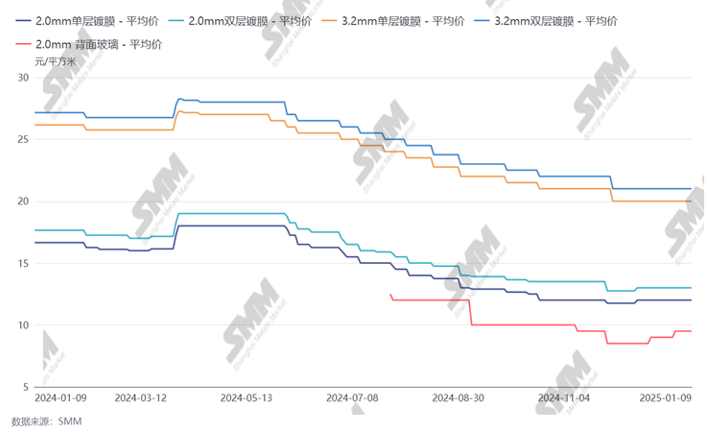

SMM January 10 News: As of January, the new glass prices are as follows: 2.0mm single-layer coating (11.5-12.5 yuan/m²); 2.0mm double-layer coating (12.5-13.5 yuan/m²); 3.2mm single-layer coating (19.5-20.5 yuan/m²); 3.2mm double-layer coating (20.5-21.5 yuan/m²); 2.0mm back glass (9.0-10.0 yuan/m²). Currently in January, the domestic glass price center remains unchanged from January, with the 2.0mm mainstream quotation center at 12 yuan/m². However, some companies have recently offered slight discounts for competitive bidding, and transaction prices have not yet been fully finalised.

Figure PV Glass Price Trends

Data Source: SMM

Specifically, as of now in January, glass companies' quotations have remained consistent with December's prices, with the 2.0mm mainstream quotation center at 12 yuan/m². However, some glass companies, due to limited destocking effects, have started offering slight discounts. Component companies have not yet begun signing procurement contracts and are prioritising shipments, with prices expected to be finalised before the Chinese New Year. This month, back glass prices have already been adjusted, with the 2.0mm back glass price increasing from 9 yuan/m² in December to 10 yuan/m², and some companies have already finalised this price.

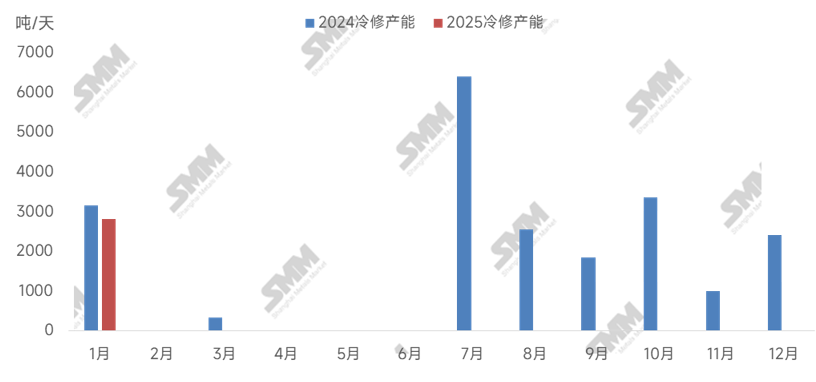

On the supply side, domestic cold repairs of kilns increased significantly in January. As of now, domestic kilns with a total capacity of 2,800 mt/day have undergone cold repairs, and an additional 1,650 mt/day of kilns have been shut down for maintenance, reducing the total operating kiln capacity by 4,450 mt/day. According to SMM, approximately 2,200 mt/day of kilns are still planned for cold repairs later in January, though the specific timeline is yet to be determined. Glass supply in January has weakened more than expected, and the supply surplus situation has slightly improved.

Figure PV Glass Kiln Cold Repair Statistics

Data Source: SMM

In summary, regarding the price forecast for the remainder of January, SMM believes prices are expected to remain stable. Although the number of cold repairs for glass kilns has increased, domestic component production schedules continue to decline significantly. Overall, the domestic supply and demand in January still reflect a supply surplus, with inventory expected to accumulate. However, glass companies' resistance to prolonged losses and their strong sentiment to stand firm on quotes suggest that prices are likely to remain stable.

![[SMM PV News] Armenia Hits 1.1 GW Solar Capacity,](https://imgqn.smm.cn/usercenter/qQwIB20251217171741.jpg)

![Spot Market and Domestic Inventory Brief Review (February 5, 2026) [SMM Silver Market Weekly Review]](https://imgqn.smm.cn/usercenter/tSwaX20251217171735.jpg)