I. Price Analysis:

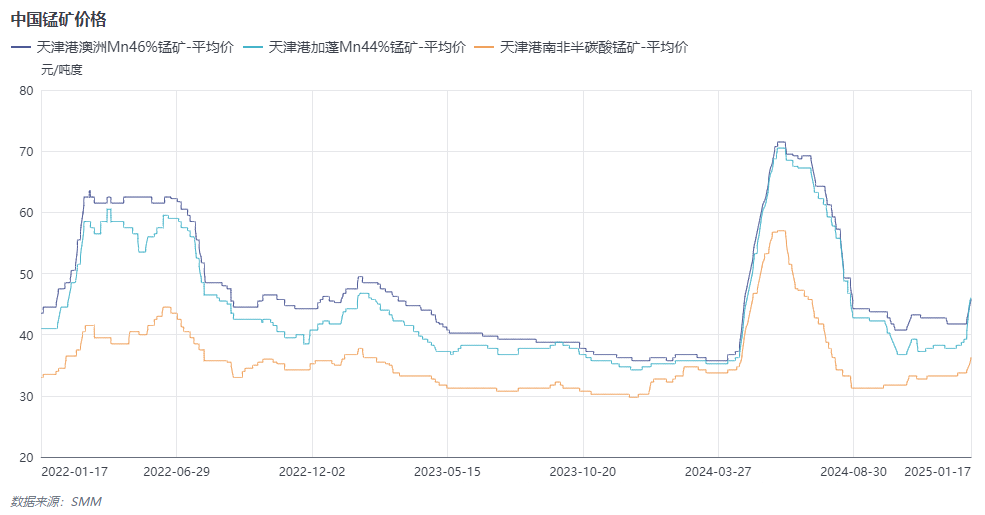

The annual average price of 46% Australian lump at Tianjin Port in 2024 was 47.66 yuan/mtu, up 16.02% YoY; the annual average price of 45.5% Gabonese lump at Tianjin Port was 45.72 yuan/mtu, up 17.77% YoY; and the annual average price of 37.5% South African semi-carbonate lump at Tianjin Port was 37.31 yuan/mtu, up 15.87% YoY.

Quarterly price review:

2024 Q1: Supply side, manganese ore port arrivals decreased MoM, but combined with previous manganese ore inventory, supply remained sufficient. Demand side, alloy plants mainly made just-in-time procurement, and port inventory destocking accelerated. Overall, despite just-in-time procurement by alloy plants, the oversupply of manganese ore pressured price increases, leading to a downward fluctuation in manganese ore prices.

2024 Q2: Influenced by news of shipment disruptions at mines, overseas miners showed strong sentiment to stand firm on quotes. Supply side, manganese ore port arrivals continued to decline, and miners were reluctant to sell, resulting in tight market availability. Demand side, alloy plants with manganese ore inventory showed strong willingness to resume production, increasing manganese alloy production and boosting manganese ore procurement enthusiasm, which significantly raised spot prices.

2024 Q3: Supply side, manganese ore port arrivals increased. Demand side, downstream alloy plants, facing severe losses, showed low acceptance of high-priced manganese ore, leading to a slight reduction in production. Specifically, alloy plants in north China maintained high operating rates and procured manganese ore at lower prices, while those in south China operated at relatively low rates with weaker procurement enthusiasm. Overall, port inventory destocking was slow, and manganese ore spot prices fluctuated downward.

2024 Q4: Supply side, manganese ore port arrivals continued to increase, and combined with previous inventory, port stocks remained high. Demand side, alloy plant production also increased, maintaining just-in-time procurement of manganese ore. However, due to sufficient supply, alloy plants mainly procured at lower prices, causing manganese ore prices to continue fluctuating downward.

II. Imports:

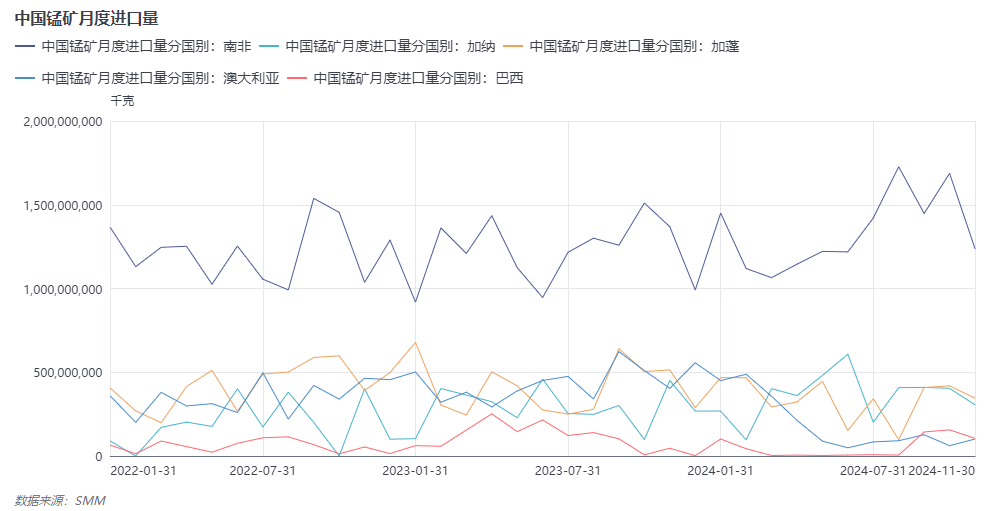

From January to November 2024, total manganese ore imports reached 26.7481 million mt, down 7.96% compared to 2023. The top five import sources were South Africa, Ghana, Gabon, Australia, and Brazil. Notably, in late March, South32 announced that shipments of Australian manganese ore scheduled for April were temporarily halted due to a tropical cyclone. On April 22, South32's Q3 report indicated that port operations were expected to resume in Q1 2025. Currently, there is no update on normal shipments from South32. If South32 resumes shipments in Q1 2025, manganese ore supply is expected to increase in 2025.

III. Demand:

Manganese oxide ore is primarily used in SiMn alloy, ferromanganese alloy, and high-purity manganese sulphate. In 2024, due to the overall rise in imported manganese oxide ore prices, especially the significant increase in high-grade manganese oxide ore prices, alloy plant profit margins were squeezed. Alloy plants actively adjusted manganese ore ratios, increasing the use of manganese-rich slag and South African semi-carbonate manganese ore. In south China, demand for domestic manganese oxide ore increased.

IV. Supply and Demand:

Due to the oversupply of manganese ore in 2023, this surplus carried over into 2024, ensuring ample market supply. Additionally, in 2024, with declining manganese alloy production and low acceptance of high-priced manganese ore, demand for imported manganese ore decreased. Overall, the manganese ore market faced an oversupply.

V. Outlook for 2025:

Demand side, SiMn production in 2024 was at a five-year low. Although SiMn currently faces overcapacity, SiMn plants aim to enhance competitiveness and reduce costs, with new commissioning plans in place. SiMn production is expected to increase slightly in 2025, driving higher manganese ore demand.

Supply side, with South32 planning to resume manganese ore shipments in Q1 2025, supply is expected to increase.

Regarding spot prices, the resumption of South32's Australian manganese ore shipments will impact the manganese ore market. Given the current oversupply situation, the market is expected to remain in a state of oversupply, with prices fluctuating at low levels.

》Subscribe to view historical price trends of SMM manganese products

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)