SMM, January 7:

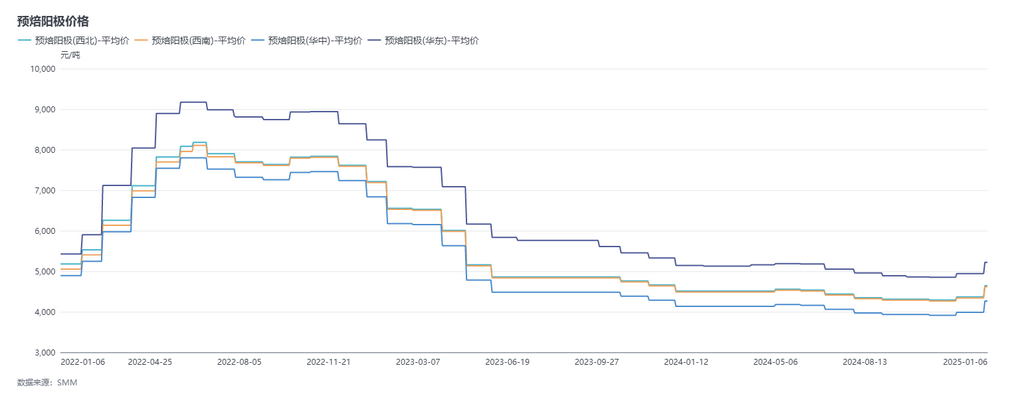

During the December cycle (December 6 to January 6), SMM prebaked anode prices continued their upward trend. The January 2025 procurement benchmark price of a certain aluminum smelter in Shandong was 4,025 yuan/mt, up 7.42% MoM. According to SMM, January prebaked anode export order prices followed the rise in domestic raw material prices, with adjustments around $30-40/mt. As of now, SMM's prebaked anode prices in east China closed at 4,025-6,418 yuan/mt.

Raw material side: During this cycle, petroleum coke prices showed slight divergence. Low-sulphur petroleum coke prices maintained a broad upward trend, while medium- and high-sulphur petroleum coke prices declined in the second half of December due to high prices reducing downstream buying sentiment. The rise in the low-sulphur petroleum coke market was mainly influenced by low refinery inventory levels in north-east China. Additionally, downstream anode material enterprises continued their procurement demand, leading to multiple price increases for low-sulphur petroleum coke. According to SMM statistics, as of now, the average price of low-sulphur petroleum coke in north-east China was approximately 3,323 yuan/mt, up 18.47% from the previous cycle. The rise in low-sulphur petroleum coke prices boosted overall market sentiment for petroleum coke. Coupled with some downstream enterprises beginning stockpiling, this further pushed petroleum coke prices upward. By December 18, the average price of petroleum coke at local refineries reached a monthly high of 1,995 yuan/mt. However, as prices reached high levels and downstream enterprises completed concentrated stockpiling, petroleum coke prices at local refineries began to weaken. Overall, petroleum coke prices experienced a process of jumping initially and then pulling back. According to SMM survey data, as of January 6, the average price of petroleum coke at local refineries fell back to 1,859 yuan/mt, slightly down by 0.06% from December 6.

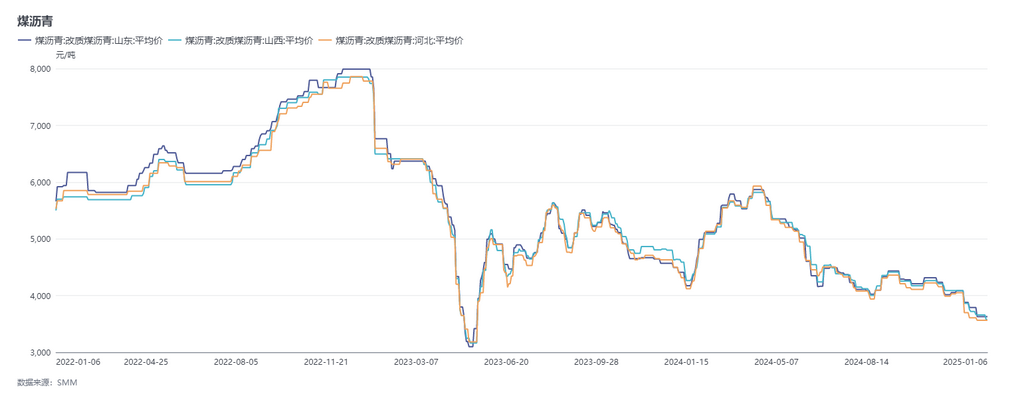

For coal tar pitch, prices continued to decline during the cycle. According to SMM data, as of January 6, the average price of coal tar pitch was 3,590 yuan/mt, down 11.90% from December 6. Overall, the cost side of prebaked anodes remained relatively firm.

Supply side: In December 2024, the operating conditions of domestic prebaked anode enterprises slightly declined. In some areas of Henan, Hebei, and Shandong, production was slightly reduced due to emergency controls for heavy pollution weather, with calcination and baking processes of most enterprises affected to varying degrees. Additionally, some enterprises resumed operations after maintenance. SMM estimated that the industry's operating rate in December was 77.44%, down 0.13 percentage points MoM. Overall, although the supply of prebaked anodes slightly decreased, the overall supply remained relatively sufficient.

Demand side: By the end of December, SMM statistics showed that the existing capacity of domestic aluminum enterprises was approximately 45.71 million mt, with operating capacity around 43.53 million mt. The industry's operating rate increased by 2.49 percentage points YoY to 95.38%. Currently, the operating capacity of domestic aluminum smelters shows both increases and decreases. The increase mainly came from the ramp-up of a new project at an aluminum smelter in Xinjiang, while the decrease was primarily due to production cuts at multiple aluminum smelters in Sichuan caused by losses and at some smelters in Guangxi due to technological transformation. Additionally, a capacity replacement project at an aluminum smelter in Inner Mongolia is proceeding as planned and is expected to be completed within the year, while a replacement project in Ningxia has already been completed. Entering January 2025, domestic aluminum operating capacity remained stable. The negative impact of earlier production cuts on production became evident. SMM learned that no additional enterprises currently plan to cut production. By the end of December, the annualized operating capacity of domestic aluminum remained stable at 43.53 million mt/year. The prebaked anode industry showed strong domestic demand performance.

Brief comment: During the cycle, a certain aluminum enterprise in Shandong announced its January 2025 prebaked anode tender benchmark price, up 278 yuan/mt MoM. Meanwhile, a major domestic prebaked anode sales company also announced its January prebaked anode sales price, up 241 yuan/mt MoM. During the cycle, petroleum coke prices fluctuated slightly, while coal tar pitch prices continued to weaken. The cost side of prebaked anodes remained supported. According to SMM calculations, as of January 6, the cost of prebaked anodes in China was approximately 4,265 yuan/mt. Due to the rise in January prebaked anode prices, the average immediate profitability of enterprises improved significantly. As the Chinese New Year holiday approaches, SMM learned that some enterprises still have minor stockpiling plans. Therefore, petroleum coke prices are expected to remain stable with slight fluctuations before the holiday. With no significant cost-side support for increases, prebaked anode prices are expected to remain stable or weaken slightly in the next cycle. Future attention should focus on the operating conditions of prebaked anodes and downstream aluminum enterprises.