Recently, the China Automotive Power Battery Industry Innovation Alliance (hereinafter referred to as "Battery Alliance") released monthly data on power batteries in March this year. Data show that China's power battery loading still showed a rapid growth trend in March. From the enterprise level, Ningde era power battery loading steadily accounted for 50%, while BYD won nearly 20% share.

Monthly installed capacity of power batteries in China; photo source: battery Alliance

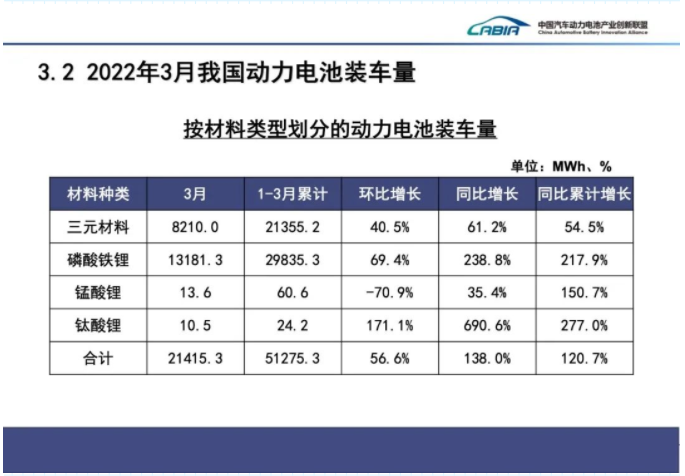

Overall, the number of power batteries loaded in China reached 21.4GWh in March, up 138% from the same period last year and 56.6% from the previous month. This is roughly in line with the overall sales of new energy vehicles in March. Sales of new energy vehicles rose 1.1 times year-on-year to 484000 in March, according to the China Automobile Association.

According to categories, the total 8.2GWh of ternary batteries in March accounted for 38.3% of the total loading, up 61.2% from the same period last year and 40.5% from the previous year; lithium iron phosphate batteries totaled 13.2GWh, accounting for 61.6% of the total loading, up 238.8% from the same period last year and 69.4% from the previous year. It can be seen that the growth rate of lithium iron phosphate battery is significantly higher than that of ternary battery.

Battery loading of ternary, lithium iron phosphate and other batteries; photo source: battery alliance

At the enterprise level, a total of 39 power battery enterprises were installed in China's new energy vehicle market in March, 4 fewer than the same period last year. The power battery loads of the top 3, top 5 and top 10 power battery companies were 16.8GWh, 18.5GWh and 20.4GWh, accounting for 78.3%, 86.4% and 95.4% of the total, respectively.

In March, the domestic power battery loading was the highest in the Ningde era, which reached 10.81GWh, accounting for 50.49%. It can still be said to carry half of the domestic power battery on its own.

On the other hand, among the top ten enterprises in Ningde era, the number of cars installed by one company is more than that of the other nine companies combined. Thus it can be seen that although the performance of second-line battery enterprises has improved in the past two years and is gaining momentum, the leading position of Ningde era in the domestic power battery supply market is still difficult to shake in the short term.

March TOP15; of domestic power battery enterprises Photo Source: battery Alliance

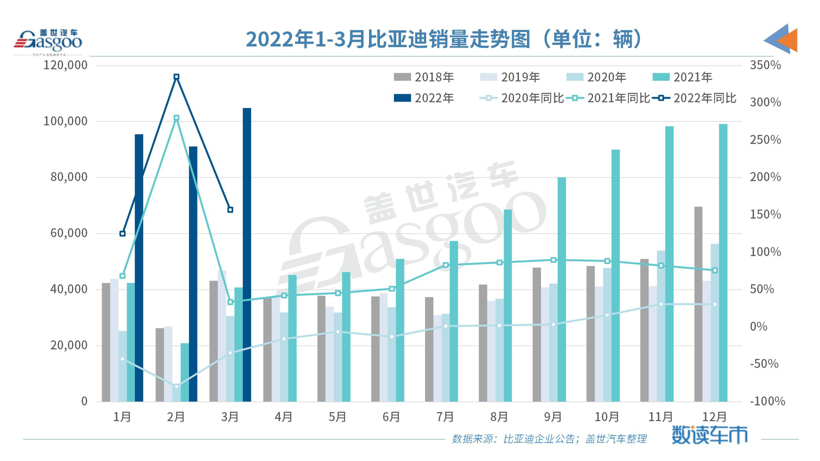

Outside the Ningde era, BYD's position is also very stable, this time still in second place. Specifically, BYD installed 4.12GWh power batteries in March, accounting for 19.24%. According to previous data, BYD's power battery load accounted for 21.24% in February and 20.93% in January. For the whole of last year, BYD's power batteries accounted for 16.2% of the total. Thus it can be seen that BYD's market share has reached a new high in 2022.

Of course, unlike the Ningde era, BYD's power batteries are mostly for their own brand's own use.

In March this year, BYD announced that it would stop production of fuel-fueled vehicles and fully invest in new energy vehicles. In fact, BYD sold zero fuel vehicles that month, while sales of new energy vehicles reached 104878, up 157 per cent from a year earlier and 15 per cent from a month earlier. This is also the main reason why BYD's power battery installed is firmly in second place.

However, in addition to this, BYD external supply incremental space is also gradually opening. It is reported that the power battery, BYD has held FAW, Ford and other considerable external supply orders. At the same time, it also continues to promote capacity construction. According to Lithium statistics from the starting point, BYD's battery capacity is expected to reach 285/430GWh in 2023, which is undoubtedly conducive to the expansion of its external supply.

China New Airlines (AVIC Lithium) ranks behind Ningde era and BYD. In March, its power battery load was 1.84GWh, accounting for 8.58%, accounting for a certain increase compared with last year.

It is worth noting that recently, China Innovation Airlines has formally submitted an application for listing in Hong Kong. According to its prospectus, from 2019 to 2021, the installed capacity of Sinovel is 1.49GWh, 3.55GWh and 9.05GWh respectively. According to the ranking for the whole year of 2021, Sinovel has ranked third in the number of power batteries installed, and has not given way to other companies in 2022. However, at present, there is still a big gap between it and BYD, especially in the Ningde era.

In addition to the above three enterprises, Guoxuan Hi-Tech, LG New Energy, Honeycomb Energy, Yiwei Lithium Energy, Funeng Technology, Xinwanda and Ruipu Energy were also among the top 10 domestic power battery companies in March, accounting for 4.34%, 3.71%, 2.37%, 2.2%, 1.86%, 1.62% and 1.04%, respectively.