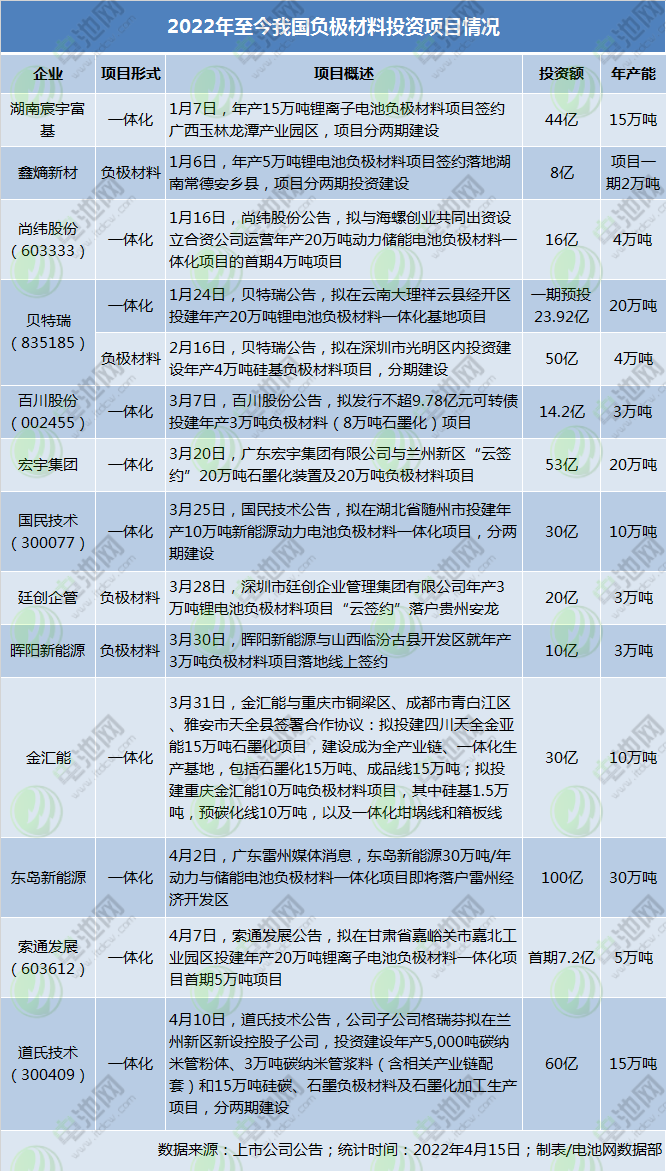

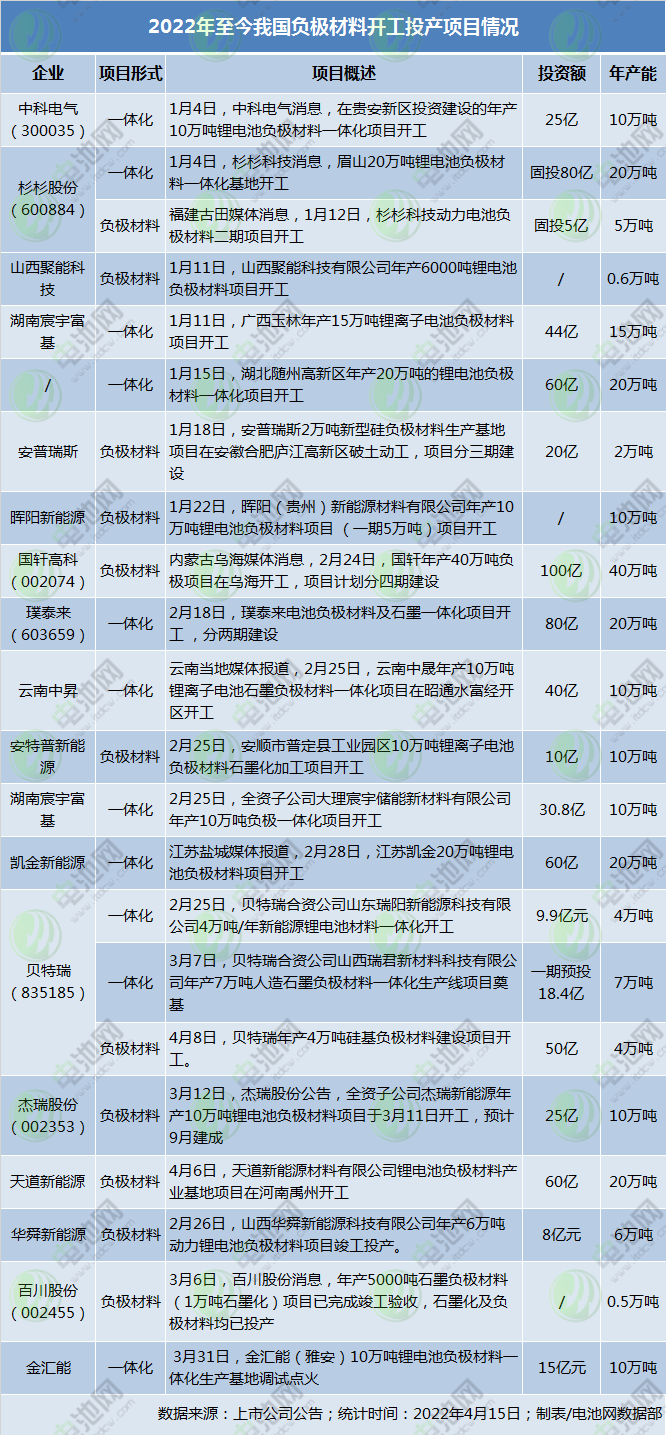

Benefiting from the high demand of new energy vehicles and energy storage market, the production capacity of upstream lithium materials continues to fall to the ground. After the crazy increase of production capacity of lithium iron phosphate and lithium hexafluorophosphate in 2021, the field of anode materials is particularly active in 2022. According to incomplete statistics of Battery Network, since the beginning of this year, 15 investment projects in the field of negative materials have been announced, with an investment amount of 46.632 billion yuan and an annual production capacity of 1.44 million tons; at the same time, 22 projects have been started and 19 have announced the amount of investment, totaling 74.11 billion yuan, with an annual production capacity of 2.541 million tons.

The intensification of competition and integrated layout has become the consensus of the industry.

According to the "White Paper on the Development of China's anode material Industry (2022)" jointly released by EVTank, Ivy Economic Research Institute and China Battery Industry Research Institute, shipments of anode materials in China reached 779000 tons in 2021, an increase of 86.4 percent over the same period last year. In 2021, global shipments of anode materials reached 905000 tons, an increase of 68.2% over the same period last year. At the same time, the global share of shipments of negative materials by Chinese enterprises has further increased, from 77.7% in 2020 to 86.1% in 2021.

In its white paper, EVTank predicts that China's total shipments of anode materials will reach 2.705 million tons and 7.054 million tons respectively by 2025 and 2030, accounting for more than 90 percent of global shipments.

Although the global market share of Chinese anode material enterprises is increasing, according to industry insiders, anode materials belong to high energy consumption industries, considering that part of the production capacity can not be fully put into production because of energy consumption targets, and graphitization is the key link that restricts the release of negative material production capacity. Therefore, the whole negative material industry is basically in a state of balance between supply and demand in the future.

