》View SMM Silicon Product Prices

》Subscribe to View Historical Price Trends of SMM Metal Spot Cargo

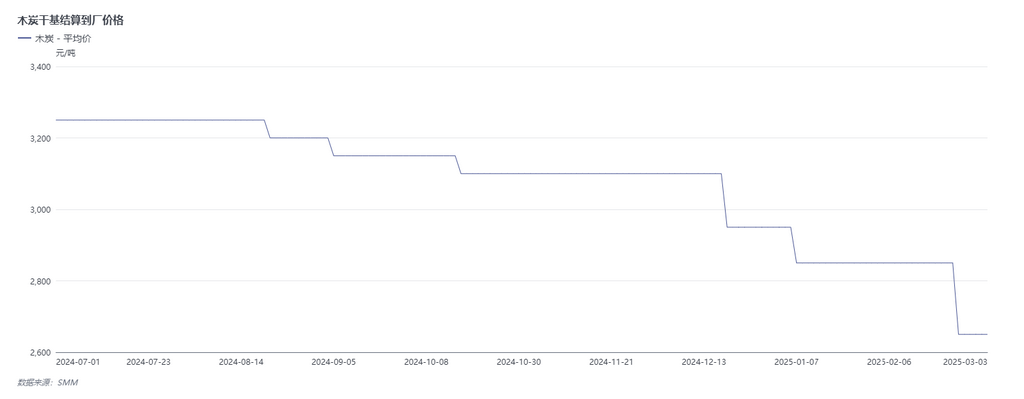

Since the beginning of 2025, prices in the raw material segment of silicon metal have mostly fluctuated downward. Even the previously resilient charcoal segment has recently entered a downward price trend, with prices starting to decline rapidly.

The recent rapid decline in charcoal prices is the result of both supply and demand factors. Supply side, due to import restrictions in Myanmar in 2024, the overall supply remained relatively tight. As a result, when prices of other silicon metal raw materials fell, charcoal prices were not significantly affected. However, Myanmar is expected to reopen its borders soon, which may lead to a significant increase in charcoal supply. Consequently, port traders have recently started offloading charcoal in bulk, causing prices to decline as traders compete to sell.

Demand side, charcoal is only used in silicon plants employing the downstream charcoal process. However, with the expansion and modernization of silicon metal production processes, the mainstream production methods now predominantly use all-coal or coal-coke processes. The charcoal process is only utilized by older production areas in south-west China and a few plants in the north. Demand for this process has never been mainstream, and with prolonged low silicon prices and the current dry season in south-west China, high electricity costs and low silicon prices have made it impossible for silicon plants in the region to operate. Only a few silicon plants remain operational, further exacerbating the already weak demand for charcoal. According to feedback from charcoal traders, charcoal orders in Q1 2025 have been muted, with only a few silicon plants in Baoshan, Yunnan maintaining stable monthly long-term contract demand. Other production areas in south China have only minimal production demand from a few small plants. Some traders, facing muted demand for charcoal orders, have largely suspended charcoal import trade and are focusing on clearing inventory.

In summary, under the current state of oversupply, charcoal prices are expected to have further room to pull back before production in south-west China recovers during the rainy season.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)