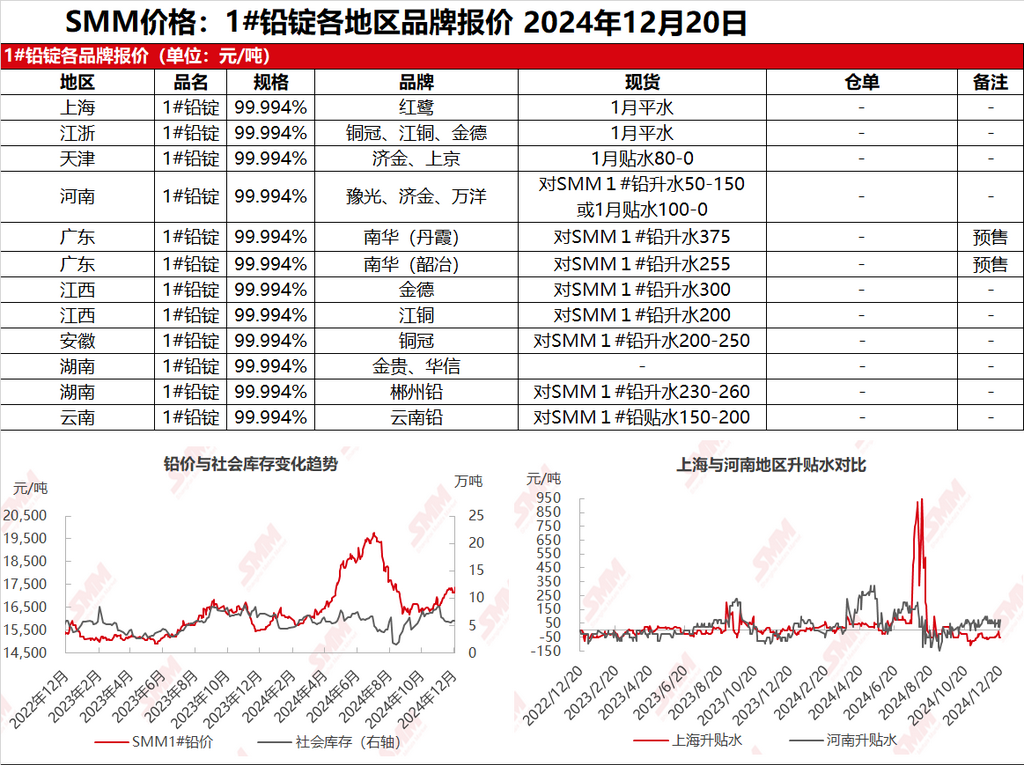

SMM, December 20: In the Shanghai market, Honglu lead was quoted at 17,290-17,315 yuan/mt, on par with the SHFE lead 2501 contract; in Jiangsu and Zhejiang regions, Tongguan, JCC, and Jinde lead were quoted at 17,290-17,315 yuan/mt, also on par with the SHFE lead 2501 contract. SHFE lead fluctuated downward, and due to production cuts on the supply side, spot market circulation was limited. Suppliers stood firm on quotes, and spot discounts (against the SHFE lead 2501 contract) gradually narrowed, with some even quoting premiums. Secondary lead was ex-factory at parity with the SMM 1# lead average price, while downstream enterprises made purchases on dips as needed, with some rigid demand shifting to secondary lead. High-priced trading volumes in the primary lead market shrank.

Other markets: Today, the SMM 1# lead price dropped by 50 yuan/mt compared to the previous trading day. In Henan, smelters maintained premiums of 50-100 yuan/mt against the SMM 1# lead price, while some suppliers, with declining inventories, stood firm on quotes with premiums of 150 yuan/mt and were reluctant to sell. In Hunan, spot lead supply remained tight, as production cuts and suspensions of crude lead due to environmental protection measures had not yet ended. Some manufacturers suspended offers after depleting their inventories. Spot primary lead was quoted with premiums of 230-260 yuan/mt, with limited rigid demand transactions downstream. Refined lead supply was locally tight, and overall market trading was subdued.