The Battery Network has noted that since 2022, the existing enterprises of negative materials have been expanding production and increasing numbers, and cross-border entry of listed companies has occurred continuously:

Beitre, the leader of the negative electrode, has successively announced two major investment projects, totaling more than 7.392 billion yuan, of which the project with an annual output of 40, 000 tons of silicon-based anode materials was announced on February 16 and started on April 8. On the day of commissioning and ignition of the integrated production base of 100000 tons of lithium battery negative materials in Ya'an, Jinhui signed cooperation agreements with Tongliang District of Chongqing, Qingbaijiang District of Chengdu and Tianquan County of Ya'an City. It is proposed to build the Sichuan Tianquan Jinyaneng 150000 ton graphitization project and the Chongqing Jinhuineng 100000 ton anode material project. Dongdao New Energy invested 10 billion yuan in Leizhou Economic Development District, Zhanjiang, Guangdong Province, to build the integration of 300000 tons / year power and energy storage battery anode materials. Suotong, a manufacturer of aluminum pre-baked anode products, has been included in the development. it is planned to build the first phase of the 50, 000-ton project with an annual output of 200000 tons of lithium-ion battery anode materials in Gansu Construction enterprise Hongyu Group also announced that it would cut into new energy, investing 5.3 billion yuan to build a 200000-ton graphitization plant and 200000-ton anode material project in Lanzhou.... It can be predicted that after the production expansion of a large number of existing enterprises and the layout of new entrants, the competition pattern of negative materials will be more fierce.

