SHANGHAI, Sep 28 (SMM) - According to SMM research, silicon wafer and polysilicon companies have begun to negotiate the prices of polysilicon in October under long-term orders starting from September 25 as the month is drawing to an end. With the finalisation of the prices with some first-tier companies, the buyers and sellers have gradually reached a consensus on polysilicon prices. So what is the progress of the order signing? How will the market perform in the future?

On September 21, in order to make it easier for customers to trade and understand the market, SMM adjusted the expected price of "SMM dense polysilicon" to 306-312 yuan/kg based on market research. On September 27, a front-line enterprise in Xinjiang set the October contract price of dense polysilicon at 307 yuan/kg. Later, SMM learned from several major factories in Sichuan and Xinjiang that they have basically set the contract price at 307-309 yuan/kg considering that the downstream is highly resistant to price hike due to cost constraints.

In addition, it is reported by a number of first-tier silicon wafer companies that due to the increase in the demand for downstream solar cells and the increase in its own operating rates, the acceptable polysilicon prices for the monthly long-term orders are generally below 310 yuan/kg. The market opinions toward polysilicon prices tend to be consistent. At the same time, SMM learned that the current transaction price of traders and some retail orders is stable at around 310 yuan/kg, and very few orders with urgent needs are traded at 314 yuan/kg.

Regarding the follow-up market trend, SMM believes that with the gradual commissioning and ramp-up of new capacity, the domestic supply of polysilicon will continue to grow, capping the prices.

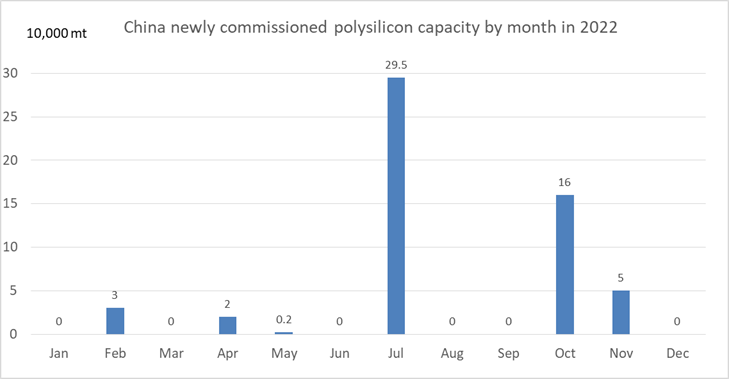

It can be seen from the above figure that the commissioning of new polysilicon capacity was relatively limited in the first half of the year, which to a certain extent led to the continuous tight supply of polysilicon, which in turn led to a continuous increase in prices. In the second half of the year, many projects were put into production in July. Considering the ramp-up period of new capacity and the impact of unexpected events from July to August, the supply of polysilicon will increase significantly in September and October.

Entering the fourth quarter, with the subsequent commissioning of new capacity and the continued ramp-up of capacity, the growth rate of polysilicon supply is expected to increase further. Domestic polysilicon supply is expected to achieve a supply-demand balance by the end of this year or even a small supply surplus, with limited upside room for polysilicon prices in the long run.

For 2023 and 2024, according to SMM research, the domestic polysilicon capacity will reach about 2.2 million mt and 3 million mt respectively, far exceeding the global demand concerning new installed PV capacity of 300GW and 340GW respectively. At that time, the market price may enter a relatively long-term downward channel.