SHANGHAI, Mar 3 - Importers across the world, from London to Warsaw, may soon face higher transport costs and severer delays in shipments as the ongoing conflict between Russia and Ukraine and the escalation of related sanctions are making it increasingly difficult to move goods between Europe and Asia.

This is another fatal blow to a global supply chain that has not yet fully recovered from the COVID-19 pandemic. The conflict between Russia and Ukraine has already led to a surge in the prices of fuel, grains, industrial metals and other raw materials that are used to produce consumer goods made in Asia, with the final products destined for Europe and the rest of the world.

Jennifer Hillman, a professor at Georgetown University and former US trade official, said, "There is still possibility of major disruptions in the supply chain. We're working hard to try to recover it, but it's going to take time. And the outbreak of war in Russia and Ukraine has left us with little time."

Russia and Ukraine are positioned along the oldest trade route in the world, and airspace between both countries is now restricted. At the same time, container ships are unable to enter Ukrainian ports and many are trying to avoid Russian ports. For the global supply chain, this freight crisis is being sieged simultaneously through land, sea and air.

Sea Transportation

Two of the world's biggest shipping giants, Maersk (A.P. Moller-Maersk A/S) and Mediterranean Shipping Co. announced Tuesday that they had suspended shipping booking services to and from Russia, signaling that Western sanctions against Russia are causing a new round of disruption to an already strained global supply chain.

This follows similar moves by the two giants' rivals Ocean Network Express and Hapag-Lloyd in an attempt to avoid the risk of carrying sanctioned cargo.

In its latest announcement, Maersk noted that it is closely monitoring the evolving international situation and the new sanctions imposed on Russia. And in light of this, it needs to establish and modify its existing processes for accepting and processing bookings.

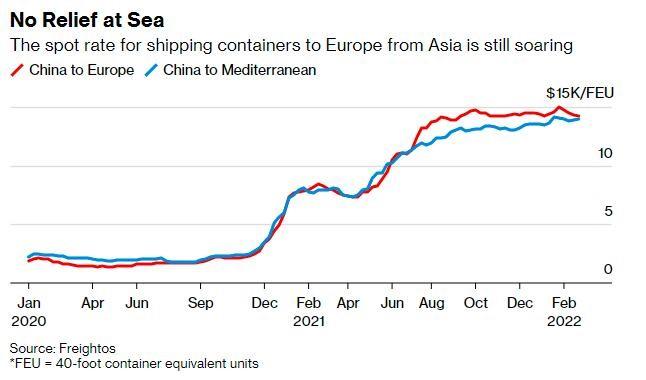

According to the London Baltic Exchange, tariff for tankers on the TD6 Black Sea to Mediterranean route have soared further to $158,000 per day as of Tuesday, which is more than nine times the $17,000 per day rate for that route less than a week ago. While the average daily rate for tankers on the TD17 Baltic to UK route has increased by $35,000 to $210,000 per day, which is the highest at least since 2008.

Jan Hoffmann, head of trade logistics at the United Nations Conference on Trade and Development, said, "There is currently little spare maritime capacity for the global movement of goods, and even an isolated regional shock would be too much to bear. There is nothing as idled capacity in the system, so anything that prevents ships from moving forward will lead to a reduction in capacity."

Gary Lau, chairman of the Hong Kong Association of Freight Forwarders and Logistics, also said that in Asia, some international shipping companies were adjusting their schedules and the disruption to cargo deliveries was inevitable in this conflict. He noted that "the longer the tensions continue, the greater is the impact on the entire European logistics chain."

Road and Air Transportation

While maritime transport centering Black Sea region is being hampered, global land and air transport is inevitably being affected.

The rail network connecting Asia and Europe via Russia is another good option for commodity shipments from Asia to Europe, with 87,000 kilometres of railways in Russia, second only to China and the USA in the world. Also, the China-Europe train has been an important gateway for trade between China and EU countries in recent years.

Both Maersk and DB Schenker, the logistics subsidiary of German state-owned rail operator Deutsche Bahn, offer intermodal services, but even these services are now subject to new restrictions and sanctions concerns.

The EU and the US have now placed RZD, Russian state railway company, on the sanctions list in an attempt to limit their ability to raise funds from overseas markets. Of course, these sanctions are mostly financial at the moment and do not affect the operation of China-Europe trains through Russia for the time being. However, some trains transiting Ukraine are already facing suspension or diversion.

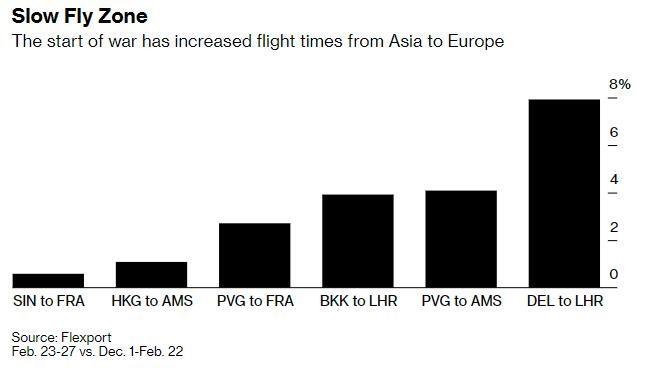

On the air freight side, Transporeon, a logistics platform and transport company with offices in nine European capitals, said the protracted Russia-Ukraine conflicts would mean that flights between the Far East and Europe could be flying via the US, adding delays and costs. The pain will be particularly acute for UK importers, who will be hit harder than those in other European countries due to the limited capacity of its cargo hubs.

Despite this, air freight disruptions are likely to be less significant than the diversions and congestion of land freight. Data from Flexport shows that while average flight time has increased by around 3-4% compared to the previous two months, it means that there are only delays of around 20 minutes. One of the routes saw an 8% increase in flight time, or around 45 minutes.

Chris Roger, supply chain economist at Flexport in London, said, "This means that airports in Asia and Europe will consume more aviation fuel, release more carbon emissions and experience more flight delays. The rough conclusion is that there is an impact, but not yet enough to make a difference to the way air freight operates."

![BC Copper 2604 Contract Closed Lower After Choppy Trading, Nonfarm Payrolls and Geopolitical Disruptions Weighed on Copper Prices [SMM BC Copper Commentary]](https://imgqn.smm.cn/usercenter/XBbTq20251217171709.jpg)