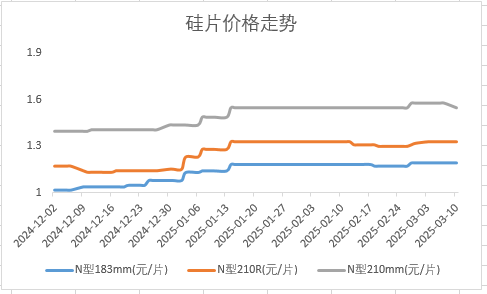

SMM March 10 News: Since February 28, there have been market rumors that top-tier silicon wafer enterprises would increase silicon wafer prices starting in March, with expectations to raise the prices of 183, 210R, and 210 to 1.2 yuan/piece, 1.35 yuan/piece, and 1.6 yuan/piece, respectively. After about a week of market feedback, how has this price hike progressed?

According to SMM, the market's acceptance of prices for different sizes varies significantly. The 210R market is currently the most active, with multiple transactions already occurring at 1.35 yuan/piece. Top-tier enterprises have largely refrained from selling below this price. The previous supply-demand mismatch for certain sizes and the continued increase in demand for 210R have become the main drivers of the price rise for 210R silicon wafers. Notably, for solar cells, 210R has also become the absolute leader in recent price increases.

Compared to the 210R size, the markets for 183 and 210 silicon wafers are relatively weaker, and the price hikes have not been successful. According to SMM, the transaction price for 183 silicon wafers remains at 1.16-1.18 yuan/piece, while the 210 size faces significant resistance. Prices at 1.6 yuan/piece have almost no market acceptance, and even transactions at 1.55 yuan/piece are challenging.

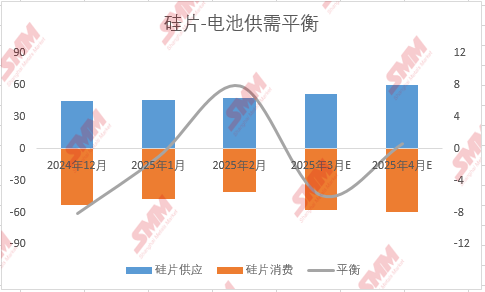

Inventory levels also reflect the differences between sizes. According to SMM, as of last week, domestic silicon wafer inventory was approximately 24 GW, with most being the 183 model. The 210 model also faces considerable pressure, though its market size was smaller compared to 183 in the earlier stages. Meanwhile, inventory for the 210R size is at an extremely low level, with some manufacturers experiencing tight delivery situations.

For the outlook, SMM believes that under the influence of the "430" and "531" rush for installations, the sentiment for price increases in the module segment continues to heat up. Top-tier module manufacturers are consistently reporting price increases, driving the entire PV market to heat up and boosting production and price increases in upstream segments such as batteries. From a supply and demand perspective, the silicon wafer market in March is expected to face a supply-demand gap of several GW, which is favorable for the silicon wafer market. From a sentiment perspective, there is potential for price increases across all sizes, driven by 210R and downstream markets, coupled with the guidance from industry associations and the reconvening of this week's meetings. In summary, for the silicon wafer market outlook, SMM maintains a bullish view on the full-size market.

》View the SMM PV Industry Chain Database

![[SMM PV News] Armenia Hits 1.1 GW Solar Capacity,](https://imgqn.smm.cn/usercenter/qQwIB20251217171741.jpg)

![Spot Market and Domestic Inventory Brief Review (February 5, 2026) [SMM Silver Market Weekly Review]](https://imgqn.smm.cn/usercenter/tSwaX20251217171735.jpg)