It is worth noting that graphitization capacity difficulties are becoming the shackles of capacity expansion of negative materials.

At present, the energy policy is tightening, and graphitization is affected by the release of high energy consumption capacity. According to a research report by Huaan Securities, the graphitization capacity in 2021 is about 880000 tons, and the annual graphitization capacity is only about 180000 tons more than in 2020. Graphitization supply is tight and the price rises, from 1.3-15000 yuan / ton in 2020 to 25000 yuan / ton at the end of 2021, and the terminal negative price also rises from 42000 yuan / ton at the beginning of 2021 to 50, 000 yuan / ton in December.

Under the pressure of high downstream demand and rising prices of raw materials and graphitization, negative material enterprises speed up the creation of integration projects and accelerate the graphitization self-supply ratio, which has become the consensus of the industry. Battery network carding found that so far this year, negative materials landed, started and put into production of 37 projects, 22 are integrated projects.

Even so, the Bank of China Securities Research report also predicts that the graphitization shortage will continue in the first half of 2022, and the capacity shortage will be alleviated to a certain extent after the release of self-owned capacity of some leading enterprises in the second half of the year, and a tight balance will be maintained throughout the year.

Acceleration of industrialization of silicon-based anode materials under demand

It is worth noting that in the current pursuit of high charge capacity of new energy vehicles, the technological exploration of negative material enterprises has not stopped. in addition to the integrated production capacity, the market prospect of silicon-based anode materials appears.

The data show that the silicon-based negative electrode is generally doped into artificial graphite to achieve industrialization (the current doping ratio is about 5%), which is divided into two technical routes: Silicon-carbon and silicon-oxygen according to the choice of silicon materials. The theoretical specific capacity of silicon-based negative electrode is 4200mAh/g, while the development of energy density of graphite negative electrode is close to the limit (372mAh/g). The former has obvious advantages in energy density, life ability and so on.

Dongfeng Securities analysis, the current silicon-based negative electrode is mainly used in high-end 3C digital, power tools, high-end power battery field, in the negative electrode permeability of less than 2%. Tesla (TSLA.US) home-made battery cylinder clearly indicated the use of silicon negative electrode, in addition, automotive battery factories such as Panasonic, Samsung, Guangzhou Automobile, Xilai and so on also announced the use of silicon negative electrode.

Under the background of the application of silicon-based negative electrode actively introduced by downstream enterprises, Chinese anode material enterprises also accelerate the investment in the construction of silicon-carbon negative electrode production line.

He Xueqin, chairman of Beitre, said at the opening ceremony of the construction project of 40,000 tons of silicon-based anode materials in Shenzhen on April 8 that the silicon-based anode materials that the company started to build this time have higher capacity and service life than traditional graphite anode materials. it breaks through the ceiling of traditional anode materials and is regarded as the future of anode materials. It is reported that as the earliest enterprise in China to mass produce silicon-based anode materials, Bertre has a silicon-based anode production capacity of 3000 tons. With the construction of the new project, it will further enhance the market competitiveness of the company's anode materials business.

In previous research activities, China Science Electric also said that silicon-based negative electrode is a direction of future development, and its mass application in power battery industrialization needs a process. In recent years, the company has continued to invest in the silicon-based negative electrode, has completed the pilot production line, and maintained a continuous R & D investment.

As an established manufacturer of negative materials, Shanshan Science and Technology will not lag behind in technological innovation. According to the research report of Zhejiang Securities, the company's silicon negative electrode is in the forefront of the industry, and its products have the advantages of dense and stable structure, low expansion and long cycle stability. it has been applied in batch in the consumer market, and it has passed the evaluation in the field of power battery delivery, and the shipment volume of the company's silicon negative electrode mixed products is at the level of 100 tons in 2021. At the same time, 4680 battery-related materials are sending samples, and the development prospect is broad.

In addition to the above enterprises, Jiangxi Zichen, Sibao Technology, Shenzhen Snow, Shi Dachenghua, Xiang Fenghua, Xin'an shares, Sibao Technology, Gelon New Materials, Jiangxi Zhengtuo, Chuangya Power, Dalian Lichang and so on are also actively promoting the industrialization of silicon-carbon negative electrodes.

It is generally believed that with the large-scale production of 4680 cylindrical batteries and long-lasting fast-charging models and the layout of superimposed silicon-based negative electrode industry chain, silicon-based negative electrode will accelerate its development in the field of high-end lithium electricity.