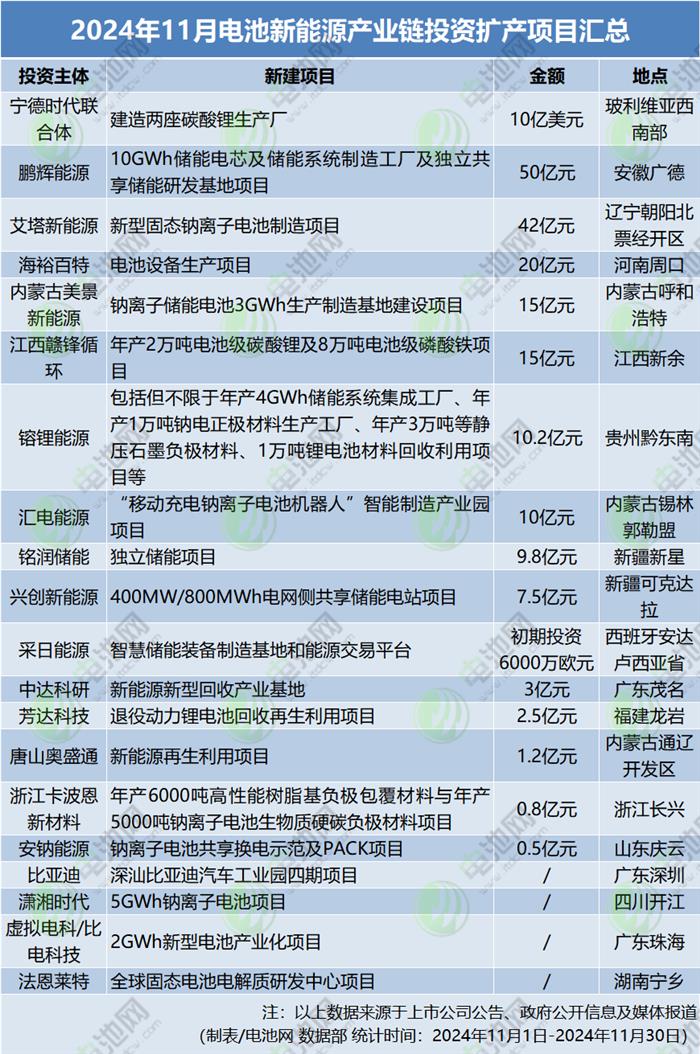

According to incomplete statistics from Battery Network, in November, China's battery new energy industry chain enterprises invested in 20 new capacity expansion projects, with 16 of them disclosing investment amounts, totaling 26.449 billion yuan. Compared to October's 14 projects with an investment of 16.058 billion yuan, November's capacity expansion slightly accelerated.

In November this year, China's annual NEV production and sales exceeded the 10-million-unit milestone, reaching 11.345 million and 11.262 million units from January to November, up 34.6% and 35.6% YoY, respectively. With the NEV market continuing its positive momentum in December, annual production and sales in 2024 are expected to surpass 12 million units.

According to data from the China Automotive Power Battery Industry Innovation Alliance, from January to November, China's cumulative production of power and other batteries reached 965.3 GWh, up 37.7% YoY. By the end of 2024, the cumulative production of power and other batteries in China is expected to exceed 1 TWh.

The battery new energy industry continues to develop positively, but the deep adjustments caused by temporary capacity surplus are not yet over. Reviewing the total investment in new projects since H2, the figures were 80.907 billion yuan in July, 24.476 billion yuan in August, 43.341 billion yuan in September, and 16.058 billion yuan in October. Enterprises are less motivated to expand capacity, and new projects are being implemented cautiously, akin to tapping the brakes while driving.

Based on incomplete statistics from Battery Network, in November, China's battery new energy industry chain enterprises invested in 20 new capacity expansion projects, with 16 of them disclosing investment amounts, totaling 26.449 billion yuan. Compared to October's 14 projects with an investment of 16.058 billion yuan, November's capacity expansion also slightly accelerated.

Analyzing the content of the new capacity expansion projects, in November, China's battery new energy industry chain investments remained cautious. However, unlike previous months, top-tier enterprises made significant moves, with lithium resource projects becoming active again, competition for mines reemerging, and the price war gradually shifting to a value war, while battery technology continued to innovate.

Top-Tier Enterprises Lead With Large-Scale Capacity Expansion

The battery new energy industry chain has never stopped expanding capacity, but the leading players have changed. In November, major projects were dominated by top-tier enterprises. On November 28, it was reported that CATL's consortium (CBC) signed the "Uyuni Salt Lake Lithium Carbonate Production Service Contract" with Bolivia's YLB on November 26. The contract, valued at $1 billion, involves the construction of two lithium carbonate production plants in southwestern Bolivia by CATL's consortium.

The $1 billion contract, equivalent to 7.24 billion yuan, represents a significant investment in lithium resource projects. From the perspective of the broader project environment, Zhang Jiangfeng, Vice President of the Lithium Industry Branch of the China Nonferrous Metals Industry Association, stated at the ABEC 2024 | 11th China (Guangzhou) Battery New Energy Industry International Summit Forum that some mines in Australia have adjusted their production plans for next year. Most have adopted production cuts, with only a few continuing to expand. "If lithium carbonate prices fall below 80,000 yuan/mt, many enterprises may reconsider whether to operate their mines," he further noted.

