2021 is a very special and challenging year, not only for the economy and financial markets, but also for the car market. After experiencing the epidemic, profound changes are taking place in the logic and pattern at the bottom. New energy has become the darling of the secondary market last year, in which new forces have also become a pole that can not be ignored. Of course, there is also a gradual differentiation within the industry. Some of these enterprises with product power and operation systematization ability further stand out, such as Xiaopeng Automobile.

On the evening of March 28th, Xiaopeng Motor disclosed its 2021 performance report, which showed that the company's operating income in 2021 was 20.99 billion yuan (the same as the same unit below), an increase of 259.1 percent over the same period last year, of which automobile sales revenue was 20.04 billion yuan, an increase of 261.3 percent over the same period last year.

Xiaopeng won narrowly in 2021, and is expected to further widen the gap in 2022.

Today, the delivery results of the new power car companies in 2021 have long been clear. The annual delivery volume of the first echelon "top three" is all in the range of 90, 000 to 100000 vehicles, of which Xiaopeng Motor increased by 263% compared with the same period last year, narrowly winning 98155 cars for the whole year. and became the biggest winner of this phased qualifying race.

Looking back on 2021, the differentiation of this qualifying began in the second half of the year: in July, Xiaopeng's delivery volume rose from the third to the second. In October 2021, Xiaopeng ranked first in delivery volume and remained the champion for many months in a row. Xiaopeng's delivery volume reached 41751 in the fourth quarter of 2021, an increase of 222% over the same period last year and 63% month-on-month.

(source: company financial report)

In the new power camp, the reason why Xiaopeng was able to catch up with and lead the delivery volume last year, in addition to the new energy car market dividend, but also from the company's intelligent product positioning and a relatively rich combination of models.

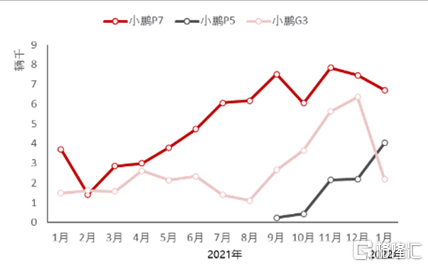

In the company's model portfolio, the Xiaopeng P7, which was listed in April 2020, delivered a total of 60569 vehicles last year, accounting for 62% of the total delivery volume last year, becoming the first pure electric new force model to break through 100000 cars off the line. and judging from the trend of the proportion of Xiaopeng P7 delivery to the company's total delivery volume, Xiaopeng P7 is likely to continue the momentum of popular style this year, and Xiaopeng P7 will hit more than 10,000 monthly deliveries in 2022.

In addition, the delivery volume of Xiaopeng P5, which started large-scale delivery in the fourth quarter of 2021, is also rising, with obvious fashion potential, and the monthly sales of Xiaopeng P5 in the second half of 2022 will be close to P7. According to the company's plan, the company's new model, the G9, will begin delivery in the third quarter of this year. According to the official website, the Xiaopeng G9 is China's first mass-produced model based on 800V high-voltage silicon carbide platform, with a "charging time of 5 minutes and a range of 200km", and will first support the XPILOT 4.0 intelligent driving assistance system. Under the strength of such products, Xiaopeng G9 undoubtedly has the potential of popular style, which means that Xiaopeng car still has plenty of stamina this year.

Monthly sales trend of Xiaopeng P7/P5/G3

Source: Minsheng Securities

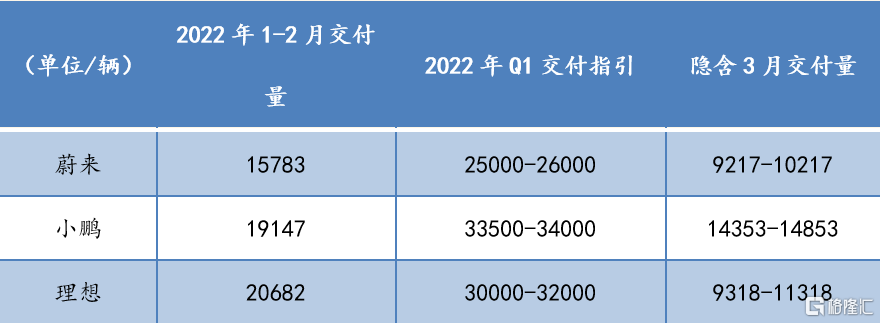

According to the delivery guidelines issued by Xiaopeng, the delivery volume of 2021Q1 will range from 33500 to 34000 vehicles, an increase of about 151.1% to 154.9% over the same period last year. Compared with the first quarter delivery guidelines recently published by Weilai and ideal Motor, Xiaopeng still ranks first in delivery volume and maintains the leading position in the first echelon of new forces.

