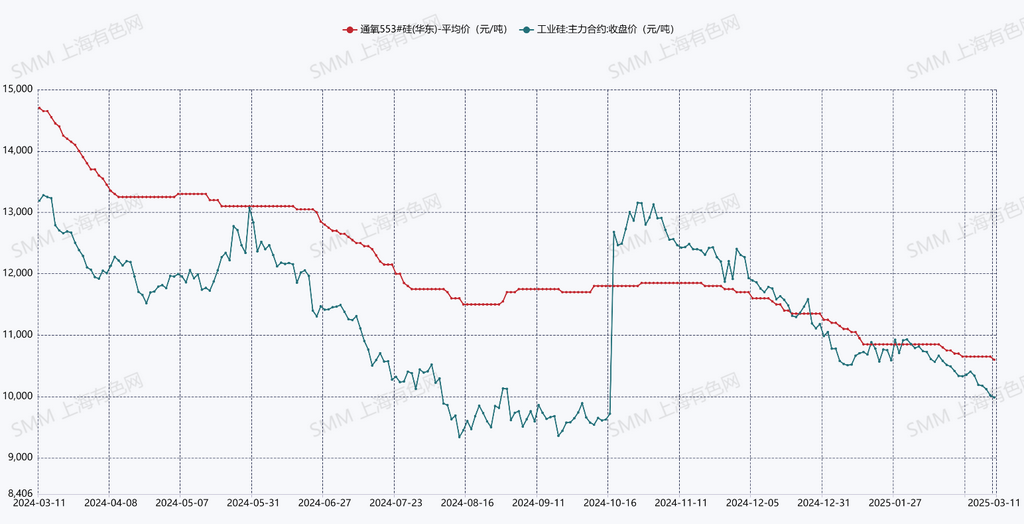

SMM March 11 News: From February to early March, spot silicon metal continued its weak trend. SMM east China above-standard #553 silicon fell by 250 yuan/mt MoM, a decrease of 2.3%. While spot prices remained weak, futures prices also dropped to new lows after implementing the new standard. On March 11, the most-traded Si2505 futures contract officially fell below 10,000 yuan/mt, closing at 9,985 yuan/mt, down 805 yuan/mt MoM, a decrease of 7.5%. The sharp decline in silicon metal futures prices, along with the influx of warehouse warrants and non-standard cargoes into the market, accelerated the drop in spot silicon metal prices, with market sentiment remaining pessimistic and difficult to reverse.

Supply: According to SMM data, silicon metal production in February 2025 was 289,500 mt, down 14,500 mt MoM, a decrease of 4.8%. Based on daily average production, February's average daily output was higher than January's. By province, silicon enterprises in Xinjiang, Inner Mongolia, and Gansu showed relatively high operating rates, with the combined supply from these three regions accounting for over 80%, while Sichuan and Yunnan accounted for less than 6%. In March, with the production release from newly resumed silicon furnaces and the expected resumption of production by some silicon enterprises, coupled with an increase in production days, silicon metal production in March is expected to increase significantly, reaching over 340,000 mt.

Demand: SMM data shows that the operating rate of the polysilicon industry fluctuated slightly from February to March. Polysilicon production in February was 90,100 mt, and March production is expected to reach 94,600 mt. By April-May, monthly polysilicon production may increase to 110,000 mt. Silicone enterprises experienced a significant decline in operating rates in February, with silicone DMC production at 199,500 mt, down 9.6% MoM. Operating rates in March are expected to remain relatively stable. The decline in production was driven by proactive maintenance of some silicone monomer capacities, reducing demand for silicon metal. For silicone, the decrease in DMC production, combined with restocking during the downstream "mini peak season," pushed silicone product prices upward, significantly improving the profitability of the silicone industry. The operating rate of the aluminum-silicon alloy industry gradually returned to normal levels from February to March.

Bullish Factors: Improved profitability of silicone enterprises

Bearish Factors: Increased supply from resumed capacities of northern silicon metal producers, new existing capacities awaiting commissioning, difficulties in inventory destocking, and weak price trends for silicon coal as a raw material

SMM Viewpoint: Based on supply-demand balance calculations, the industry experienced slight destocking in January-February. However, with the increase in operating capacity and significant production growth on the supply side in March, coupled with minimal demand growth, the balance is expected to shift back to surplus in March. Polysilicon enterprises have relatively large supporting silicon metal capacities, with large-scale silicon enterprises (annual capacity of 100,000 mt or more) accounting for a higher proportion of supply and offering greater supply stability compared to small and medium-sized enterprises. The fundamental outlook for silicon metal remains strong supply and weak demand. Even if some small and medium-sized enterprises implement production cuts, it will be difficult to change the current supply-demand situation. Spot silicon metal prices are expected to remain at low levels in the near term.

For more detailed market information and updates, or if you have other inquiries, please call 021-51666820.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)