Weekly Review

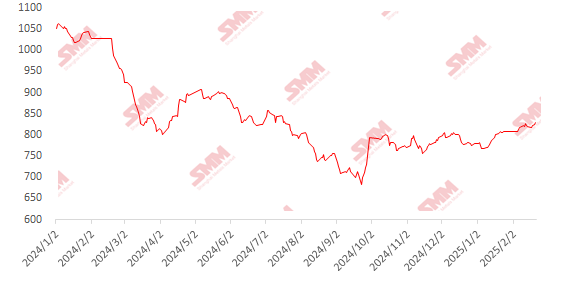

This week, imported iron ore prices showed a weak-to-strong trend. The impact of the Australian cyclone on shipments came to an end, coupled with a pullback in the US dollar index, leading to a sharp decline in the most-traded iron ore contract on Monday. However, as downstream demand picked up, steel mills saw a significant improvement in order-taking, rebar apparent demand rebounded rapidly, finished steel inventory remained relatively low YoY, and with the approach of the Two Sessions, market news increased, sentiment shifted quickly, driving iron ore prices from weak to strong. In terms of port prices, PB fines in Shandong rose by 5-10 yuan/mt WoW.

Chart: SMM 62% Imported Ore MMi Index

Data Source: SMM

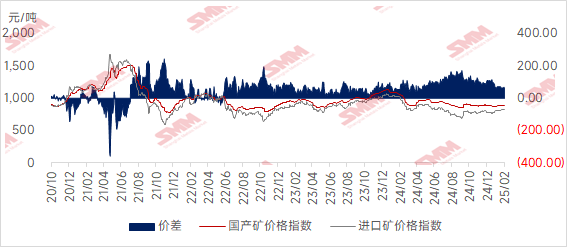

Domestic ore prices showed mixed performance this week. It is expected that domestic ore prices will still have room for slight upward movement next week. In Hebei's Tangshan, Qian'an, and Qianxi regions, prices fell by 5-10 yuan/mt, while in west Liaoning's Chaoyang, Beipiao, and Jianping regions, prices increased by 5-10 yuan/mt. Prices in east China rose by 10-15 yuan/mt.

Tangshan RegionThe market operated steadily with sluggish trading. Recently, local iron ore concentrate prices dropped back slightly, with 66-grade dry basis, tax-included delivery-to-factory prices at 960-970 yuan/mt. The overall supply from mines and beneficiation plants remained tight, with weak supply and demand in the market. Steel mills restocked at a slow pace, and with limited improvement in steel products, mills faced significant financial pressure, showing a strong desire to bargain down prices.

West Liaoning RegionIron ore concentrates showed a slight upward trend recently, with 66-grade wet basis, tax-excluded ex-factory prices at 715-720 yuan/mt. Recently, local mines and beneficiation plants halted production due to low temperatures but are gradually resuming operations. Supply from mines and beneficiation plants may ease slightly in the near term. On the demand side, steel mills maintained a strong desire to bargain down prices, with most iron ore concentrate purchases being made as needed. Steel mills continued normal production, and recent finished steel transactions improved slightly compared to earlier periods, which may drive local demand for iron ore concentrates.

East China RegionMost mining enterprises operated normally, with supply returning to pre-holiday levels and no inventory accumulation. Steel mills actively purchased, maintaining inventory levels of 4-7 days. Long-term contract purchases remained relatively stable, and some local iron ore resources flowed to the Hebei Wu'an region. Overall market transactions were moderate.

Considering both domestic and imported ore prices, imported ore prices rose significantly this week, narrowing the price spread between domestic and imported ore. It is expected that the price spread may widen next week.

Outlook for Next Week

For imported ore: With the end of the Australian cyclone and heavy rains, global iron ore shipments are expected to rebound significantly. However, due to low shipment volumes from Australia and Brazil at the end of January, port arrivals are expected to decline MoM. Currently, strong iron ore prices are squeezing steel mill profits. Coupled with lingering doubts about downstream demand growth, blast furnace resumption remains sluggish, pig iron production remains stable with a weak trend, and overall iron ore demand is stable. Port inventory may continue to decline slightly. Considering strong market expectations ahead of the Two Sessions, ore prices may continue to fluctuate upward, but with current high valuations, further upward breakthroughs will be challenging.

For domestic ore: Overall, some mines and beneficiation plants have recently resumed production, with a slight increase in iron ore concentrate output. On the steel mill side, pig iron production remains at a high level. It is expected that domestic iron ore concentrate prices will still have some room for upward movement in the short term.

Click to View the SMM Metal Industry Chain Database

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)