Platinum Group Metals: The Lifeblood of Automobiles

Platinum Group Metals (PGMs) fall under the category of rare metals, distinguished by their wear resistance and high-temperature resilience. Their primary application lies in the realm of automotive exhaust catalysts. As environmental regulations have progressively tightened over recent years, the "China VI vehicle emission standards" have imposed stricter demands on vehicular exhaust emissions in comparison to their "China V vehicle emission standards" counterparts. Under these 'China VI' regulations, the quantity of PGMs incorporated in each vehicle approximates to around 4-8g. As catalysts, the importance of PGMs in the automotive industry is set to escalate in prominence.

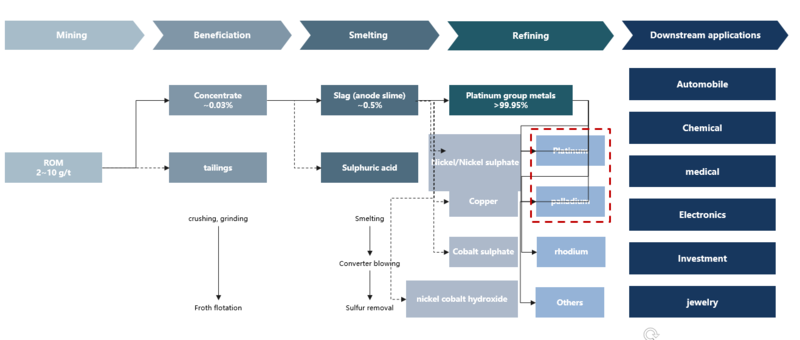

(Figure 1: Diagram of the Platinum and Palladium Industry Value Chain)

Demand:

SMM's estimates forecast a total global Platinum requirement of 7,770 koz in 2023, indicating a shortfall of 304 koz. Simultaneously, the global Palladium demand for the same year is projected to reach 10,342 koz, signifying a deficit of 14 koz.

The automotive sector emerges as the paramount consumer within the demand landscape. Specifically, the automotive industry's demand for Platinum is estimated at 2,975 koz, which constitutes 38.3% of the total. In contrast, for Palladium, the corresponding demand within the auto sector is projected at 8,446 koz, amounting to a staggering 81.7% of the overall demand.

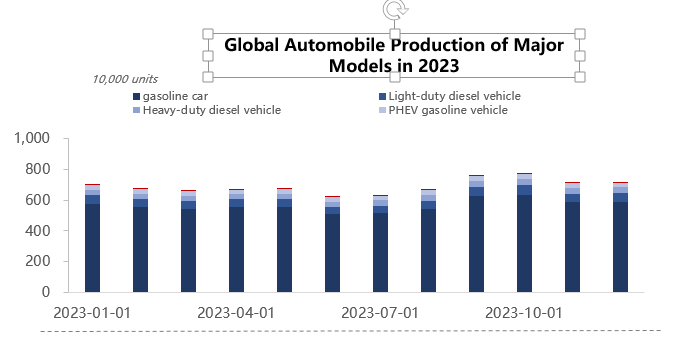

The residual demand is distributed across varied industries, encompassing jewelry, chemical manufacturing, and petroleum refining. The tangible consumption within the automotive industry, a key determinant of downstream demand for Platinum and Palladium, is influenced by the global macroeconomic climate. The industry is anticipated to navigate potential production slowdown risks in the year's first half, with a prospective recovery envisaged for the latter half.

(Figure 2: Predicted Production of Key Automobile Models Globally in 2023)

Supply:

SMM's assessments project the global platinum supply for 2023 at 7,466 koz, with the primary mining output accounting for 5,849 koz. Remarkably, the production from the top four industry giants totals 5,440 koz, capturing a hefty 93.0% of the overall supply.

In parallel, the global Palladium supply for the same year is expected to hit 10,328 koz, with the primary mining contribution being 7,119 koz. In this context, the production from the leading four companies stands at 6,272 koz, comprising a notable 88.1% of the aggregate supply.

In a significant development in February 2023, Eskom, the national electricity corporation of South Africa — the world's most prolific platinum producer — announced its inability to fulfill the power demands of the mining sector. This power deficit is projected to intensify throughout 2023 and 2024. Consequently, SMM anticipates this development to adversely affect the output stability of South African platinum group metals, thereby potentially exacerbating the predicted demand-supply gap for these precious metals.

Price:

from the price functioning range to the global macroeconomic climate for platinum and palladium, coupled with the fundamental market supply-demand interplay, SMM projects that in 2023, platinum prices will fluctuate approximately at 245 yuan/g, while palladium is expected to swing around 450 yuan/g. On balance, platinum is likely to outperform palladium in the market.

The SMM Global Platinum and Palladium Procurement Monthly Report crafts a comprehensive supply and demand forecast model, adeptly integrating a myriad of global macroeconomic influencers such as Federal Reserve interest rates, U.S. CPI, U.S. unemployment rates, the freshest production data from principal worldwide manufacturers, and shifts in global demand. This diligent predictive analysis of platinum and palladium prices endeavors to expertly decipher the current multifarious facts and figures, offering a deep-dive into prevailing and future price trajectories for platinum and palladium metals.

This report stands as an invaluable suggestion tool for enterprises across the platinum and palladium industry value chain, enabling them to promptly institute forward-looking strategic initiatives. For detailed insights, please reach out to our Non-ferrous Consulting Project Manager, Zhang Yuting (18701906042). Subscriptions to the SMM Global Platinum and Palladium Procurement Strategy Monthly Report are warmly welcomed. A glimpse of the SMM consulting report content is as follows:

![This Week, Platinum and Palladium Experienced Significant Pullbacks, End-Use Demand Recovered, and Spot Market Trading Was Normal [SMM Platinum and Palladium Weekly Review]](https://imgqn.smm.cn/usercenter/obeMy20251217171735.jpg)

![Silver Prices Continue to Pull Back, Suppliers Remain Reluctant to Sell, Spot Market Premiums Hard to Decline [SMM Daily Review]](https://imgqn.smm.cn/usercenter/LVqfJ20251217171736.jpg)