On January 24th, Lianchuang Electronics announced that in order to meet the needs of production, operation and business development of India Liangchuang Electronics Co., Ltd. (hereinafter referred to as "India Liangchuang"), the company agreed that its subsidiary Chongqing Liangjiang Lianchuang Electronics Co., Ltd. (hereinafter referred to as "Chongqing Lianchuang") intends to provide joint liability guarantee of no more than 200 million yuan (or equivalent US $30 million) to India Lianchuang Electronics Co., Ltd. The above guarantee limit shall be valid for 12 months from the date of examination and approval by the general meeting of the shareholders of the company.

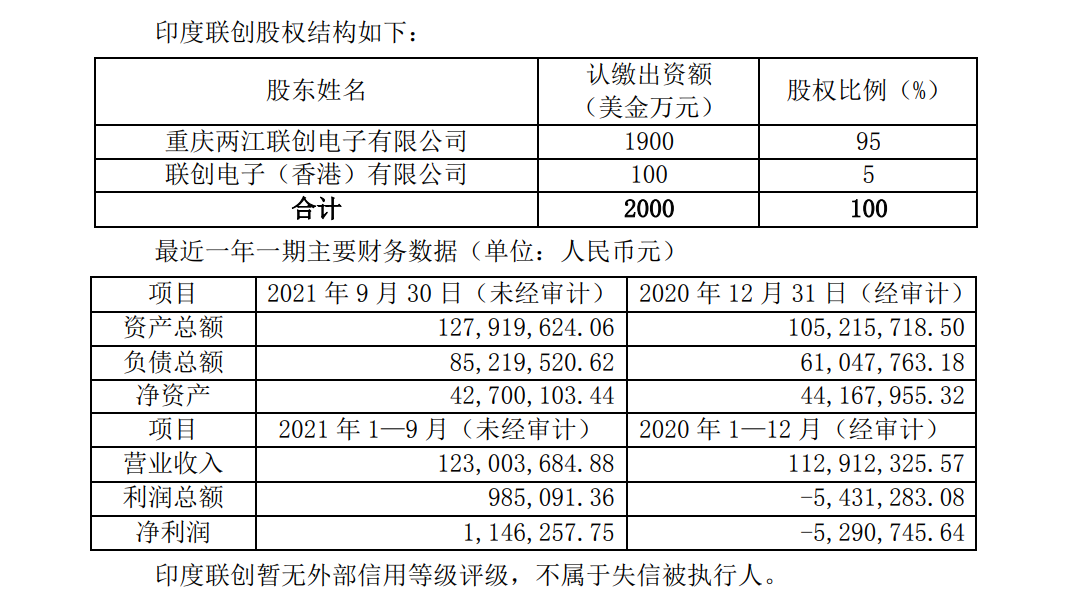

According to the announcement, the business scope of Lianchuang in India includes the research and development, production and sales of touch display products. In the first three quarters of 2021, Lianchuang achieved sales revenue of 123 million yuan and net profit of 1.1463 million yuan.

As of the date of this announcement, the cumulative guarantee balance of Lianchuang Electronics and its subsidiaries was 4.5606627 billion yuan, accounting for 125.14% of the company's audited net assets on December 31, 2020, of which the cumulative guarantee balance for subsidiaries within the scope of the consolidated statement was 4.4706627 billion yuan. Accounted for 122.67% of the company's audited net assets on December 31, 2020; Jiangxi Lianchuang provided 90 million yuan in guarantees to its shareholding company, Lianchuang Hongsheng, accounting for 2.47 per cent of the company's audited net assets on December 31, 2020.

Lianchuang Electronics said that if the guarantee matters under consideration take effect, the amount of guarantee applied for by the company and its subsidiaries will be 5.44 billion yuan, accounting for 149.27% of the company's audited net assets on December 31, 2020, of which the guarantee limit for holding subsidiaries is 5.35 billion yuan. The guarantee limit for participating companies is 90 million yuan.

The company pointed out that the object of this guarantee is the subsidiaries within the scope of the company's consolidated statements, the financial situation and solvency are good, and the company can effectively control its operation and management, finance, investment, financing and other aspects. the company has the ability to fully grasp and monitor the cash flow of the guaranteed company, and the financial risk is within the scope of the company's effective control.