(source: company financial report)

According to the company, in the traditional off-season of the automobile market after the Spring Festival, Xiaopeng has achieved rapid growth, first, because the company has accumulated a large number of orders before the price rise, and second, during the Spring Festival. Xiaopeng has carried out a technical transformation of the production base in Zhaoqing, and now fully resumes production in mid-February as planned, which means that Xiaopeng will usher in a prosperous situation of supply and demand this year. It is likely to further widen the gap with other new car companies.

Xiaopeng has outstanding growth, and the improvement of gross profit margin is expected in the future.

Xiaopeng also took the lead in revenue growth last year, thanks to strong delivery growth. According to the financial report, Xiaopeng Motor achieved an operating income of 20.99 billion yuan in 2021, an increase of 259.1% over the same period last year.

(source: company financial report)

In the current stage of rapid expansion of the new energy vehicle market, compared with the immediate profits, the company's R & D investment and sales network are more important. According to the financial report, Xiaopeng Automobile has a total R & D expenditure of 4.114 billion yuan in 2021, and sales and general expenses of 5.305 billion yuan. It is worth affirming that, with economies of scale, various expense rates have shown a downward trend.

First of all, R & D investment is the key to win the future, which directly determines the product power. Xiaopeng's investment in this area has been sparing no effort, and the R & D strength and results are obvious to all, especially in the field of intelligence. In 2021, the company launched the NGP automatic driving system, parking memory parking VPA, 800VSiC high-pressure platform and P5, G3i two models. In 2022, the company will also launch VPA-L, CNGP, G9, XPILOT4.0, Robotaxi five major research and development achievements, in the new power car companies, Xiaopeng's input-output performance is outstanding. And Xiaopeng's intelligent positioning is also in line with the view of the China Electric vehicle 100 people Forum on March 25: "Intelligent network connection will be an important development direction of the automobile in the future."

Of course, the surge in R & D investment and marketing expenses also matches the pace of the company's products and market expansion. At present, Xiaopeng already has three models on sale. In addition to the G9, which will be launched in 2022, there are also two new platforms and two new cars on the market in 2023, with a fast pace of launch; at the end of 2021, the number of sales stores and cities covered by them reached 357 and 120 respectively, an increase of 123% and 87% respectively over the same period last year, and the sales network expanded rapidly.

It is worth mentioning that, considering that the G9 will be delivered by Q3 this year, from the product positioning and pricing range as well as management, G9 is bound to have a structural impact on gross profit margin, which is the embodiment of Xiaopeng brand's upward force. Xiaopeng management also said on the conference call that Xiaopeng's medium-and long-term gross profit margin was above 25%.

Conclusion

There must be no doubt about the gold content of Xiaopeng's latest answer, and the delivery curve and revenue growth in 2021 have fully verified the effectiveness of the company's strategy and implementation.

In 2021, the penetration rate of new energy vehicles in China has exceeded 20%, passing the stage inflection point, and the new forces, as the vanguard of domestic independent brands to advance to the high-end market, have become a pole that can not be ignored in China's bullish car market.

In such an all-dimensional competitive environment, Xiaopeng car wants to win the future, the current investment is essential. In terms of Xiaopeng's strategic development rhythm and delivery curve, the current company's loss expansion is only phased Xu Li. In the long run, as the company's delivery scale continues to rise and its investment reaches its peak in stages, under the diversified income structure of "vehicle + software + content", the market and R & D costs will continue to be diluted, thus continuously releasing profits, and the situation of "volume profit" may rise in the future.

Undeniably, this year's economic environment is full of many variables. As one of the few racing tracks with both growth and certainty in the world, the valuation of new energy vehicles is also under tremendous pressure. Xiaopeng's share price is inevitably subject to a sharp pullback, but the company's performance, especially delivery volume, is still on the rise. under the joint action of the two, Xiaopeng's configuration cost-effective ratio began to appear.