SMM News, February 20, 2025:

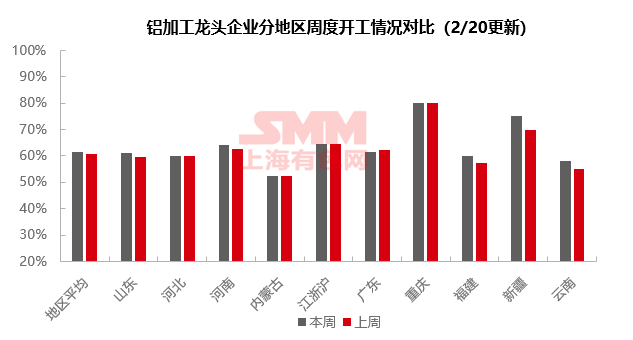

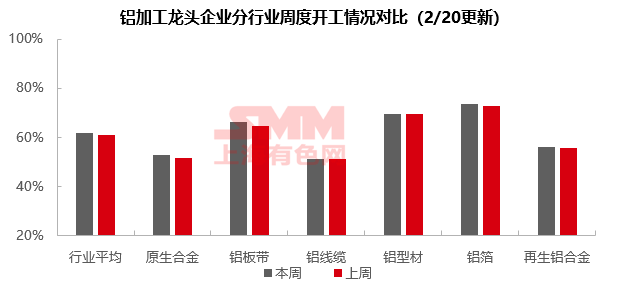

This week, the operating rate of leading downstream aluminum processing enterprises in China continued its upward trend, but the growth slowed compared to the previous two weeks, rising 0.8 percentage points WoW to 61.6%. By segment, the operating rate of primary aluminum alloy increased 1.4% WoW to 53.0%, though some enterprises experienced supply-demand mismatches, and demand recovery remains to be observed. The operating rate of aluminum plate/sheet and strip rose to 66.4%, benefiting from favorable policies and seasonal expectations, with a potential continuation of recovery. The operating rate of aluminum foil slightly increased to 73.4%, supported by peak season demand and stimulus policies, but the oversupply imbalance persists. The operating rate of secondary aluminum alloy rebounded to 56.3%, with improved raw material supply, though weak terminal orders suppressed price momentum. The operating rates of aluminum wire and cable and aluminum extrusion enterprises stabilized this week. The wire and cable sector faced pressure from insufficient new orders and seasonal construction restrictions in the short term. In the aluminum extrusion segment, strong industrial extrusion orders offset weakness in the construction sector, while PV-related orders mildly rebounded, keeping the overall operating rate stable. Overall, downstream consumption remains in a recovery phase, with short-term attention needed on the pace of peak season order fulfillment and the impact of aluminum prices on end-user purchase willingness. According to SMM forecasts, the operating rate of leading downstream aluminum processing enterprises in China is expected to increase by 1.2 percentage points next week to 62.8%.

Primary Aluminum Alloy: This week, the operating rate of leading primary aluminum alloy enterprises in China recorded 53.0%, up 1.4% WoW. Aluminum prices showed an upward trend this week, and while the overall operating rate of primary aluminum alloy enterprises maintained an upward trajectory, feedback among enterprises was mixed, with some reporting slight supply-demand mismatches. After the Lantern Festival, downstream primary aluminum alloy enterprises are gradually resuming operations, but actual demand remains somewhat insufficient, and shipments of primary aluminum alloy fell short of expectations. A small number of enterprises reported improved demand for primary aluminum alloy over the past week, driving production increases, but more enterprises indicated stable production or demand lagging behind production increases. Entering late February, the operating rate of downstream primary aluminum alloy enterprises is expected to continue its recovery trend, but under the pressure of relatively high aluminum prices, the operating rate may rise slowly next week.

Aluminum Plate/Sheet and Strip: This week, the operating rate of leading aluminum plate/sheet and strip enterprises slightly increased by 1.8 percentage points to 66.4%. After the Lantern Festival, downstream customers of some aluminum plate/sheet and strip enterprises increased their orders, driving up the operating rate. Recently, the benefits of multiple economic stimulus policies introduced by the government are gradually being transmitted to the aluminum plate/sheet and strip sector. With March, the traditional peak season, approaching, the operating rate of the aluminum plate/sheet and strip industry is expected to continue warming up on a MoM basis.

Aluminum Wire and Cable: This week, the operating rate of leading aluminum wire and cable enterprises in China remained at 51%, with a stable recovery pace. Although the industry has entered an orderly resumption phase, the operating rate showed a stable-to-weak trend due to insufficient new orders, reduced orders on hand YoY, and relaxed delivery cycles. By region, enterprises in south-west China reported good order delivery efficiency, while the northern market faced pressure on delivery efficiency due to delayed project progress caused by cold weather. Overall, the industry remains cautiously optimistic. SMM believes that in the short term, the aluminum wire and cable industry will face insufficient upward momentum in operating rates due to weak demand and seasonal construction restrictions. Attention should be focused on the progress of State Grid order releases, which are expected to boost market confidence and support the recovery of operating rates in the industry.

Aluminum Extrusion: This week, the overall operating rate of the domestic aluminum extrusion industry was 69.5%, unchanged from last week. By sub-sector, leading enterprises in the industrial extrusion segment continued to maintain high operating rates. Automotive extrusion enterprises had sufficient orders, with new capacity gradually being released. PV extrusion enterprises showed a positive outlook, with SMM surveys indicating that major enterprises saw steady order growth, driven mainly by seasonal increases in production plans. Notably, the newly introduced PV grid connection policy has yet to significantly impact the industry, and no large-scale rush for installations has been observed. In the construction extrusion segment, leading enterprises quickly resumed operations, leveraging their orders on hand, though residential-related orders were relatively weak, while commercial projects such as industrial parks gained a higher share. Overall, despite varying performances across sub-sectors, the industry’s comprehensive operating rate remained stable. SMM will continue to monitor inventory trends, changes in downstream demand, and the impact of industry and regional policies.

Aluminum Foil: This week, the operating rate of leading aluminum foil enterprises slightly increased by 0.7 percentage points to 73.4%. With the traditional consumption peak season approaching, demand for aluminum foil in sectors such as food packaging and durable consumer goods increased. Coupled with the continuous introduction of national policies supporting consumption upgrades in automotive, electronic, and home products, some aluminum foil enterprises saw moderate increases in production and sales. However, the overall market remains oversupplied, with severe cut-throat competition in the industry. Additionally, some aluminum foil enterprises have started negotiating processing fees for the new year. Under the mixed influences of these factors, the short-term operating rate of the aluminum foil industry is expected to rise slowly.

Secondary Aluminum Alloy: This week, the operating rate of leading secondary aluminum enterprises rebounded by 0.6 percentage points WoW to 56.3%. As traders resumed operations, the domestic circulation of aluminum scrap continued to increase, easing raw material procurement pressure for secondary aluminum plants, leading to a slight production increase. However, downstream demand recovery was slower than expected, with weak terminal order releases. Combined with increased operating rates and market supply, market prices lacked upward momentum. In the short term, the operating rate of the secondary aluminum industry is expected to remain largely stable, with continued attention on raw material supply and the pace of downstream demand recovery.

》Click to View the SMM Aluminum Industry Chain Database

(SMM Aluminum Team)