CITIC Securities analyzed that the concentrated production cuts in Australian lithium mines indicate that current lithium prices have already impacted enterprises' cash costs, and further production cuts cannot be ruled out.

Against this backdrop, CATL's bold capacity expansion may reflect the confidence of top-tier enterprises. According to data from the China Automotive Power Battery Industry Innovation Alliance, from January to November, CATL led domestic power battery installations with 211.72 GWh, capturing a market share of 45.02%. SNE data also showed that from January to October, CATL maintained its global and overseas leadership in power battery installations, with market shares of 36.8% and 26.4%, respectively.

CATL's Q3 financial report also revealed that the company achieved operating revenue of 92.278 billion yuan in Q3, down over 12% YoY, while net profit reached 13.136 billion yuan, up 25.97% YoY. Calculations show that the company earned over 140 million yuan per day in Q3.

Not only CATL but also BYD has demonstrated strong confidence. On November 19, BYD signed an agreement with the Shenzhen-Shanwei Special Cooperation Zone to construct the fourth phase of the BYD Auto Industrial Park in Shenzhen-Shanwei. Public information indicates that the fourth phase of the project focuses on expanding the production scale of key components such as battery cells to support the launch of more high-performance car models. Although the investment amount for the fourth phase has not been disclosed, considering the 36.5 billion yuan invested in the first three phases, the fourth phase is also expected to involve a significant amount. Official information further reveals that with the completion and operation of the third and fourth phases, the annual output value of the entire park is expected to exceed 200 billion yuan.

Meanwhile, Great Power Energy announced another new project in November after unveiling several capacity expansion projects. The company plans to invest 5 billion yuan in Guangde, Anhui, to build a 10 GWh energy storage battery cell and ESS manufacturing plant, along with an independent shared energy storage R&D base. Within just four months, Great Power Energy has announced three capacity expansion plans, with a total investment of 8.3 billion yuan.

From the above capacity expansion projects, it is evident that large-scale capacity expansion projects in the battery new energy industry are increasingly concentrated among top-tier enterprises. In the long term, top-tier enterprises with capacity assurance are expected to achieve more solid development after undergoing cyclical adjustments.

Sodium Batteries Scale Up, New Battery Technologies Advance Simultaneously

From the battery new energy industry chain's capacity expansion projects in November, sodium battery industry projects have been frequently implemented. Among the 20 new projects included in the statistics, 7 explicitly involved the sodium battery industry.

The successive implementation of sodium battery projects highlights the industrial leap driven by technological advancements.

According to the "Top 10 Cities for Sodium-Ion Battery Industry in China (2025)" report jointly released by EVTank, the Yiwei Economic Research Institute, and the China Battery Industry Research Institute, China's actual shipments of sodium-ion batteries are expected to exceed 2 GWh in 2024, significantly higher than 0.7 GWh in 2023. Additionally, the energy density of sodium-ion batteries disclosed by industry enterprises has reached up to 230 Wh/kg, with some enterprises already selling them at a price of 0.45 yuan/Wh. Against this backdrop, local governments are prioritizing sodium-ion battery industries as a key next-generation battery system, conducting planning studies, and attracting investments.

It can be said that after facing market challenges caused by lithium carbonate price fluctuations, sodium batteries have found their niche and entered a new growth cycle.

On November 17, CATL's Chief Scientist Wu Kai revealed that the second-generation sodium-ion battery has been developed and is expected to be launched in 2025. Previously, CATL introduced the "Xiaoyao" hybrid battery with 4C ultra-fast charging capability, utilizing the "lithium-sodium hybrid" AB battery technology. This technology not only excels in fast charging performance but also achieves new heights in battery stability and low-temperature performance.

In addition to the rapid scaling of sodium-ion battery projects, solid-state battery projects are also being implemented. On November 11, Aita New Energy signed an agreement for a new-type solid-state sodium-ion battery manufacturing project in Chaoyang, Liaoning, with a total planned investment of 4.2 billion yuan. Once completed, the project will primarily produce 12 GWh of battery cells and 12 GWh of integrated PACK intelligent manufacturing products annually.

While projects are being implemented, advancements in new battery technologies are also progressing simultaneously. On November 11, Faradion and Hunan Ningxiang High-Tech Zone officially signed an agreement for a global solid-state battery electrolyte R&D center project, jointly promoting the commercial development and market application of solid-state battery technology. On November 10, Huafa Group signed a project agreement with WELION New Energy, under which WELION New Energy and Guangdong WELION will engage in solid-state battery production and manufacturing in Zhuhai, with plans to establish a subsidiary in Zhuhai or Hengqin to create a solid-state battery R&D center and overseas business headquarters.

Conclusion:

From the recent months' capacity expansion projects in the battery new energy sector, the era of massive capacity expansion is over. As expansion thresholds rise, industry concentration is also increasing.

Enterprises now have clearer industrialisation plans, and the evolution of the battery new energy sector is shifting from external growth to internal development. Players in the sector are no longer fixated on rapidly expanding capacity but are instead focusing more on technological innovation.

Recently, a letter from CATL to its supplier partners stated that CATL is willing to provide financial support and promote battery innovation through open cooperation and communication with suppliers. This move instantly demonstrated the determination and sincerity of top-tier enterprises to drive technological innovation. Under their leadership, a new wave of development in the battery new energy industry driven by technological competition may soon begin.