SMM February 6 News: On February 4, 2025, the Ministry of Commerce and the General Administration of Customs issued Announcement No. 10 of 2025, announcing the decision to impose export controls on tungsten, tellurium, bismuth, molybdenum, and indium-related items. According to the relevant provisions of the "Export Control Law of the People's Republic of China," the "Foreign Trade Law of the People's Republic of China," the "Customs Law of the People's Republic of China," and the "Regulations on the Export Control of Dual-Use Items of the People's Republic of China," and to safeguard national security and interests and fulfill international obligations such as non-proliferation, the State Council has approved the decision to impose export controls on the following items.

Among them, tellurium-related items:

(1) 6C002.a. Metallic tellurium (Customs Commodity Code: 2804500001).

(2) 6C002.b. Monocrystalline or polycrystalline products of tellurium compounds (including substrates or epitaxial wafers) of any of the following types:

1. Cadmium telluride (Customs Commodity Codes: 2842902000, 3.818 billion);

2. Cadmium zinc telluride (Customs Commodity Codes: 2842909025, 3.818 billion);

3. Cadmium mercury telluride (Customs Commodity Codes: 2852100010, 3.818 billion).

(3) 6E002 Technology and materials for producing items under 6C002 (including process specifications, process parameters, processing programs, etc.).

As a major global producer and exporter of tellurium-related items, China has long been committed to fulfilling international obligations such as non-proliferation. Based on the need to safeguard national security and interests, China has implemented export controls on specific related items in accordance with the law. The addition of these items to the control list reflects a regulatory approach that balances development and security, contributing to better safeguarding national security and interests, fulfilling international obligations such as non-proliferation, and ensuring the security and stability of global industry and supply chains. This export control on tellurium and its products aligns with international mechanisms.

Currently, China's metallic tellurium production is relatively concentrated, with Guangdong, Hunan, Jiangxi, and Henan being the main production areas. China's tellurium ingot production has shown relatively small changes in recent years; since 2020, production has gradually increased overall. In 2024, domestic tellurium ingot production also saw a slight YoY increase. At present, China ranks first globally in metallic tellurium production, accounting for the majority of the world's tellurium output.

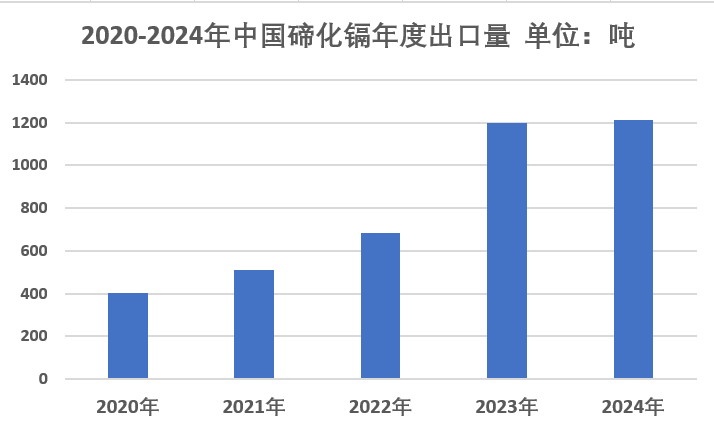

On the export side, according to customs data, taking cadmium telluride as an example, China's cadmium telluride exports were approximately 685 mt in 2022, while in 2023, exports reached about 1,200 mt, with an annual growth of over 75%. In 2024, cadmium telluride export volumes remained above 1,200 mt and showed a continued upward trend.

China's tellurium and its compounds are mainly used in solar cells, piezoelectric ceramics, semiconductors, and optoelectronic devices. The addition of tellurium and tellurium product categories to export controls marks a further upgrade in China's strategic resource management. This move helps promote industry chain upgrades, reduce the export of low-priced products, ensure domestic raw material supply, and strengthen China's leading position in the strategic resource field. Industry insiders revealed that First Solar, the world's largest thin-film battery producer, holds a significant share of the global thin-film battery market, particularly in cadmium telluride batteries. Therefore, this export control on tellurium and tellurium products could have a significant impact on the US.

Regarding the timing of this policy release, the tellurium market has just resumed from the holiday, and many tellurium industry participants are adopting a wait-and-see attitude, awaiting clearer policy interpretations and guidance. They generally hold a reserved opinion on this policy and are in the stage of digesting and adapting to it, cautiously assessing its potential long-term impacts.

![[SMM Analysis] Futures Lack Momentum to Rise Further, Pre-Holiday Demand Stalls, and Stainless Steel Social Inventory Accumulation Intensifies](https://imgqn.smm.cn/usercenter/HBsPu20251217171723.jpeg)