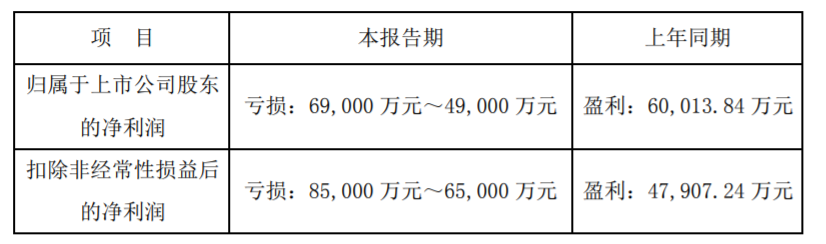

On the evening of January 23rd, Changying Precision disclosed its 2021 performance forecast that the company's net profit during the reporting period is expected to be a loss of 490 million yuan to 690 million yuan, compared with a profit of about 600 million yuan in the same period last year, and a net profit loss of 650 million yuan to 850 million yuan after deducting non-recurring profits and losses. in the same period last year, the profit was 480 million yuan, from profit to loss compared with the same period last year.

Changying Precision pointed out that the performance changes are mainly due to the further increase in R & D investment in strategic products of major customers, the increase in costs, and the increase in the layout of new energy components and R & D investment. At the same time, the main customer key products are in the climbing period of mass production, and the yield is low.

In addition, some production bases have been affected by the epidemic situation and customer chip shortage, resulting in a decline in capacity utilization and a rise in production costs; the price of the company's main raw materials, such as copper and aluminum, has risen sharply, which is difficult to digest in a short period of time; changes in exchange rate and rising labor costs all have a certain impact on gross profit margin. In addition, some of the inventory at the end of the period is impaired due to the above reasons, and the provision for impairment is made.