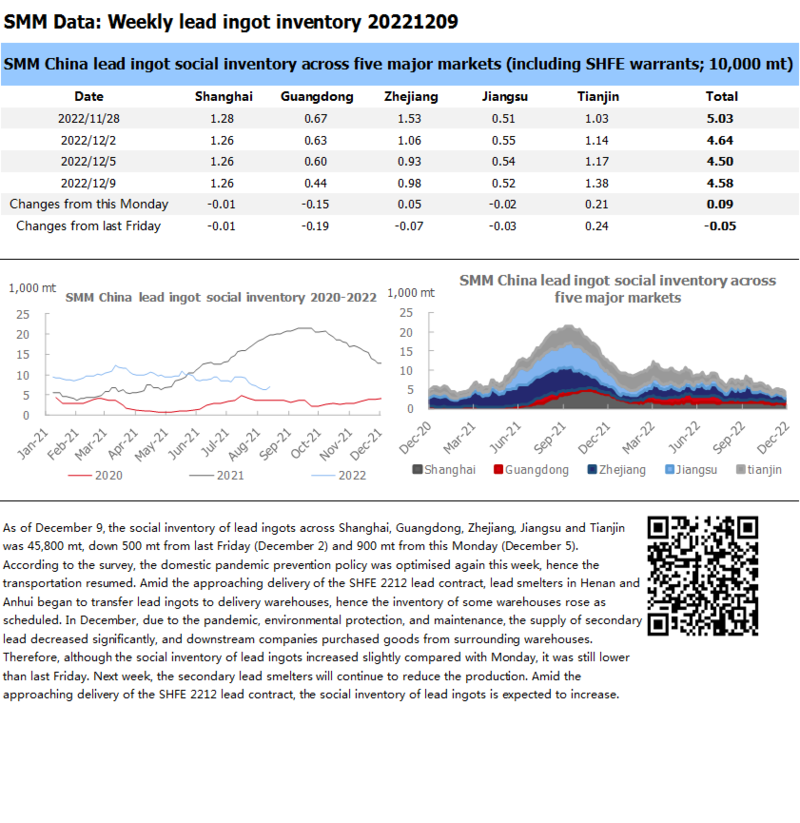

SHANGHAI, Dec 9 (SMM) - As of December 9, the social inventory of lead ingots across Shanghai, Guangdong, Zhejiang, Jiangsu and Tianjin was 45,800 mt, down 500 mt from last Friday (December 2) and 900 mt from this Monday (December 5).

According to the survey, the domestic pandemic prevention policy was optimised again this week, hence the transportation resumed. Amid the approaching delivery of the SHFE 2212 lead contract, lead smelters in Henan and Anhui began to transfer lead ingots to delivery warehouses, hence the inventory of some warehouses rose as scheduled. In December, due to the pandemic, environmental protection, and maintenance, the supply of secondary lead decreased significantly, and downstream companies purchased goods from surrounding warehouses. Therefore, although the social inventory of lead ingots increased slightly compared with Monday, it was still lower than last Friday. Next week, the secondary lead smelters will continue to reduce the production. Amid the approaching delivery of the SHFE 2212 lead contract, the social inventory of lead ingots is expected to increase.