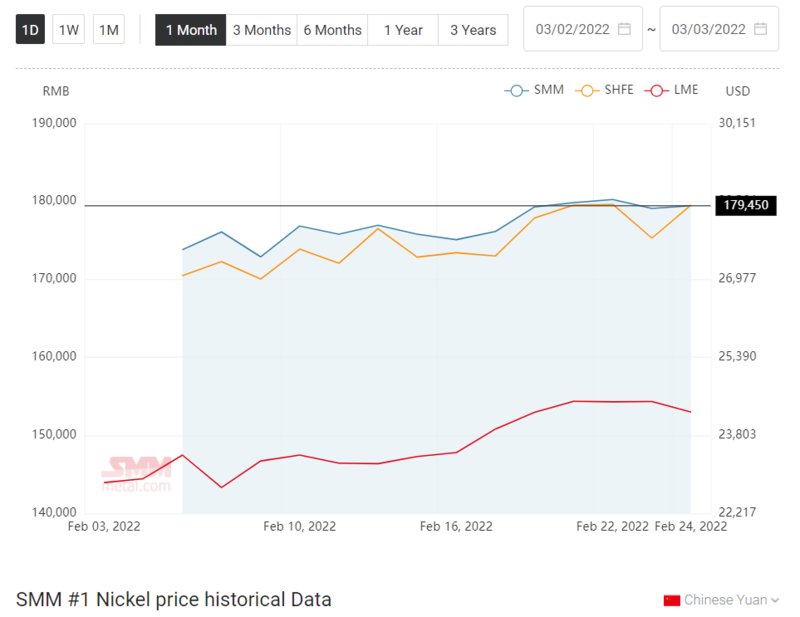

SHANGHAI, Mar 3 (SMM) - LME nickel skyrocketed on the fire between Russia and Ukraine. Intraday LME nickel soared to a high of $26,840/mt since May 31 2011. SHFE nickel, on the other hand, recorded only modest gains compared with its counterpart. As of 11:55 am Beijing time, intraday LME and SHFE nickel rose 3.52% and 0.95% respectively.

In the spot market, the average price of intraday SMM #1 refined nickel stood at 18,400 yuan/mt, up 0.66% from yesterday. The average price of high-grade NPI recorded 1,495 yuan/mtu (ex-works, tax included) on March 2, flat from a day ago. The stainless steel downstream demand was less than expected, and stainless steel prices have also been falling and stabilised only recently, hence the profits of steel mills were poor, pressuring NPI prices. Meanwhile, the steel mills were also wait and see toward high-priced raw material prices. The supply market was still tight, which offered relatively strong support to NPI prices, coupled with high nickel ore prices. NPI prices are expected to stay high in the short term.

On the supply side, nickel sulphate output recovered slightly, which still fell short of expectation. Pure nickel spot supplies were tight, sustaining the premiums at a high level. On the demand side, the growth of precursor output surpassed that of nickel sulphate, while the production schedule was less than expected. In terms of stainless steel, new capacity is being put into production, but the progress has been slow.

Currently, the market shall watch the sanctions on Russia, as well as the change of SHFE – LME spread. The energy prices soared on geopolitical tensions, which has been reflected in the commodity market. The short-term sentiment and fundamentals are expected to offer relatively strong support to nickel prices.

![[NPI Daily Review] The Market Was Mainly Driven by Restocking to Meet Immediate Needs; High-Grade NPI Prices Held Steady](https://imgqn.smm.cn/usercenter/CjEnN20251217171733.jpg)